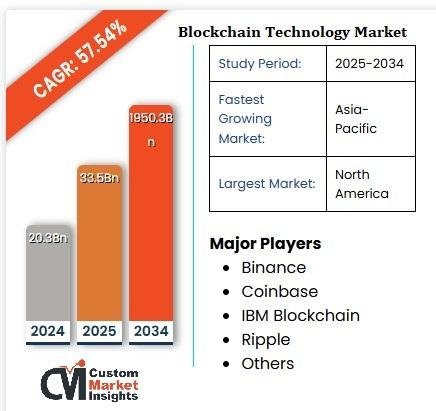

As per the Blockchain Technology Market analysis conducted by the CMI Team, the global Blockchain Technology Market is expected to record a CAGR of 57.54% from 2025 to 2034. In 2025, the market size is projected to reach USD 33.5 Billion, and by 2034, the valuation is anticipated to escalate to USD 1950.3 Billion.

✅ Get Free Report Insights – Download Now @https://www.custommarketinsights.com/request-for-free-sample/?reportid=10761

Blockchain adoption continues to accelerate across enterprises, financial institutions, governments, and technology-driven ecosystems. Demand is increasing for secure data-sharing frameworks, tamper-proof transaction systems, decentralized applications (dApps), and tokenization platforms. Advancements in scalability, interoperability, zero-knowledge proofs, and enterprise-grade blockchain infrastructure are further boosting adoption across banking, retail, healthcare, supply chain, digital identity, and cybersecurity sectors.

Companies are emphasizing decentralized finance (DeFi), tokenized assets, stablecoin ecosystems, and blockchain-as-a-service (BaaS) platforms to enhance efficiency, transparency, and transaction traceability. The growing need for improved security, reduced operational costs, and automation via smart contracts is also shaping the long-term market outlook.

➤ Market Overview

The global blockchain technology market is experiencing exponential growth as organizations continue integrating decentralized architectures for improved transparency, trust, and operational efficiency. Public and private blockchains are being deployed across multiple industries, supporting applications such as digital identity verification, remittances, real-time settlement systems, supply chain traceability, fraud mitigation, and decentralized data storage.

Public blockchains remain essential for cryptocurrency ecosystems and open-source innovation, while enterprise-grade private and hybrid blockchain architectures are witnessing rising uptake due to their scalability, privacy, and regulatory compliance advantages. Cloud-based blockchain deployment continues to gain traction due to flexible scalability and lower infrastructure costs.

Additionally, the rising adoption of AI-integrated smart contract automation, stablecoin-based payments, NFT exchanges, and Web3 development are fueling market expansion through 2034.

✅ Customize This Report to Your Needs @ https://www.custommarketinsights.com/request-for-customization/?reportid=10761

➤ Key Market Dynamics

Growth Drivers

• Surging adoption of digital payments & DeFi: Blockchain enables real-time, low-cost, cross-border transactions, driving adoption among fintechs and enterprises.

• Rising demand for secure and transparent data systems: Industries increasingly rely on blockchain for tamper-proof recordkeeping and fraud prevention.

• Tokenization of assets: Growing use of blockchain to tokenize securities, commodities, real estate, and digital goods.

• Smart contract automation: Enhances operational efficiency in supply chains, financial settlements, insurance claims, and governance processes.

• Government blockchain initiatives: Numerous countries are adopting blockchain for identity management, land records, public administration, and digital currencies.

➤ Market Challenges

• Regulatory uncertainty in several countries

• High energy consumption of some blockchain networks

• Interoperability issues between different blockchain ecosystems

• Security challenges in crypto exchanges and DeFi platforms

➤ Opportunities

• Expansion of enterprise blockchain solutions

• Growing demand for blockchain-based identity verification

• Integration of blockchain with AI, IoT, and cloud computing

• Large-scale adoption of stablecoins

• Rise of Web3, decentralized applications (dApps), and metaverse projects

➤ Segment Analysis

By Offering

Platforms

Core blockchain frameworks enabling decentralized storage, smart contracts, and transaction execution.

Used for financial applications, supply chain networks, identity systems, and more.

Services

Includes consulting, development, integration, support, and BaaS offerings.

Growing demand for enterprise implementation and compliance services.

By Provider

Application Providers

Develop blockchain-based applications such as wallets, exchanges, smart contract tools, and dApps.

Infrastructure Providers

Deliver blockchain platforms, nodes, validators, consensus mechanisms, and cloud-based solutions.

