WISeKey Reports H1 2025 Results; Updates on the Quantum Convergence Strategy Underpinned by a Strong Balance Sheet

Schedules Conference Call and Webcast for Friday, September 26 at 8:00 am ET (2:00 pm CET)

Geneva, Switzerland – September 23, 2025: – Ad-Hoc announcement pursuant to Art. 53 of SIX Listing Rules – WISeKey International Holding Ltd. (“WISeKey”, the “Group” or the “Company”) (SIX: WIHN, NASDAQ: WKEY), a global leader in cybersecurity, digital identity, and Internet of Things (IoT) innovations operating as a holding company, today announces its unaudited financial results for the six-month period ending June 30, 2025 (H1 2025).

WISeKey’s performance in the first half of 2025 is in line with our expectations, while the Company is executing on its strategy moving towards next-generation semiconductors, space connectivity, transactional IoT, trust services and blockchain, laying the foundation for sustainable long-term growth. Specifically:

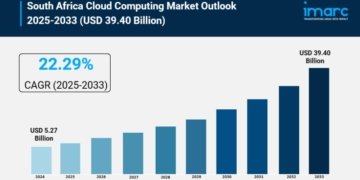

- Revenues for the period grew slightly by $0.1 million to $5.3 million, in line with our expectations reflecting the continued transition period ahead of the industry-wide strategic shift towards post-quantum and IoT-driven technologies. The Company expects strong growth in the second half of the year with full year revenues expected to be in the range of $18.0 to $21.0 million. This growth is driven by the expected return to growth in the demand for SEALSQ Corp’s (NASDAQ: LAES, “SEALSQ”) traditional products, the consolidated revenue of IC’ALPS since the completion of the acquisition by SEALSQ on August 4, 2025, as well as the continuing development of the revenue streams of our other business divisions.

- The Company’s operating losses increased by $13.2 million to $27.3 million largely driven by a one-off stock-based compensation charge of $10.1 million, in addition to increased investment in research and development of $1.0 million and an increase in the general and administrative costs as a result of an investment in the infrastructure of the Company to support the developing verticals. The increase in the operating losses is partially offset by an increased non-operating income due to a one-off gain on the settlement of the ExWorks loan of $3.7 million and interest earned on cash deposits of $1.6 million. This results in a net loss of $22.3 million which has increased by $6.8 million in comparison with the same period last year.

- Investments in research and development totaled $5.8 million that focused on SEALSQ’s quantum-resistant chips, the SEALCOIN AG (“SEALCOIN”) transactional IoT platform, WISeSat.Space AG (“WISeSat”) expansion, and the launch of the WISe.ART 3.0 platform.

- Our cash balance of $124.6 million as of June 30, 2025, will allow the Group to accelerate its technological development and to execute strategic investments that expand its capabilities, strengthen growth pipeline and position it at the forefront of the transition to quantum-resilient security solutions.

The first half of 2025 marked a decisive step forward in WISeKey’s Convergence strategy.

By integrating semiconductors, trust services, satellites, blockchain, and digital identity into a unified architecture of trust, WISeKey is no longer operating separate businesses but a single interconnected ecosystem. This Convergence is starting to demonstrate its financial potential, as each component drives value creation for the others, enabling WISeKey to multiply revenues, reduce dependency on any single line of business, and capture new, recurring income streams.

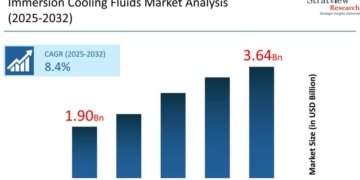

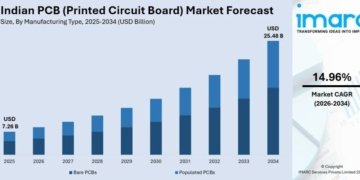

- At the core of this model is SEALSQ, which WISeKey controls with 52% of the voting rights (as of June 30, 2025). SEALSQ develops post-quantum secure chips, such as the QS7001 and QVault-TPM, that will generate revenues from hardware sales and recurring revenues through chip personalization at Outsourced Semiconductor Personalization and Test (OSPT) centers, where WISeKey will earn service fees each time a chip is provisioned with a secure identity.

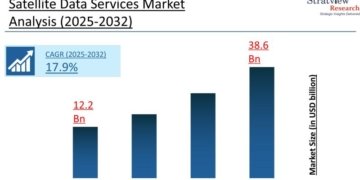

- These chips will extend their value further once deployed, as they will be able to connect to the satellite constellation of WISeSat, a wholly owned WISeKey subsidiary providing satellite-based IoT communications. This model is set to multiply one revenue opportunity into several distinct revenue streams: chip sales, OSPT personalization services, satellite communication services, and PKI subscriptions for lifecycle identity management.

