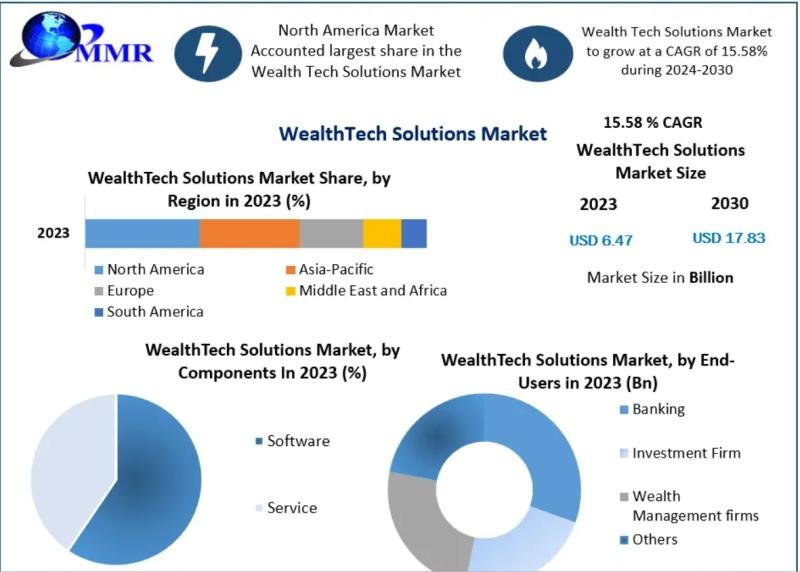

WealthTech Solutions Market was valued at USD 6.47 Billion in 2023, and it is expected to reach USD 17.83 Billion by 2030, exhibiting a CAGR of 15.58% during the forecast period (2024-2030).

WealthTech Solutions Market Overview

The global WealthTech Solutions Market is undergoing a transformative phase, driven by changing customer preferences, digital innovation, and evolving financial landscapes. WealthTech solutions provide digital tools and platforms that enhance operational efficiency for financial advisors, wealth management firms, and individual investors. These solutions facilitate portfolio optimization, improved liquidity, cost transparency, and superior customer service. Key applications include wealth planning, retirement savings, digital customer relationship management, process automation, and comprehensive financial data analysis. Rapid adoption of cloud-based software, automated robo-advisors, and personalized financial management platforms has democratized access to sophisticated investment solutions, allowing a broader demographic-including millennials and senior investors-to benefit from tailored portfolio management and financial advisory services.

Download a Free Sample Report Today :https://www.maximizemarketresearch.com/request-sample/167061/

WealthTech Solutions Market Dynamics

The WealthTech market is driven by the growing demand for digital financial wellness, intergenerational wealth transfers, and the need for operational efficiency in wealth management firms. Financial advisors increasingly leverage technology for client engagement, regulatory-compliant onboarding, and lifecycle management, reducing administrative burdens while improving service delivery. Venture capital investment into WealthTech has surged, reflecting confidence in AI-driven analytics, big data, and automation solutions that streamline back-office operations, robo-advisory services, and self-service investment platforms. The market is also shaped by regulatory frameworks demanding transparency and customization, compelling wealth managers to adopt innovative, cost-effective solutions. Technological disruption, coupled with rising client expectations for digital experiences and accessibility, continues to redefine traditional wealth management paradigms.

WealthTech Solutions Market Outlook and Future Trends

The WealthTech Solutions Market is poised for strong growth, projected to expand from USD 6.47 billion in 2023 to USD 17.83 billion by 2030, at a CAGR of 15.58%. Future trends point to deeper adoption of AI-powered investment tools, AutoML, MLOps, and predictive analytics to enhance client engagement, portfolio management, and operational efficiency. Cloud-based platforms and mobile-first applications will continue to drive accessibility and democratization of financial services. Additionally, the rise of robo-advisors, micro-investment platforms, and digital brokers will expand financial inclusion, particularly among younger and tech-savvy investors. WealthTech solutions are expected to increasingly integrate blockchain, big data, and AI for real-time insights, automated compliance, and personalized financial planning, while regions such as Asia-Pacific are set to emerge as key growth hubs due to rising wealth creation and digital adoption.

Key Recent Developments

WealthTech companies are actively innovating to address evolving investor needs and regulatory requirements. Leading firms such as Aixigo offer high-speed digital wealth management solutions for institutional clients, while platforms like Albert provide personalized financial advisory tools through data aggregation. Venture funding has surged globally, supporting innovations in automated portfolio management, robo-advisory, and cloud-based wealth platforms. Financial institutions are increasingly acquiring WealthTech firms to enhance operational efficiency and scale their digital offerings. In Asia-Pacific, countries like Singapore, China, and India are witnessing rapid adoption of WealthTech solutions, driven by high smartphone penetration, supportive regulatory environments, and growing demand for succession planning and cross-border wealth management. These developments underscore WealthTech’s role in transforming the wealth management ecosystem by combining technology, efficiency, and accessibility.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report :https://www.maximizemarketresearch.com/request-sample/167061/

WealthTech Solutions Market Segmentation

by Deployment Type

1.Cloud

2.Premises

by Components

1.Software

2.Service

by Organization Size

1.Large Enterprises

2.Small-Medium Size Enterprise

by End-Users

1.Banking

2.Investment Firm

3.Wealth Management firms

4.Others

Some of the current players in the WealthTech Solutions Market are:

1. Acorns

2. Active Asset Allocation

3.Additiv

4.Advestis

5.Advisor Software

6. Advize

7. Aixigo

8.Albert

9.Allocare

10. Aspiration

11. BestInvest

12. Bitbond

13. Calastone

14. Comply Advantage

15.ComplySci

16.ComplySolutions

17. Delio

18.Digit

19.Drive Wealth

20.Elinvar

21.Ellevest

22. Estate Guru

23. Etoro

24.EQIS

25.Expersoft

26.Financeware

27. Tindeco

28. TrackInsight

29. Trade Republic

30.True Potential

31. TrueWealth

32. Valphi

33.Vestmark

34. Vestwell

35.VisualVest

36.Walnut

37.Wealtharc

For additional reports on related topics, visit our website:

♦ Low-Code Development Platform Market https://www.maximizemarketresearch.com/market-report/global-low-code-development-platform-market/55407/

♦ Digital Content Creation Market https://www.maximizemarketresearch.com/market-report/global-digital-content-creation-market/14892/

♦ Global Computer Aided Design (CAD) Market https://www.maximizemarketresearch.com/market-report/global-computer-aided-design-cad-market/63443/

♦ Open-Source Intelligence Market https://www.maximizemarketresearch.com/market-report/global-open-source-intelligence-market/66653/

♦ Online Travel Booking Market https://www.maximizemarketresearch.com/market-report/global-online-travel-booking-market/26269/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.