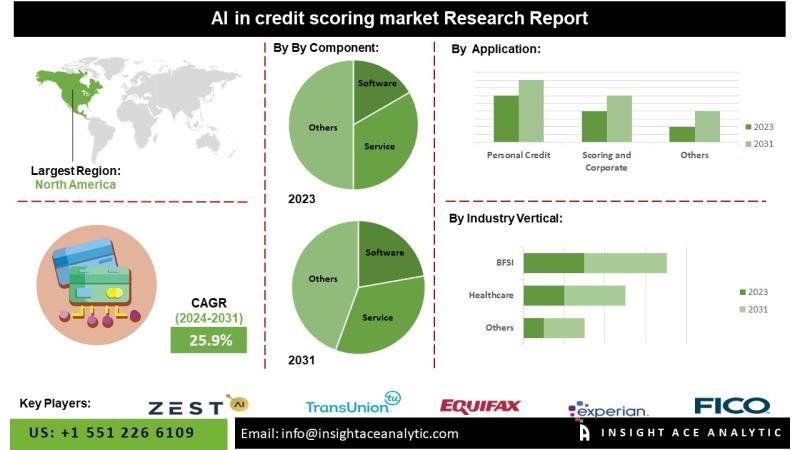

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the “Global AI In The Credit-Scoring Market – (By Component (Software and Service), By Application (Personal Credit Scoring and Corporate Credit Scoring), By Industry Vertical (BFSI (Banking, Financial Services, Insurance), Retail, Healthcare, Telecommunications, Utilities, and Real Estate)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031.”

According to the latest research by InsightAce Analytic, the Global AI In The Credit-Scoring Market is expected to grow with a CAGR of 25.9% during the forecast period of 2024-2031.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/2578

The adoption of artificial intelligence (AI) and machine learning (ML) in credit scoring is progressing at a steady pace; however, its alignment with national development goals remains in the nascent stages. Financial institutions and fintech startups are increasingly leveraging these technologies to improve financial inclusion and contribute to broader economic advancement. Central to this transformation is the utilization of alternative data sources, advanced AI and ML algorithms, and scalable cloud-based platforms to establish credit scoring models tailored for underserved and underbanked populations. This data-driven approach enables financial service providers to design more inclusive financial products and extend credit access to individuals and communities traditionally excluded from the formal financial ecosystem.

While AI offers substantial potential in redefining credit assessment, its implementation is not without challenges. The global market for AI-based credit scoring is expanding, driven by rapid advancements in machine learning techniques and the proliferation of big data. These AI-enabled systems incorporate diverse data inputs-including social media engagement, digital footprints, and transactional behavior-to generate more accurate and comprehensive credit assessments than conventional methods. This innovation not only improves the accuracy of credit evaluations but also empowers lenders to responsibly serve a broader customer base, including those with limited or non-existent credit histories.

List of Prominent Market Players in the AI credit scoring market:

• FICO (Fair Isaac Corporation)

• Experian

• Equifax

• TransUnion

• Zest AI

• LenddoEFL

• Kreditech

• CreditVidya

• CreditXpert

• Upstart

• Pagaya

• Underwrite.ai

• Kensho Technologies

• Scienaptic

• DataRobot

• Deserve

• ClearScore

• ScoreData

• CredoLab

• Trust Science

• Other Prominent Players

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-08

Market Dynamics

Drivers:

The global market for AI in credit scoring is propelled by several key factors. AI models demonstrate exceptional proficiency in analyzing vast datasets with high accuracy, identifying patterns and correlations that traditional scoring methods may fail to detect. This results in more precise credit assessments. The rapid data processing capabilities of AI facilitate real-time credit evaluations, which are essential for timely decision-making in the financial sector.

Automation through AI significantly reduces dependence on manual processes, thereby lowering operational costs for financial institutions. Additionally, AI enables the incorporation of alternative data sources, allowing credit access to individuals with limited or no formal credit history and expanding the addressable market. These models also enhance risk evaluation, offering more reliable predictions of default likelihood and thereby improving financial risk management. Moreover, AI contributes to regulatory compliance by delivering standardized and unbiased credit assessments, reducing the likelihood of penalties arising from non-compliance.

Challenges:

Despite the numerous benefits, the AI-based credit scoring market faces considerable challenges. A major concern is the risk of algorithmic bias, which can result in inequitable credit decisions. The effectiveness of AI systems is highly dependent on the availability of high-quality data, making data integrity a critical requirement. Data privacy and security concerns also pose significant obstacles, given the sensitive nature of financial and personal information handled by these systems. Moreover, the lack of transparency and interpretability of complex AI models can undermine trust among consumers and regulators, underscoring the need for explainable AI frameworks that ensure accountability and clarity in decision-making processes.

Regional Trends:

North America is anticipated to retain the largest market share over the forecast period. This leadership position is primarily driven by the region’s robust technological infrastructure, significant investments in AI and data analytics, and the presence of major financial institutions and fintech enterprises. In the United States in particular, there is widespread adoption of AI solutions in credit scoring to enhance accuracy, reduce default rates, and offer tailored financial products. Europe also holds a substantial share of the market, fueled by increasing digital transformation in the financial sector, a considerable population with limited banking access, and proactive adoption of AI technologies, especially in developing economies across the region.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/2578

Recent Developments:

• In Jan 2024, Intuit Inc., the worldwide financial technology platform responsible for Intuit TurboTax, Credit Karma, and Mailchimp, has declared that Credit Karma members Online customers now have the ability to complete and submit their 2023 tax returns using TurboTax directly within the Credit Karma Online product interfaces.

Segmentation of AI in credit scoring market-

By Component

• Software

• Service

By Application

• Personal Credit Scoring

• Corporate Credit Scoring

By Industry Vertical

• BFSI

o Banking,

o Financial Services,

o Insurance

• Retail,

• Healthcare,

• Telecommunications,

• Utilities,

• Real Estate

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

Read Overview Report- https://www.insightaceanalytic.com/report/ai-in-the-credit-scoring-market/2578

About Us: InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: http://www.insightaceanalytic.com

Tel : +1 607 400-7072

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.