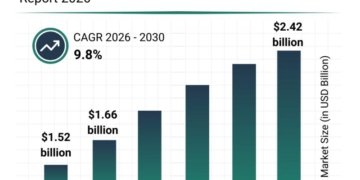

According to a new study by DataHorizzon Research, the online payroll service market is projected to grow at a CAGR of 10.2% from 2025 to 2033, driven by accelerating small business formation requiring affordable payroll solutions, increasing regulatory compliance complexity demanding specialized expertise, and widespread adoption of cloud-based human resources management systems that integrate seamlessly with automated payroll processing. The market valuation is anticipated to exceed $18.3 billion by 2033, reflecting robust demand from businesses across all sectors seeking to eliminate manual payroll administration, reduce compliance risk exposure, and redirect internal resources toward revenue-generating activities rather than administrative overhead. The expansion is powered by artificial intelligence integration enabling intelligent time tracking and exception handling, mobile accessibility allowing employees to access pay information and update details remotely, and the fundamental shift from on-premise software installations to subscription-based services that eliminate upfront capital investment while providing continuous feature updates and regulatory adjustments. Industry participants recognize that specialized payroll service providers deliver competitive advantages through multi-jurisdiction tax compliance expertise, direct deposit and payment method flexibility, and comprehensive reporting capabilities that manual systems and generic accounting software cannot economically replicate.

Online Payroll Service Market Key Growth Drivers and Demand Factors

The global online payroll service market was valued at approximately USD 7.5 billion in 2024 and is expected to reach around USD 18.3 billion by 2033, growing at a compound annual growth rate (CAGR) of about 10.2% from 2025 to 2033.

The online payroll service market continues experiencing sustained momentum as businesses confront escalating payroll complexity driven by remote workforce distribution across multiple tax jurisdictions, gig economy worker classification challenges, and frequent legislative changes affecting wage calculations, tax withholding, and benefit deductions. Small and medium-sized business growth represents the primary catalyst, with entrepreneurship rates reaching historic highs and new business formations requiring immediate payroll infrastructure without capital budgets for dedicated HR staff or enterprise software systems.

Regulatory compliance pressure intensifies as federal, state, and local governments implement new requirements around paid leave mandates, minimum wage adjustments, overtime regulations, and employment tax reporting. The online payroll service market benefits tremendously from providers assuming compliance responsibility and automatically updating systems to reflect regulatory changes, effectively transferring legal risk from business owners to specialized vendors with dedicated compliance teams. Labor shortage challenges facing businesses create urgency around employee experience improvement, with self-service portals, instant pay stubs, and mobile access to tax documents becoming expected rather than optional features.

Technology convergence represents a transformative driver, with payroll platforms integrating time tracking, benefits administration, applicant tracking, and performance management within unified human capital management ecosystems. The online payroll service market expansion is further accelerated by artificial intelligence applications including anomaly detection that flags unusual time entries, predictive analytics forecasting labor costs, and chatbot interfaces answering routine employee questions without HR intervention. Direct deposit ubiquity and alternative payment methods including prepaid cards and instant pay options enable flexible compensation timing that supports employee financial wellness.

Investment trends show consistent migration from legacy desktop software and manual processes toward cloud-based solutions, with average payroll processing costs declining 40-50% when comparing in-house administration to outsourced online services. Accounting firm partnerships create referral ecosystems where tax preparation and bookkeeping professionals recommend integrated payroll solutions to clients, driving customer acquisition through trusted advisor channels.

Get a free sample report: https://datahorizzonresearch.com/request-sample-pdf/online-payroll-service-market-50014

Why Choose Our Online Payroll Service Market Research Report

Our comprehensive research methodology delivers granular market intelligence through primary research encompassing 350+ service provider interviews, small business owner surveys across 35 countries, and feature utilization analysis from anonymized user data. The report provides exhaustive segmentation across business size categories, industry verticals, service tier offerings, and integration capabilities, enabling precise competitive positioning and product development strategies. Forecast accuracy is validated through correlation analysis with business formation rates, employment growth patterns, and regulatory complexity indices that influence payroll outsourcing adoption trajectories.

The analytical framework extends beyond traditional market sizing to encompass pricing structure analysis, customer lifetime value modeling, and churn rate benchmarking across different acquisition channels and customer segments. Competitive landscape assessment examines platform usability scores, integration ecosystem breadth, compliance guarantee frameworks, and customer support effectiveness metrics that determine retention and referral generation. The deliverable includes actionable insights on feature prioritization, pricing optimization strategies, and partnership development with accounting software providers and banking institutions. Geographic opportunity identification leverages small business density data, regulatory environment complexity scoring, and digital payment infrastructure maturity to guide international expansion sequencing and localization requirements.