- The ecosystem will then be extended through SEALCOIN, which is 75% owned by WISeKey. SEALCOIN is developing a technology that will allow each chip-secured device to transact autonomously, creating transaction-based revenues in the machine-to-machine and transactional IoT economy. Earlier this year, WISeKey validated this model by completing the world’s first space-based cryptocurrency transaction, demonstrating how chips, satellites, and blockchain converge to power a new digital economy.

- WISeKey also owns 87.5% of WISe.ART, a Swiss-based Web3.0 company, with the remaining 12.5% held by The Hashgraph Group. The newly launched WISe.ART 3.0 platform combines blockchain and cybersecurity to enable the authenticated trading of both digital and physical assets, adding yet another recurring revenue layer to the Convergence model.

- Finally, the WISeID platform, 96% owned by WISeKey, provides the PKI backbone for the ecosystem, securing every identity, device, and transaction, and enabling new applications such as Matter Protocol certification for smart home devices and GSMA eUICC digital identity services.

For shareholders, the value of this model lies in its scalability and resilience. Hardware sales will generate immediate revenues, while OSPT services, satellite subscriptions and blockchain transactions will create recurring income streams that compound with adoption. A defense contractor adopting SEALSQ chips also becomes a potential client for OSPT services, a potential subscriber to WISeSat connectivity services, a potential participant in SEALCOIN t-IoT transactions, and potentially a user of WISe.ART for tokenized asset management. Few companies in the sector can offer this depth of vertical integration.

Strategic partnerships are amplifying these efforts.

- The Quantix Edge Security initiative in Spain positions WISeKey at the heart of Europe’s semiconductor sovereignty strategy.

- Collaboration with the Swiss Army, combining the technology of WISeSat, SEALSQ and SEALCOIN into a single project, demonstrates that the Convergence model is already underway for secure, sovereign communications.

- At the same time, WISeKey’s HUMAN-AI-T initiative with the United Nations positions WISeKey at the forefront of global AI governance, reinforcing its leadership at the intersection of AI, security, and trust.

As WISeKey moves into the second half of 2025, its focus is on scaling execution.

The Company is preparing for the commercial launch of SEALSQ’s QVault-TPM in Q4 2025 that is expected to unlock significant new growth in 2026 and beyond. It is expanding the WISeSat constellation to increase global coverage and subscription revenues. SEALCOIN and WISe.ART are being brought from pilot stages into commercial deployment and are expected to generate transaction-based income streams. WISeKey is also expanding its OSPT footprint, with the goal of allowing every SEALSQ chip to be rapidly personalized and integrated into the ecosystem.

With a robust revenue pipeline across the entire group—along with WISeKey’s strong balance sheet and growing recognition of its role at the intersection of quantum security, space connectivity, blockchain, and AI—WISeKey is building a sovereign, trusted digital infrastructure designed for scale, resilience, and long-term shareholder value. WISeKey is not merely adapting to technological change; it is shaping it.

Conference Call

The Company will host a conference call to review its results on Friday, September 26, 2025, at 8:00 am ET (2:00 pm CET).

Toll-Free Dial-In Number: 877-445-9755; International Dial-In Number: 201-493-6744.

The webcast of the call can be accessed through the Investor Relations section of WISeKey’s website at http://www.wisekey.com. An archived version of the call will also be made available.

WISeKey Group Structure and Participation

SEALSQ Corp (NASDAQ: LAES)

- WISeKey controls: 52% of voting rights as of June 30, 2025.

- Role within Convergence: Foundation of the group strategy. SEALSQ develops post-quantum secure semiconductors (e.g., QS7001) and QVault-TPM chips.

- Monetization potential:

- Immediate revenues from chip sales.

- Recurring revenues via our planned OSPT (Outsourced Semiconductor Personalization & Test) centers where WISeKey will earn service fees each time a chip is provisioned.

- Integration into WISeSat for secure IoT connectivity, expanding recurring income streams.

WISeSat.Space AG

- WISeKey ownership: 100%

- Role within Convergence: Provides satellite-based IoT connectivity and secure communications, enabling SEALSQ chips to connect securely anywhere in the world.

- Monetization potential:

- Subscription revenues from IoT connectivity services.

- Defense and national security applications (Swiss Army, EU projects).

- Strategic projects (88-satellite constellation, European-neutral constellation).

SEALCOIN AG

- WISeKey ownership: 75%

- Role within Convergence: Aims to power machine-to-machine (M2M) and transactional IoT (t-IoT), where each chip-secured device would be able to transact autonomously within SEALCOIN.

- Monetization potential:

- Transaction fees from autonomous IoT exchanges.

- Integration with satellites + chips = creates a third recurring revenue layer.

- Backed by a $50 million investment commitment from GEM Digital through a structured token subscription agreement.

