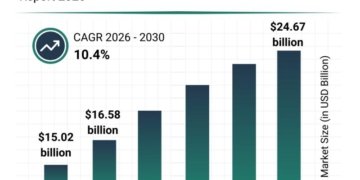

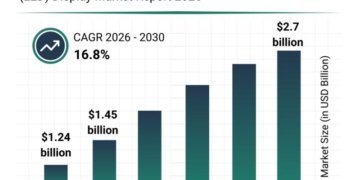

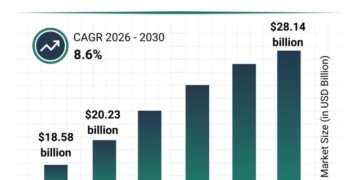

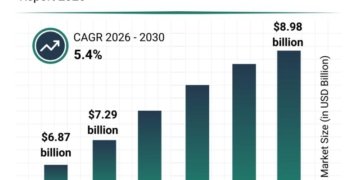

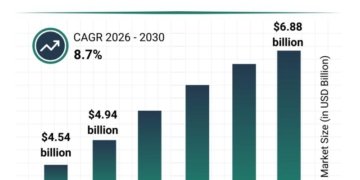

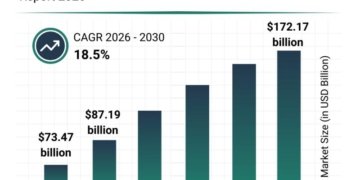

Market Size and Growth

Singapore Cards and Payments Market is estimated to grow at a high CAGR during the forecast period 2024-2031

Key Development:

Singapore: Recent Industry Developments

✅ In September 2025, Singapore’s fintech sector attracted nearly US$1.04 billion across 90 deals, marking the highest investment level since H1 2023.

✅ In September 2025, OKX introduced stablecoin payments at GrabPay merchants in Singapore, enabling transactions in USDC or USDT stablecoins converted into the Singapore dollar-pegged stablecoin, XSGD.

✅ In February 2025, the Monetary Authority of Singapore and the Association of Banks in Singapore announced plans to establish a new entity to oversee the administration and governance of national payment schemes.

Japan: Recent Industry Developments

✅ In October 2025, SoftBank’s PayPay Corp acquired a 40% stake in Binance Japan, aiming to deepen collaboration in digital payments and crypto assets.

✅ In September 2025, Credit Saison launched a multi-million-dollar blockchain investment fund named Onigiri Capital, targeting real-world asset startups.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/singapore-cards-and-payments-market?sb

Recent Mergers and acquisitions:

Singapore: Recent M&A Activity

✅ In October 2025, HashStudioz Technologies Pvt. Ltd., a global technology firm specializing in IoT, data analytics, AI, travel technology, and custom software development, acquired a majority stake in Maxify Digital, a boutique consultancy offering expertise in Salesforce, SaaS, and AI-driven solutions. This acquisition enhances HashStudioz’s capability to deliver comprehensive digital transformation services across various sectors, including aviation, travel, media, banking, and fintech.

✅ In September 2025, Singapore’s fintech sector attracted US$1.04 billion across 90 deals, led by payments, digital assets, and AI investments. Notable transactions included Airwallex’s US$301 million raise, positioning the country as a regional epicenter for digital payments innovation.

✅ In August 2025, Singapore’s fintech deal count rose by 19 percent to 117 deals in H1’25, with significant investments in cryptocurrency, blockchain, and payments.

Japan: Recent M&A Activity

✅ In October 2025, SoftBank’s PayPay Corp acquired a 40% stake in Binance Japan, aiming to deepen collaboration in digital payments and crypto assets. This strategic partnership allows Binance Japan users to directly use PayPay Money for crypto transactions.

✅ In August 2025, Japan’s M&A deal volume reached a 20-year peak in the first half of 2025. This surge in domestic transactions reflects a robust recovery in deal activity across Asia.

✅ In June 2025, Japan marked a record-high $232 billion in M&A transactions in the first half of 2025, driven by corporate restructuring, shareholder activism, and a low interest rate environment. Major deals included the privatization of listed subsidiaries by companies such as Toyota and NTT, as well as a $40 billion funding commitment to OpenAI by SoftBank Group.

Key Players:

=> HSBC, Royal Bank of Scotland, Barclays, Nationwide Building Society, Santander Singapore plc, The Co-operative Bank p.l.c, Virgin Money, Clydesdale Bank, GoCardless, Paypal UK, Worldpay

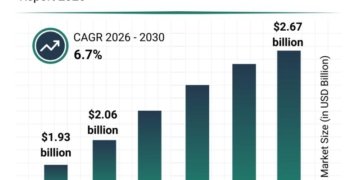

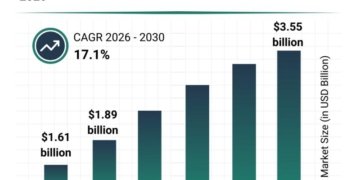

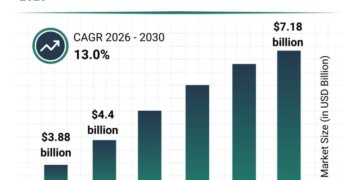

Growth Forecast Projected:

The Global Singapore Cards and Payments Market is anticipated to rise at a considerable rate during the forecast period, between 2024 and 2031. In 2023, the market is growing at a steady rate, and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

Research Process:

Both primary and secondary data sources have been used in the global Singapore Cards and Payments Market research report. During the research process, a wide range of industry-affecting factors are examined, including governmental regulations, market conditions, competitive levels, historical data, market situation, technological advancements, upcoming developments, in related businesses, as well as market volatility, prospects, potential barriers, and challenges.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=singapore-cards-and-payments-market

Key Segments:

➥ By Payment Methods: Debit Cards, Credit/Charge/Purchasing Cards, Cash, Direct Debit, Bacs Direct Debit, Faster Payments & Other Remote Banking, CHAPS, Standing Order, Cheque, Others

Regional Analysis for Singapore Cards and Payments Market:

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

Benefits of the Report:

Chapter 1: Sets the stage by outlining the report’s coverage, summarizing key market segments by region, product type, and application. Presents a snapshot of market sizes, growth potential across segments, and anticipated industry evolution both short and long term.

Chapter 2: Highlights pivotal market insights and uncovers the most significant emerging trends driving change within the industry.

Chapter 3: Offers an in-depth look at the competitive landscape among Singapore Cards and Payments producers, including revenue shares, strategic moves, and recent mergers and acquisitions.

Chapter 4: Presents comprehensive profiles of the market’s key players, delving into details such as revenue, profit margins, product portfolios, and company milestones.

Chapters 5 & 6: Analyze Singapore Cards and Payments revenue at both regional and country levels, providing quantitative breakdowns of market sizes, growth opportunities, and development prospects worldwide.

Chapter 7: Focuses on different market segments by type, examining their individual sizes and potential, guiding readers toward high-impact, untapped market areas.

Chapter 8: Explores segmentation by application, evaluating industry growth potential in various downstream markets and pinpointing promising sectors for expansion.

Chapter 9: Provides a thorough review of the industry’s supply chain mapping out both upstream and downstream activities.

Chapter 10: Concludes with a summary of the report’s key findings and highlights the most critical takeaways for industry stakeholders.

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/singapore-cards-and-payments-market?sb

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription?sb

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg?sb

Contact Us –

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us –

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.