Which drivers are expected to have the greatest impact on the over the ai in fintech market’s growth?

The increase in the use of AI in the fintech market is being driven by the need for fraud detection in financial services and fintech institutions. AI, composed of machine learning algorithms, can expand its knowledge as it accumulates data, providing deeper insights for banks. A key benefit of AI is that the algorithm continues to evolve as it gathers more data, starting as soon as the AI is implemented and unceasingly improving. PricewaterhouseCoopers’ 2022 survey revealed that 46% of participating organizations reported incidents of fraud, corruption or other financial crimes in the past two years. Additionally, a FintechNews report from September 2021 highlighted that banks are deploying AI-based solutions at an extraordinary pace, investing over $217 billion in AI applications for middle-office tasks like fraud prevention and risk assessment. This demand for fraud detection spearheads the fintech market’s adoption of AI.

Get Your AI in FinTech Market Report Here:

https://www.thebusinessresearchcompany.com/report/ai-in-fintech-global-market-report

What is the future CAGR of the ai in fintech market, and how will it impact industry expansion?

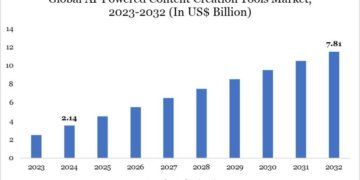

The market size of AI in fintech has witnessed significant expansion over the past few years. The market, which is projected to accelerate from $14.13 billion in 2024 to reach $17.79 billion in 2025, anticipates a compound annual growth rate (CAGR) of 25.9%. The surge experienced in the preceding period can be linked to the growth in risk management and fraud deterrence, improved customer experience, automation of everyday chores, utilization of data analytics for making decisive choices, as well as algorithmic trading and investment.

Expectations are high for the AI in fintech market size to experience substantial expansion in the coming years. Projections indicate it reaching $52.19 billion by 2029, with a compound annual growth rate (CAGR) of 30.9%. This forecasted growth could largely be due to the rising use of chatbots and virtual assistants, a heightened focus on regulatory compliance, and the implementation of robo-advisors in wealth management. Key trends to look out for during this period span from regulatory compliance automation to alternate credit scoring models, cross-selling, upselling suggestions, and the use of AI for enhancing cybersecurity. Automation in decentralized finance (DeFi) is also significant.

Get Your Free Sample Now – Explore Exclusive Market Insights:

https://www.thebusinessresearchcompany.com/sample.aspx?id=6240&type=smp

What new trends are reshaping the ai in fintech market and its opportunities?

Key players in the AI in fintech sector are concentrating on creating advanced technologies such as AI-driven banking systems to improve customer satisfaction and streamline procedures through personalized services, fraud identification, and optimized risk management. These innovations aim to create more robust and efficient financial solutions. An AI-powered banking platform leverages artificial intelligence to boost services such as personalization, fraud detection, and customer support, thereby streamlining operations and enhancing decision-making through sophisticated data analysis and automation. For instance, Temenos, a software firm based in Switzerland, introduced Responsible Generative AI Solutions in May 2024. These solutions amplified operational efficiency and decision-making through data-informed insights, all while prioritizing ethical conduct, transparency, and risk reduction. They encourage innovation and customization, allowing businesses to stay competitive in the fast-paced market environment.

Which key market segments comprise the ai in fintech market and drive its revenue growth?

The AI in fintech market covered in this report is segmented –

1) By Type: Solutions, Services

2) By Deployment: Cloud, On-premise

3) By Application: Asset Management, Risk Investigation, Business Analytics, Regulatory Compliance, Data Collection, Predictive Analytics, Virtual Assistance, Other Applications

Subsegments:

1) By Solutions: Fraud Detection and Prevention Solutions, Credit Scoring And Risk Assessment Tools, Algorithmic Trading Platforms, Robo-Advisors For Investment Management, Customer Service Chatbots

2) By Services: AI Consulting Services, Implementation and Integration Services, Maintenance and Support Services, Training And Education Services, Managed Services For AI Systems

Unlock Exclusive Market Insights – Purchase Your Research Report Now!

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=6240

What regions are at the forefront of ai in fintech market expansion?

North America was the largest region in the AI in fintech market in 2024. The regions covered in the AI in fintech market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Who are the leading players fueling growth in the ai in fintech market?

Major companies operating in the AI in fintech market include Alphabet Inc., Microsoft Corporation, Klarna Inc., Amazon Web Services Inc., Intel Corporation, International Business Machines Corporation, PayPal Holdings Inc., Square Inc., Salesforce.com Inc., Stripe Inc., Social Finance Inc., Robinhood Markets Inc., Nuance Communications Inc., Affirm Inc., Revolut Ltd., Adyen N.V., Ant Financial Services Group, On Deck Capital Inc., Kabbage Inc., Plaid Inc., IPsoft Inc., Onfido Limited, Betterment LLC, Funding Circle Limited, Wealthfront Corporation, Kensho Technologies Inc., Inbenta Technologies Inc., Trifacta Inc., Next IT Corporation, Zeitgold GmbH, ZestFinance Inc., Ayasdi Inc., FeedzAI inc., Numerai LLC, Riskified Ltd., Oscar Health Inc., Ripple Labs Inc., Chainalysis Inc., ThetaRay Ltd., Darktrace Limited, TruValue Labs Inc., Wealthsimple Inc., TrueAccord Corporation

Customize Your Report – Get Tailored Market Insights!

https://www.thebusinessresearchcompany.com/sample.aspx?id=6240&type=smp

What Is Covered In The AI in FinTech Global Market Report?

• Market Size Forecast: Examine the ai in fintech market size across key regions, countries, product categories, and applications.

• Segmentation Insights: Identify and classify subsegments within the ai in fintech market for a structured understanding.

• Key Players Overview: Analyze major players in the ai in fintech market, including their market value, share, and competitive positioning.

• Growth Trends Exploration: Assess individual growth patterns and future opportunities in the ai in fintech market.

• Segment Contributions: Evaluate how different segments drive overall growth in the ai in fintech market.

• Growth Factors: Highlight key drivers and opportunities influencing the expansion of the ai in fintech market.

• Industry Challenges: Identify potential risks and obstacles affecting the ai in fintech market.

• Competitive Landscape: Review strategic developments in the ai in fintech market, including expansions, agreements, and new product launches.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Europe: +44 207 1930 708,

Asia: +91 88972 63534,

Americas: +1 315 623 0293 or

Email: mailto:info@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.