WISe.ART

- WISeKey ownership: 87.5%

- Role within Convergence: Digital marketplace for authenticated NFT and tokenized asset trading. Extends WISeKey’s trust model to both digital and physical assets.

- Monetization potential:

- Transaction revenues from NFT/digital assets.

- Expansion of blockchain infrastructure revenues.

- Positioned as the fourth monetization layer in the Convergence model.

WISeKey SA (WISeID, INeS Platform and PKI as a Service)

- WISeKey ownership: 96% (this is the core WISeKey platform).

- Role within Convergence: Provides the PKI backbone (public key infrastructure) enabling device attestation, secure identity management and lifecycle management of chips and devices.

- Monetization potential:

- Service fees for PKI and digital identity lifecycle management.

- Adoption in smart home / Matter protocol products and GSMA eUICC services.

Summary of WISeKey Participation

- SEALSQ: 52% voting rights (semiconductors, hardware revenues & personalization services).

- WISeSat: 100% (satellite IoT connectivity, subscriptions & defense).

- SEALCOIN: 75% (transactional IoT & machine-to-machine transaction fees).

- WISe.ART: 87.5% (NFTs, tokenized assets & blockchain monetization).

- WISeID (WISeKey SA): 96% (PKI, digital identity & backbone of trust infrastructure).

WISeKey has designed a vertically integrated Convergence ecosystem where each company bolsters and magnifies the impact the others — from chip to trust services to satellite to blockchain to marketplace.

UNAUDITED ADDITIONAL FINANCIAL & OPERATIONAL DATA

Unaudited Condensed Consolidated Statements of Comprehensive Income/(Loss) [as reported]

| Unaudited 6 months ended June 30, | |||

| USD’000 | 2025 | 2024 | |

| Net sales | 5,293 | 5,174 | |

| Cost of sales | (3,173) | (3,834) | |

| Depreciation of production assets | (243) | (228) | |

| Gross profit | 1,877 | 1,112 | |

| Other operating income | 82 | 178 | |

| Research & development expenses | (5,792) | (2,942) | |

| Selling & marketing expenses | (7,393) | (3,967) | |

| General & administrative expenses | (16,090) | (8,518) | |

| Total operating expenses | (29,193) | (15,249) | |

| Operating loss | (27,316) | (14,137) | |

| Non-operating income | 6,964 | 1,129 | |

| Debt conversion expense | – | (21) | |

| Interest and amortization of debt discount | (88) | (529) | |

| Non-operating expenses | (1,816) | (584) | |

| Loss before income tax expense | (22,256) | (14,142) | |

| Income tax expense | (1) | (1,310) | |

| Net loss | (22,257) | (15,452) | |

| Less: Net loss attributable to noncontrolling interests | (17,807) | (5,982) | |

| Net loss attributable to WISeKey International Holding AG | (4,450) | (9,470) | |

| Earnings per Class A Share (USD) | |||

| Earnings per Class A Share | |||

| Basic | (0.53) | (0.45) | |

| Diluted | (0.53) | (0.45) | |

| Earning per Class A Share attributable to WISeKey International Holding Ltd | |||

| Basic | (0.11) | (0.27) | |

| Diluted | (0.11) | (0.27) | |

| Earnings per Class B Share (USD) | |||

| Earnings per Class B Share | |||

| Basic | (5.32) | (4.48) | |

| Diluted | (5.32) | (4.48) | |

| Earning per Class B Share attributable to WISeKey International Holding Ltd | |||

| Basic | (1.06) | (2.74) | |

| Diluted | (1.06) | (2.74) | |

| Other comprehensive income / (loss), net of tax: | |||

| Foreign currency translation adjustments | 700 | (515) | |

| Unrealized gains on debt securities | |||

| Unrealized holding gains arising during the period | 23 | – | |

| Defined benefit pension plans: | |||

| Net gain arising during the period | 95 | 34 | |

| Other comprehensive loss | 818 | (481) | |

| Comprehensive loss | (21,439) | (15,933) | |

| Other comprehensive income / (loss) attributable to noncontrolling interests | 65 | 45 | |

| Other comprehensive loss attributable to WISeKey International Holding AG | 753 | (526) | |

| Comprehensive loss attributable to noncontrolling interests | (17,742) | (5,937) | |

| Comprehensive loss attributable to WISeKey International Holding AG | (3,697) | (9,996) | |

The notes are an integral part of our consolidated financial statements.

