UK Mobile Payments Market 2025-2033

According to IMARC Group’s report titled “UK Mobile Payments Market Report by Mode of Transaction (WAP (Wireless Application Protocol), NFC (Near Field Communications), SMS (Short Message Service), USSD (Unstructured Supplementary Service Data), and Others), Application (Entertainment, Energy and Utilities, Healthcare, Retail, Hospitality and Transportation, and Others), and Region 2025-2033”, The report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

How Big is the UK Mobile Payments Industry ?

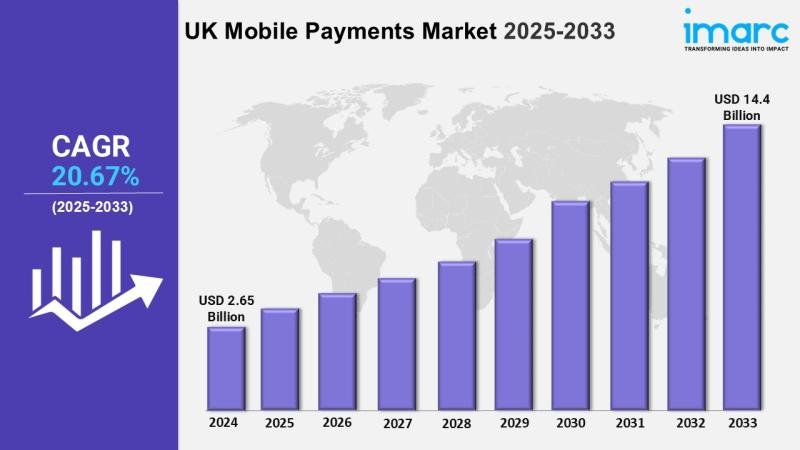

The UK mobile payments market size was valued at USD 2.65 Billion in 2024 and expects the market to reach USD 14.4 Billion by 2033, exhibiting a growth rate (CAGR) of 20.67% during 2025-2033.

UK Mobile Payments Market Trends:

The UK market for mobile payments is undergoing strong change, being shaped by technical advance and evolving customer habits. Widespread usage of contactless payments, hastened by the pandemic and supported by growing levels of NFC-capable smartphone take-up, are a characteristic feature. Digital wallets such as Apple Pay, Google Pay, and Samsung Pay are also winning attention, with customers increasingly being users of new-payment technologies from mainstream banks in emerging markets.”. Besides, the market is also experiencing a rise in “buy now, pay later” (BNPL) implementations in mobile payment apps, deconstructing the distinction between transactions and lending.

In addition, open banking initiatives are promoting seamless peer-to-peer (P2P) payments and real-time transactions via apps such as PayPal and Revolut. Essentially, the intersection of security improvements (e.g., biometric verification) and hyper-personalized loyalty programs is transforming the way consumers engage with mobile payment platforms.

Request for a sample copy of this report: https://www.imarcgroup.com/uk-mobile-payments-market/requestsample

UK Mobile Payments Market Scope and Growth Analysis:

The UK mobile payments market covers a wide-ranging ecosystem of retail transactions, transport ticketing, and online commerce with strong growth driven by high smartphone penetration and strong digital infrastructure. In addition, regulatory backing through initiatives such as the Financial Conduct Authority’s (FCA) Open Banking regime is driving competition and innovation among fintech participants. Besides, SMEs are increasingly turning to mobile payment solutions to streamline processes and accommodate cash-shy customers, making the market broader.

Additionally, the fusion of AI-powered fraud detection and blockchain solutions is solving security issues while improving the efficiency of transactions. Essentially, while faced with threats such as cybersecurity vulnerability and fragmented merchant adoption, the market’s alignment towards cashless economy objectives and consumer demand for seamless experiences guarantees continued growth to place the UK among European leaders in mobile payments.

UK Mobile Payments Industry Segmentation:

The report has segmented the market into the following categories:

Mode of Transaction Insights:

• WAP (Wireless Application Protocol)

• NFC (Near Field Communications)

• SMS (Short Message Service)

• USSD (Unstructured Supplementary Service Data)

• Others

Application Insights:

• Entertainment

• Energy and Utilities

• Healthcare

• Retail

• Hospitality and Transportation

• Others

Regional Insights:

• London

• South East

• North West

• East of England

• South West

• Scotland

• West Midlands

• Yorkshire and The Humber

• East Midlands

• Others

Competitor Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Other key areas covered in the report:

• COVID-19 Impact on the Market

• Porter’s Five Forces Analysis

• Strategic Recommendations

• Market Dynamics

• Historical, Current and Future Market Trends

• Market Drivers and Success Factors

• SWOT Analysis

• Value Chain Analysis

• Comprehensive Mapping of the Competitive Landscape

• Top Winning Strategies

• Recent Industry News

• Key Technological Trends & Development

Explore More Research Reports & Get Your Free Sample Now:

UK Fashion and Apparel Market: https://www.imarcgroup.com/uk-fashion-apparel-market/requestsample

UK Green Technology Market: https://www.imarcgroup.com/uk-green-technology-market/requestsample

UK Fintech Lending Market: https://www.imarcgroup.com/uk-fintech-lending-market/requestsample

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask an analyst: https://www.imarcgroup.com/request?type=report&id=25445&flag=C

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.