Important Points

• The online payroll service market exhibits strong customer retention with average subscription duration exceeding 4.5 years and annual churn rates below 18% due to switching friction and payroll criticality

• Small businesses with 1-50 employees represent 68% of total customer base but only 42% of revenue, while mid-market companies with 50-500 employees generate disproportionate per-customer value

• Average monthly subscription costs range from $40-$60 for basic plans serving micro-businesses to $200-$500 for comprehensive platforms with HR management integration and dedicated support

• Compliance guarantee offerings where providers assume penalty liability for tax filing errors command 25-30% premium pricing over basic processing services

• Mobile application adoption has reached 64% of users as of 2024, with employee self-service features reducing HR inquiry volume by 45-50%

• Integration capabilities with accounting platforms including Xero, and FreshBooks represent the most frequently cited purchase decision factor, influencing 73% of buyer selections

Top Reasons to Invest in the Online Payroll Service Market Report

• Identify high-growth customer segments and vertical markets exhibiting above-average adoption rates for targeted marketing investment and product customization strategies

• Access comprehensive competitive intelligence on pricing models, feature sets, integration partnerships, and customer satisfaction benchmarks guiding market positioning decisions

• Leverage demand forecasting models calibrated to small business formation rates, employment growth projections, and regulatory complexity trends affecting outsourcing propensity

• Understand emerging technology requirements including AI-powered analytics, blockchain-based payment verification, and embedded finance capabilities reshaping platform expectations

• Benchmark operational metrics including processing accuracy rates, customer onboarding timelines, support response performance, and compliance incident frequency against industry standards

• Navigate partnership ecosystem opportunities with banks, accounting software providers, and HR technology platforms that accelerate customer acquisition and reduce integration friction

Online Payroll Service Market Challenges, Risks, and Barriers

The online payroll service market confronts significant obstacles including intense competitive pressure driving pricing erosion, with established players and new entrants offering free basic tiers that commoditize simple payroll processing. Data security concerns and high-profile breaches create trust barriers as businesses recognize sensitive employee information including Social Security numbers, bank accounts, and compensation data represents attractive hacking targets. Regulatory complexity across international jurisdictions limits scalability for providers lacking multi-country expertise and localized compliance frameworks. Customer acquisition costs continue escalating as digital advertising competition intensifies and organic search visibility becomes harder to achieve without substantial content investment. Integration maintenance burden grows as accounting platforms, time tracking systems, and HRIS solutions release frequent updates requiring ongoing compatibility testing. Economic recession sensitivity affects small business survival rates and discretionary spending on premium service tiers. Feature parity challenges emerge as competitors rapidly replicate differentiated capabilities, reducing sustainable competitive advantage duration. Bank partnership dependencies create concentration risk when direct deposit processing or payment infrastructure experiences disruptions. Compliance liability exposure despite guarantee programs creates insurance cost pressures and potential catastrophic loss scenarios.

Top 10 Market Companies

• PayStreamPro Solutions

• WorkforceWage Systems

• PayrollCloud Technologies

• CompensateNow Corporation

• SalarySync Services

• PayMaster Online

• StaffPay International

• DirectWage Solutions

• CloudPayroll Group

• CompensationHub Services

Market Segmentation

By Deployment Type

o Cloud-based

o On-premises

By Organization Size

o SMEs

o Large Enterprises

By Service Type

o Managed payroll services

o Self- service payroll services

By Region

o North America

o Europe

o Asia Pacific

o Latin America

o Middle East & Africa

Recent Developments

• PayStreamPro Solutions launched AI-powered wage and hour compliance assistant that automatically flags potential overtime violations and meal break infractions before payroll processing, reducing legal exposure

• WorkforceWage Systems completed strategic acquisition of benefits administration platform, creating unified HR technology suite serving mid-market companies with 50-1,000 employees

• PayrollCloud Technologies announced embedded finance partnership with fintech provider enabling instant pay options where employees access earned wages before scheduled pay dates

• CompensateNow Corporation secured $65 million Series C funding to accelerate international expansion across European markets and develop blockchain-based payment verification system

• SalarySync Services introduced consumption-based pricing model eliminating per-employee charges in favor of per-payroll-run fees, simplifying cost structure for seasonal businesses with variable workforce sizes

Online Payroll Service Market Regional Performance & Geographic Expansion

North America dominates the online payroll service market with approximately 46% global share, driven by high small business formation rates, complex multi-jurisdiction tax environments, widespread cloud software adoption, and mature direct deposit infrastructure. Europe demonstrates consistent growth through digital transformation initiatives, cross-border labor mobility requiring multi-country payroll capabilities, and regulatory frameworks including GDPR imposing data handling requirements that favor specialized providers. Asia-Pacific emerges as fastest-growing region with 16%+ annual expansion, fueled by entrepreneurship acceleration, labor law modernization creating compliance complexity, expanding middle-market segment, and smartphone-first business management preferences. Latin America shows promising adoption patterns as digital payment infrastructure matures, informal economy formalization drives payroll system requirements, and regional integration creates cross-border employment scenarios. Middle East markets exhibit moderate growth concentrated in UAE and Saudi Arabia where economic diversification policies encourage small business development and regulatory modernization increases compliance burdens.