Unaudited Condensed Consolidated Balance Sheets [as reported]

| As at June 30, | As at December 31, | ||

| USD’000 | 2025 (unaudited) | 2024 | |

| ASSETS | |||

| Current assets | |||

| Cash and cash equivalents | 124,596 | 90,600 | |

| Accounts receivable, net of allowance for credit losses | 3,137 | 4,285 | |

| Notes receivable, current | – | 13 | |

| Inventories | 2,204 | 1,418 | |

| Prepaid expenses | 2,043 | 1,364 | |

| Government assistance | 2,149 | 2,247 | |

| Other current assets | 1,417 | 573 | |

| Total current assets | 135,546 | 100,500 | |

| Noncurrent assets | |||

| Notes receivable, noncurrent | – | 32 | |

| Deferred tax credits | 829 | 250 | |

| Property, plant and equipment net of accumulated depreciation | 4,172 | 3,275 | |

| Intangible assets, net of accumulated amortization | – | – | |

| Crypto assets | 401 | 96 | |

| Operating lease right-of-use assets | 1,295 | 1,502 | |

| Investments in unconsolidated affiliates | 3,487 | – | |

| Available-for-sale debt securities, noncurrent | 127 | – | |

| Goodwill | 8,317 | 8,317 | |

| Equity securities, at cost | 518 | 455 | |

| Other noncurrent assets | 297 | 261 | |

| Total noncurrent assets | 19,443 | 14,188 | |

| TOTAL ASSETS | 154,989 | 114,688 | |

| LIABILITIES | |||

| Current Liabilities | |||

| Accounts payable | 17,311 | 13,496 | |

| Notes payable | 1,965 | 5,900 | |

| Indebtedness to related parties, current | 85 | 78 | |

| Convertible note payable, current | 10 | 9 | |

| Deferred revenue, current | 141 | 93 | |

| Current portion of obligations under operating lease liabilities | 689 | 607 | |

| Income tax payable | – | 2 | |

| Other current liabilities | 2,187 | 1,135 | |

| Total current liabilities | 22,388 | 21,320 | |

| Noncurrent liabilities | |||

| Bonds, mortgages and other long-term debt | 87 | 102 | |

| Indebtedness to related parties, noncurrent | 1,458 | 1,387 | |

| Deferred revenue, noncurrent | 13 | 21 | |

| Operating lease liabilities, noncurrent | 676 | 853 | |

| Employee benefit plan obligation | 3,803 | 3,877 | |

| Other noncurrent liabilities | – | 4 | |

| Total noncurrent liabilities | 6,037 | 6,244 | |

| TOTAL LIABILITIES | 28,425 | 27,564 | |

| Commitments and contingent liabilities | |||

| SHAREHOLDERS’ EQUITY | |||

| Common stock – Class A | 16 | 16 | |

| Par value: CHF 0.01 and CHF 0.01 | |||

| Authorized – 2,000,880 and 2,000,880 shares | |||

| Issued and outstanding – 1,600,880 and 1,600,880 shares | |||

| Common stock – Class B | 440 | 359 | |

| Par value: CHF 0.10 and CHF 0.10 | |||

| Authorized – 6,696,467 and 6,194,267 | |||

| Issued – 4,080,546 and 3,365,560 | |||

| Outstanding – 4,024,038 and 3,309,052 | |||

| Share subscription in progress | 1 | 1 | |

| Treasury stock, at cost (56,508 and 56,508 shares held) | (502) | (502) | |

| Additional paid-in capital | 326,471 | 316,431 | |

| Accumulated other comprehensive income / (loss) | 3,903 | 3,150 | |

| Accumulated deficit | (298,857) | (294,407) | |

| Total shareholders’ equity attributable to WISeKey shareholders | 31,472 | 25,048 | |

| Noncontrolling interests in consolidated subsidiaries | 95,092 | 62,076 | |

| Total shareholders’ equity | 126,564 | 87,124 | |

| TOTAL LIABILITIES AND EQUITY | 154,989 | 114,688 | |

The notes are an integral part of our consolidated financial statements.

Disclaimer

This communication expressly or implicitly contains certain forward-looking statements concerning WISeKey International Holding Ltd and its business. Such statements involve certain known and unknown risks, uncertainties and other factors, which could cause the actual results, financial condition, performance or achievements of WISeKey International Holding Ltd to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. WISeKey International Holding Ltd is providing this communication as of this date and does not undertake to update any forward-looking statements contained herein as a result of new information, future events or otherwise.

This press release does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, and it does not constitute an offering prospectus within the meaning of the Swiss Financial Services Act (“FinSA”), the FinSa’s predecessor legislation or advertising within the meaning of the FinSA. Investors must rely on their own evaluation of WISeKey and its securities, including the merits and risks involved. Nothing contained herein is, or shall be relied on as, a promise or representation as to the future performance of WISeKey.

Press and Investor Contacts

| WISeKey International Holding Ltd Company Contact: Carlos Moreira Chairman & CEO Tel: +41 22 594 3000 info@wisekey.com | WISeKey Investor Relations (US) The Equity Group Inc. Lena Cati Tel: +1 212 836-9611 lcati@theequitygroup.com |