Archax, the first FCA regulated global digital securities exchange, custodian and broker, today announced a partnership with Ownera, provider of a global inter-trading network based on the open-source FinP2P protocol, to distribute digital securities over the Ownera FinP2P network.

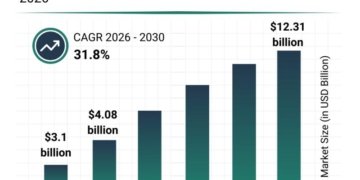

The digital securities industry is growing fast but has lacked regulated, institutional-grade exchanges and market infrastructure, as well as a common global distribution network for connecting issuers, investors, exchanges, and other market participants. As a result, the rate of institutional adoption and investor access to high-quality digital assets has been limited up until now.

To help address this, Archax is rolling out a digital asset ecosystem, built with institutions in mind, and designed to allow them to raise funds through digital issuances, as well as custody and trade a variety of digital assets, such as digital securities, NFTs and cryptocurrencies. Coupled with this, Archax subsidiary Montis is leveraging blockchain technology to revolutionise the post-trade space by building a blockchain-based Central Securities Depository (CSD), which will allow regulated digital securities to realise their full potential.

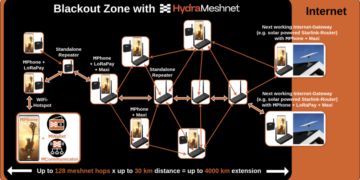

On the distribution side, Ownera has brought the industry together to develop the FinP2P open-source routing protocol to orchestrate the instant exchange of digital assets held on any blockchain platform, for digital cash held on any ledger. It supports primary issuance, secondary trading and DeFi-style instant borrowing against assets pledged as collateral. This routing network has the power to open up digital distribution for the private markets and unlock global liquidity in a way that no single institution or exchange can achieve on its own.

Speaking about the partnership, Graham Rodford, CEO and co-founder of Archax, said: “Together Archax and Ownera are perfectly positioned to help move the institutional adoption of digital assets forward to the next level. It is clear that tokenisation and the use of natively digital assets are the future for capital markets, and recent investments in this space by established traditional players into both Archax and Ownera, clearly demonstrate this.”

“Ownera and Archax have had a close relationship for some time – two UK companies with a very well aligned vision for the digital transformation of the global private markets. As such we are particularly pleased to be able to cement this collaboration by enabling Archax’s Issuers and Investors to benefit from access to the global Ownera FinP2P network.” Adds Ami Ben David, the Founder and CEO of Ownera.

About Archax:

Archax is a global, regulated, digital asset exchange, brokerage and custodian based in London. Founded by experts from the financial markets world and backed by an accomplished advisory board, Archax offers a credible bridge between the blockchain-centric crypto community and the traditional investment space.

Archax is the first-ever firm to receive FCA regulation as a digital securities exchange, custodian and brokerage. It was also the first firm to be listed on the FCA’s Cryptoasset Register as a VASP (Virtual Asset Service Provider).

Archax has been designed specifically for institutional investors to trade in all types of digital assets, from cryptocurrencies to digital securities. It is built using existing, proven, resilient, scalable, high-performance exchange infrastructure, hosted in top-tier datacentre space, and integrated into the existing institutional trading workflow. For more information, go to www.archax.com

About Ownera:

Ownera is a digital securities software company building the institutional inter-trading rails for a new multi-trillion-dollar digital securities market. The company led the creation of the open-source FinP2P interoperability protocol and delivers FinP2P based network nodes and digital securities solutions to the financial industry. This peer-to-peer network unlocks global distribution and liquidity by digitally connecting agents, brokers, and exchanges across the world for the instant issuance, trading, pledging and settlement of securities transactions.

Ownera recently announced its Series A investment round including strategic investment from J.P. Morgan, Draper Goren Holm, tokentus Investment AG, Accomplice Blockchain, Polymorphic Capital, The Ropart Group and Archax. For more information, go to www.ownera.io