Middleware Providers

Connect blockchain networks with legacy systems, enabling seamless data communication and interoperability.

By Type

Public Blockchain

Open, decentralized networks used in cryptocurrencies, NFTs, and community-governed applications.

Private Blockchain

Permissioned networks used by enterprises for secure internal data management and automation.

Hybrid Blockchain

Combines public transparency with private control-ideal for business and government applications.

Consortium Blockchain

Shared governance among multiple organizations; widely used in banking, supply chain, and insurance.

By Deployment Mode

Cloud-Based

Fastest-growing segment due to scalability, lower cost, and simplified deployment.

On-Premise

Preferred for industries requiring strict data control and regulatory compliance.

➤ Regional Insights

North America

Dominates the market due to advanced fintech ecosystems, strong tech adoption, and significant blockchain R&D investments. High adoption in banking, supply chain, and healthcare.

Europe

Strong regulatory frameworks and digital transformation initiatives. High uptake in digital identity, carbon tracking, and enterprise blockchain applications.

Asia Pacific

Fastest-growing region, driven by government blockchain programs, expanding crypto ecosystems, and rapid digitization in China, India, Japan, and South Korea.

Latin America

Growing demand for secure payment systems, crypto adoption for remittances, and supply chain digitization.

Middle East & Africa

Strategic blockchain investments in public administration, oil & gas supply chains, logistics, and smart city projects.

➤ Key Developments

August 2025 – Ripple Announces Acquisition of Rail

Ripple announced its agreement to acquire Toronto-based stablecoin payments platform Rail for $200 million, with the transaction expected to close in Q4 2025 pending regulatory approvals.

The acquisition strengthens Ripple’s stablecoin payment capabilities by integrating Rail’s virtual accounts and automated back-office infrastructure into Ripple’s ecosystem. Rail currently handles nearly 10% of global stablecoin payment activity and is supported by regulated banking partnerships.

Ripple aims to enhance its leadership in the global digital payments and stablecoin arena, leveraging both Rail’s infrastructure and the company’s own stablecoin RLUSD following recent U.S. crypto regulatory clarity.

✅ Access Full Report for In-Depth Insights @ https://www.custommarketinsights.com/report/blockchain-technology-market/

➤ Competitive Landscape

The Blockchain Technology Market is highly competitive, with global and regional players continuously innovating across platforms, infrastructure, and applications.

Leading Players Include:

• Binance

• Coinbase

• IBM Blockchain

• Ripple

• Block (formerly Square)

• Chainlink

• Circle

• Paxos

• Ava Labs

• ConsenSys

• Chainalysis

• Hyperledger Fabric

• Amazon Web Services (AWS)

• Nvidia

• Others

➤ Why Buy This Report?

• Understand accurate market forecasts for the Blockchain Technology Market through 2034.

• Analyze competitive positioning across major blockchain ecosystem players.

• Identify emerging growth opportunities across platforms, services, and deployment models.

• Gain insights into market drivers, restraints, and technological advancements.

• Evaluate regional performance to target profitable markets.

• Support investment decisions with data-driven insights and ROI projections.

• Track regulatory developments and their impact on industry transformation.

• Leverage detailed segmentation to optimize product, service, and go-to-market strategies.

➤ FAQs

1. What will be the Blockchain Technology Market size by 2034?

The global market is projected to reach USD 1950.3 Billion by 2034.

2. What is the expected CAGR for the market?

The market is anticipated to grow at a CAGR of 57.54% from 2025-2034.

3. Which blockchain type leads the market?

Public blockchains lead in decentralization and crypto ecosystems, while private and hybrid blockchains are growing fastest in enterprise adoption.

4. Which industries use blockchain the most?

Banking & financial services, supply chain, retail, healthcare, cybersecurity, real estate, and government applications.

5. What is driving global blockchain adoption?

Demand for secure data systems, growth in digital payments, tokenization of assets, smart contract automation, and advancements in Web3 technologies.

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI is a one-stop solution for data collection and investment advice. Our company’s expert analysis digs out essential factors that help us understand the significance and impact of market dynamics. The professional experts advise clients on aspects such as strategies for future estimation, forecasting, opportunities to grow, and consumer surveys.

Contact Us:

Joel John

Custom Market Insights

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

US & Europe: +1 737 734 2707

APAC & Rest: +91 20 46022736

WhatsApp: +1 801-639-9061

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

This release was published on openPR.