Ai Crypto Trading Bot Market Analysis 2025-2034: Industry Size, Share, Growth Trends, Competition and Forecast Report

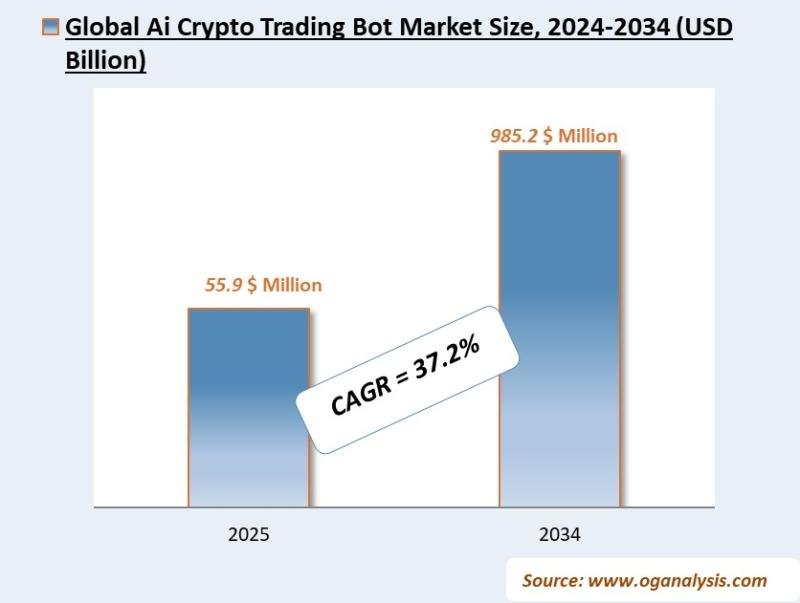

According to OG Analysis, a renowned market research firm, the Global Ai Crypto Trading Bot Market was valued at USD 40.8 billion in 2024. The market is projected to grow at a compound annual growth rate (CAGR) of 37.2%, rising from USD 55.9 billion in 2025 to an estimated USD 985.2 billion by 2034.

Get a Free Sample: https://www.oganalysis.com/industry-reports/ai-crypto-trading-bot-market

AI Crypto Trading Bot Market Overview

The AI Crypto Trading Bot Market is rapidly evolving, powered by the convergence of artificial intelligence and digital asset trading. As cryptocurrency adoption increases among retail and institutional investors, the demand for intelligent, automated trading tools has surged. These bots use advanced machine learning algorithms, deep learning models, and natural language processing to analyze vast amounts of real-time market data, predict price movements, and execute trades at high speeds without emotional bias. AI-based bots not only enhance profitability but also allow for round-the-clock trading with customizable strategies, minimizing manual intervention. The market encompasses various bot types-arbitrage bots, market-making bots, portfolio automation bots, and technical analysis bots-each serving different user intents, from high-frequency trading to risk-managed long-term investing.

Major market drivers include the increasing complexity and volatility of the cryptocurrency market, the expansion of decentralized finance (DeFi), and growing investments in AI-driven financial technologies. Additionally, the integration of AI bots with centralized and decentralized exchanges has improved interoperability and execution efficiency. Key players like 3Commas, Cryptohopper, Pionex, HaasOnline, and Bitsgap continue to innovate by introducing advanced backtesting, copy trading, and sentiment analysis tools. North America leads the market due to early adoption and advanced fintech infrastructure, followed by Europe and Asia-Pacific. However, regulatory uncertainties and cybersecurity threats present challenges that vendors must navigate. Overall, the AI Crypto Trading Bot Market is expected to grow exponentially, driven by technological advancements, demand for passive income generation, and increasing crypto asset diversification strategies.

Access Full Report @ https://www.oganalysis.com/industry-reports/ai-crypto-trading-bot-market

Key AI Crypto Trading Bot Market Companies Analysed in this Report include –

Pionex

Mizar

CryptoHopper

Bitsgap

TradeSanta

CryptoHero

Kryll

HaasOnline

Coinrule

Gunbot

Dash 2 Trade

Lea2Trade

3Commas

eToro

Bitcoin 360 Ai

b-cube

SmithBot

Shrimpy.io

Zignaly

ATPBot

Key Insights from the report –

Rise of Algorithmic Portfolio Optimization

AI bots are increasingly integrating portfolio balancing tools that automatically adjust holdings based on volatility, market cap, or risk scores. This ensures dynamic asset allocation and minimizes drawdowns during market swings. Investors now demand smarter bots that adapt in real-time.

Integration with DeFi Protocols

Bots are evolving to interact seamlessly with decentralized exchanges and yield farming platforms. This unlocks arbitrage and liquidity mining opportunities across DeFi ecosystems. As DeFi scales, bot capabilities are expanding beyond just centralized platforms.

Adoption of Reinforcement Learning Models

Advanced bots are using reinforcement learning to improve strategy over time based on reward feedback. These models simulate various market scenarios and adjust trading behavior automatically. Such adaptive systems outperform static rule-based bots in volatile environments.

Increased Use of Sentiment and News Analysis

Natural Language Processing (NLP) is being used to analyze crypto-related news, social media, and tweets in real time. Bots incorporate this data to predict short-term market shifts. Traders now rely on bots with built-in sentiment intelligence.

Expansion of No-Code and Low-Code Platforms

The rise of no-code interfaces allows non-technical users to create, customize, and deploy trading bots. These platforms democratize algorithmic trading by reducing entry barriers. User-friendly design is becoming a competitive differentiator.

Focus on Regulatory Compliance and Security

As regulations around crypto tighten, bot developers are prioritizing AML/KYC integration and trade auditability. Enhanced encryption, API permission controls, and anomaly detection are being embedded. Security and compliance are now core to product design.

Tailor the Report to Your Specific Requirements @ https://www.oganalysis.com/industry-reports/ai-crypto-trading-bot-market

Get an In-Depth Analysis of the AI Crypto Trading Bot Market Size and Market Share split –

by Type

– Grid Trading Bot

– Rebalancing Bot

– Spot-Futures Arbitrage Bot

– Others

By Deployment

– Cloud-Based

– On-Premise

– Hybrid

By Subscription

– Free/Open Source

– Monthly/Annual Subscription

– One-Time Purchase

– Performance-Based Pricing

By End-Use

– Individual

– Institution

– Others

By Geography

– North America (USA, Canada, Mexico)

– Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

– Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

– The Middle East and Africa (Middle East, Africa)

– South and Central America (Brazil, Argentina, Rest of SCA)

DISCOVER MORE INSIGHTS: EXPLORE SIMILAR REPORTS!

https://www.oganalysis.com/industry-reports/selfcheckout-pos-terminal-market

https://www.oganalysis.com/industry-reports/selfservice-kiosks-for-healthcare-market

https://www.oganalysis.com/industry-reports/algorithmic-trading-market

https://www.oganalysis.com/industry-reports/robotics-market

Contact Us:

John Wilson

Phone: 88864 99099

Email: sales@oganalysis.com

Website: https://www.oganalysis.com

Follow Us on LinkedIn: linkedin.com/company/og-analysis/

OG Analysis

1500 Corporate Circle, Suite # 12, Southlake, TX-76300

About OG Analysis:

OG Analysis has been a trusted research partner for 14+ years delivering most reliable analysis, information and innovative solutions. OG Analysis is one of the leading players in market research industry serving 980+ companies across multiple industry verticals. Our core client centric approach comprehends client requirements and provides actionable insights that enable users to take informed decisions.

This release was published on openPR.