How Online Payroll Service Market Insights Drive ROI Growth

Strategic intelligence enables service providers to optimize product tiering by identifying feature combinations and price points that maximize customer lifetime value while minimizing support costs and development complexity. Competitive analysis reveals positioning opportunities and underserved customer segments where specialized capabilities or vertical expertise support premium pricing and reduced churn. Understanding customer onboarding friction points and feature adoption patterns improves user experience design and tutorial effectiveness that accelerates time-to-value realization.

Pricing strategy refinement based on willingness-to-pay analysis across business sizes and industry categories maximizes revenue capture while maintaining accessible entry points for price-sensitive micro-businesses. Channel partner development informed by referral value assessment and revenue share optimization improves distribution efficiency through accounting firm networks and banking relationships. Marketing message effectiveness measurement guides content investment toward highest-converting topics and formats that resonate with target decision-makers.

Customer retention enhancement based on churn predictor identification and satisfaction driver analysis enables proactive intervention preventing cancellations and expanding wallet share through feature upsells. Product roadmap prioritization leveraging competitive feature analysis and customer request patterns focuses development resources on highest-impact capabilities that drive differentiation and reduce switching propensity.

Sustainability & Regulatory Outlook

The online payroll service market operates within stringent regulatory frameworks governing employment tax compliance, data privacy protection, and wage payment timing that shape service delivery models and liability structures. Tax authority requirements at federal, state, and local levels mandate accurate withholding calculations, timely deposit submissions, and comprehensive reporting across multiple forms including W-2, 1099, and quarterly filings. Failure consequences include substantial penalties, interest charges, and potential criminal liability for egregious violations, creating existential risks that drive compliance guarantee demand.

Data privacy regulations including GDPR in Europe, CCPA in California, and emerging state-level frameworks impose strict requirements around employee data collection, storage, access controls, and breach notification protocols. The online payroll service market benefits from economies of scale in compliance investment where specialized providers implement enterprise-grade security measures and privacy frameworks that individual businesses cannot economically replicate. Payment Card Industry Data Security Standards apply when processing payroll funding transactions, requiring vulnerability scanning, penetration testing, and third-party audits.

Labor law complexity continues escalating with jurisdiction-specific requirements around minimum wage levels, overtime thresholds, paid sick leave mandates, and predictive scheduling regulations that vary dramatically across cities and states. Gig economy worker classification remains contentious regulatory area with ongoing litigation and proposed legislation attempting to clarify employment status determination criteria that fundamentally impact payroll tax obligations.

Sustainability considerations within the market focus primarily on paperless operations eliminating physical check printing, manual time card processing, and paper-based tax form distribution. Digital document delivery through employee portals reduces environmental impact while improving accessibility and reducing lost form issues. The shift from on-premise servers to cloud infrastructure concentrates computing resources in hyperscale data centers achieving superior energy efficiency compared to distributed local installations.

Responsible AI development practices are emerging as machine learning applications expand, with emphasis on algorithmic transparency, bias detection in compensation analytics, and human oversight of automated decision systems. The regulatory trajectory increasingly emphasizes worker data rights, algorithmic accountability, and platform interoperability that may reshape competitive dynamics and technical architectures within the online payroll service market.

Key Questions Answered in the Report

1. What is the projected revenue forecast for the online payroll service market across different business size segments and service tiers through 2033?

2. Which geographic region will dominate market share and what regulatory complexity levels and small business concentrations drive sustained competitive advantages?

3. What are the high-margin service offerings and customer segments exhibiting strongest growth trajectories and most attractive profitability characteristics?

4. Who are the emerging technology providers disrupting established market dynamics through innovative pricing models, AI capabilities, or vertical specialization strategies?

5. How do regulatory changes and compliance complexity evolution impact service demand patterns and feature requirement priorities across different jurisdictions?

6. What partnership ecosystem strategies and distribution channel approaches correlate with superior customer acquisition efficiency and retention outcomes?

Contact:

Ajay N

Ph: +1-970-633-3460

Latest Reports:

Fitness Club & Gym Management Software Market: https://datahorizzonresearch.com/fitness-club-and-gym-management-software-market-38626

Home Services Management Software Market: https://datahorizzonresearch.com/home-services-management-software-market-39302

Labeling Software Market: https://datahorizzonresearch.com/labeling-software-market-39978

Software Defined Networking And Network Function Virtualization Market: https://datahorizzonresearch.com/software-defined-networking-and-network-function-virtualization-market-40655

Company Name: DataHorizzon Research

Address: North Mason Street, Fort Collins,

Colorado, United States.

Mail: sales@datahorizzonresearch.com

DataHorizzon is a market research and advisory company that assists organizations across the globe in formulating growth strategies for changing business dynamics. Its offerings include consulting services across enterprises and business insights to make actionable decisions. DHR’s comprehensive research methodology for predicting long-term and sustainable trends in the market facilitates complex decisions for organizations.

This release was published on openPR.