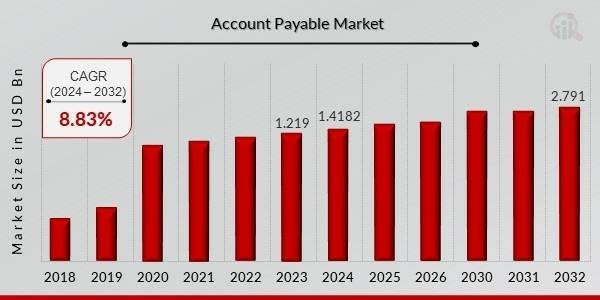

The global Accounts Payable (AP) Market is poised for significant expansion, with projections indicating a rise from USD 1.41 billion in 2024 to USD 2.79 billion by 2032, demonstrating a Compound Annual Growth Rate (CAGR) of 8.83% during the forecast period. This follows a market valuation of USD 1.21 billion in 2023.

The impressive growth trajectory is primarily fueled by the increasing adoption of automation, particularly through Artificial Intelligence (AI), for key AP functions, alongside a growing understanding of the critical role timely bill payments play in enhancing corporate credit ratings.

The traditional accounts payable process, often characterized by manual data entry, paper-based invoices, and lengthy approval cycles, has long been a bottleneck for businesses. However, the landscape is rapidly transforming with the integration of advanced technologies.

Get a Free PDF Sample: https://www.marketresearchfuture.com/sample_request/8683

AI at the Forefront of AP Transformation:

Artificial intelligence is emerging as a game-changer in the AP market, revolutionizing how businesses manage their financial operations. AI-powered solutions are automating a wide array of tasks that were previously labor-intensive and prone to human error, including:

• Automated Invoice Processing: AI, often coupled with Optical Character Recognition (OCR) and Natural Language Processing (NLP), can intelligently extract data from various invoice formats (PDFs, emails, scanned documents), eliminating manual data entry and significantly speeding up processing times.

• Three-Way Matching: AI excels at validating invoice data against purchase orders and receipts, automatically flagging discrepancies and streamlining the matching process. This is crucial for achieving “touchless” AP automation.

• Fraud Detection: AI algorithms can analyze transaction data for anomalous patterns or behaviors, such as duplicate invoices, unusual payment amounts, or inconsistencies in vendor details, thereby bolstering security and preventing financial losses.

• Dynamic Discounting: AI can identify opportunities for early payment discounts, optimizing cash flow by recommending expedited payments when financially advantageous.

• Vendor Management: AI automates tasks like vendor onboarding, documentation management, and query resolution, improving vendor relationships and reducing administrative burden.

• Predictive Analytics: Leveraging historical data, AI can forecast future costs and invoices, enabling more accurate financial planning and cash flow management.

The shift towards AI-driven automation not only enhances efficiency and reduces operational costs but also frees up AP teams to focus on more strategic initiatives, contributing to overall business value.

Browse Complete Research Report: https://www.marketresearchfuture.com/reports/account-payable-market-8683

Timely Payments and Credit Ratings: A Virtuous Cycle:

Beyond internal efficiencies, the market growth is also propelled by the increasing recognition among businesses of the profound impact timely bill payments have on their credit ratings. A strong business credit rating is essential for:

• Access to Capital: Companies with good credit scores are more likely to secure loans, lines of credit, and other financing options with favorable terms, including lower interest rates.

• Favorable Vendor Relationships: Consistent on-time payments build trust and credibility with suppliers, potentially leading to better payment terms, discounts, and uninterrupted supply chains.

• Improved Reputation: A reputation for financial responsibility is a valuable asset, enhancing a business’s standing in the market and with its partners.

• Operational Flexibility: Good credit provides a safety net, allowing businesses to navigate unforeseen expenses or pursue growth opportunities.

Late payments, conversely, can severely damage a company’s credit profile, leading to higher interest rates, stricter payment terms, limited access to credit, and even strained vendor relationships. Accounts payable automation solutions help businesses ensure timely payments by providing greater visibility into payment schedules, automating reminders, and streamlining approval workflows.

Buy Premium Research Report: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=8683

Market Segmentation and Future Outlook:

The Accounts Payable market is segmented by components (solutions and services), deployment modes (on-premise and cloud), and enterprise size (large enterprises, small, and medium-sized enterprises). Cloud-based solutions are particularly gaining traction due to their scalability, cost-effectiveness, and ease of access. Geographically, North America currently dominates the market, largely due to early adoption of advanced technologies and the presence of key market players, while the Asia-Pacific region is expected to witness the fastest growth as digitalization efforts accelerate.

As businesses worldwide continue to prioritize digital transformation, operational efficiency, and financial health, the Accounts Payable market is set to witness sustained growth, driven by the transformative power of AI and the undeniable benefits of timely and accurate financial operations.

Related Reports:

France Banking as a Service Market https://www.marketresearchfuture.com/reports/france-banking-as-a-service-market-55192

GCC Banking as a Service Market https://www.marketresearchfuture.com/reports/gcc-banking-as-a-service-market-55194

Germany Banking as a Service Market https://www.marketresearchfuture.com/reports/germany-banking-as-a-service-market-55190

India Banking as a Service Market https://www.marketresearchfuture.com/reports/india-banking-as-a-service-market-55197

Japan Banking as a Service Market https://www.marketresearchfuture.com/reports/japan-banking-as-a-service-market-55191

South America Banking as a Service Market https://www.marketresearchfuture.com/reports/south-america-banking-as-a-service-market-55195

UK Banking as a Service Market https://www.marketresearchfuture.com/reports/uk-banking-as-a-service-market-55189

US Banking as a Service Market https://www.marketresearchfuture.com/reports/us-banking-as-a-service-market-14064

Brazil Core Banking Solutions Market https://www.marketresearchfuture.com/reports/brazil-core-banking-solutions-market-55160

Canada Core Banking Solutions Market https://www.marketresearchfuture.com/reports/canada-core-banking-solutions-market-55152

Market Research Future (MRFR) is a global market research company that takes pride in its services, offering a complete and accurate analysis regarding diverse markets and consumers worldwide. Market Research Future has the distinguished objective of providing the optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Contact:

Market Research Future

99 Hudson Street,5Th Floor

New York, New York 10013

United States of America

Sales: +1 628 258 0071(US)

+44 2035 002 764(UK

Email: sales@marketresearchfuture.com

This release was published on openPR.