Mordor Intelligence has published a new report on the Digital Lending Market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Overview of the Digital Lending Market

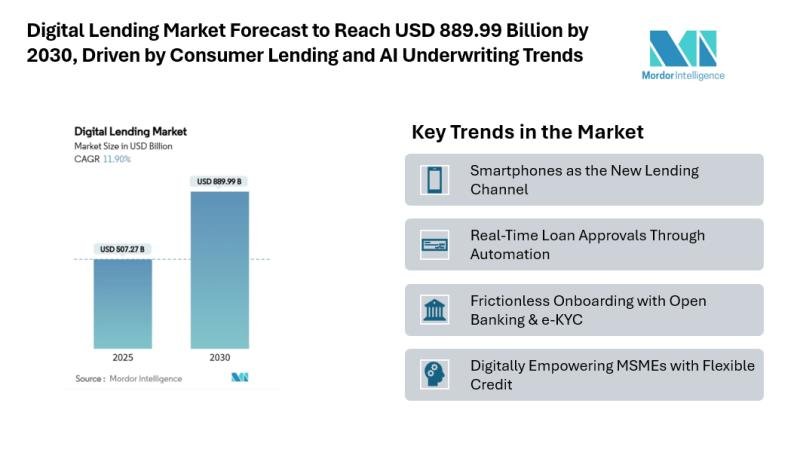

According to the Mordor Intelligence, the Digital Lending Market reached a value of USD 507.27 billion in 2025 and is forecast to climb to USD 889.99 billion by 2030, translating into an 11.9% CAGR. North America currently holds the largest Digital Lending Market share, while Asia-Pacific is emerging as the fastest-growing region, supported by increasing smartphone penetration and mobile-first lending solutions.

The Digital Lending Market trends indicate a shift toward faster loan approvals, lower processing costs, and more flexible financing options for both consumers and enterprises.

Report Overview: https://www.mordorintelligence.com/industry-reports/digital-lending-market?utm_source=openpr

Key Trends in the Digital Lending Market

1. Smartphones as the New Lending Channel

The widespread use of smartphones and internet access allows lenders to reach customers directly through mobile apps. In Asia-Pacific, digital-wallet transactions are creating an environment ripe for in-app credit offers.

2. Real-Time Loan Approvals Through Automation

Digital lending platforms now provide nearly immediate loan approvals. Automated underwriting engines process borrower data in real time, often granting approvals within minutes without extensive documentation.

3. Frictionless Onboarding with Open Banking & e-KYC

Digital identity systems, such as e-KYC interfaces, enable onboarding in under a minute, improving operational efficiency and borrower satisfaction.

4. Digitally Empowering MSMEs with Flexible Credit

Small and medium enterprises face significant funding gaps, which digital lenders address through revenue-based financing and invoice factoring. Real-time sales data allows rapid disbursement of working-capital loans, supporting businesses in Latin America, Southeast Asia, and North America.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/digital-lending-market?utm_source=openpr

Market Segmentation of the Digital Lending Market

By Type:

Consumer

Enterprise / SME

By Loan Type:

Personal Loans

Auto Loans

Student Loans

Mortgage / Home Equity

Small Business Working-Capital Loans

By Deployment Mode:

Cloud-Based Platforms

On Premise Solutions

Hybrid

By Business Model:

Peer-to-Peer (Marketplace) Lending

Balance-Sheet (Direct) Lending

Embedded-Finance / BNPL Lending

Crowdfunding and Revenue-Based Financing

By Technology:

AI / Machine-Learning-Driven Underwriting

API and Open-Banking Platforms

Blockchain-Based Lending

Big-Data Analytics

By Geography:

North America: United States, Canada, Mexico

Europe: Germany, United Kingdom, France, Russia, Rest of Europe

Asia-Pacific: China, Japan, India, South Korea, Australia, Rest of Asia-Pacific

Middle East and Africa: Middle East (Saudi Arabia, United Arab Emirates, Rest of Middle East), Africa (South Africa, Egypt, Rest of Africa)

South America: Brazil, Argentina, Rest of South America

Explore Our Full Library of Technology, Media and Telecom Research Industry Reports – https://www.mordorintelligence.com/market-analysis/technology-media-and-telecom?utm_source=openpr

Key Players in the Digital Lending Market

Funding Circle Limited (Funding Circle Holdings PLC): A leading peer-to-peer lending platform focused on providing loans to small and medium-sized enterprises globally.

On Deck Capital Inc.: Offers online lending solutions for small businesses, specializing in term loans and lines of credit.

Prosper Marketplace, Inc.: One of the first peer-to-peer lending marketplaces in the U.S., connecting borrowers with individual and institutional investors.

Bizfi LLC: Provides small-business financing through online lending platforms, including term loans and merchant cash advances.

LendInvest Plc: A UK-based online platform offering property finance, including buy-to-let and bridging loans.

Explore more insights on Digital Lending Market competitive landscape: https://www.mordorintelligence.com/industry-reports/digital-lending-market/companies?utm_source=openpr

Conclusion on the Digital Lending Market

The Digital Lending Market size is set for substantial growth as digital-first lending solutions continue to gain acceptance among consumers and enterprises. The increasing use of smartphones, automation in underwriting, and favorable regulatory frameworks are driving the expansion of digital loan offerings.

Digital Lending Market statistics indicate that emerging regions, particularly in Asia-Pacific and Africa, while North America remains a significant contributor to market size.

For complete market analysis, please visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/digital-lending-market?utm_source=openpr

Industry Related Reports:

United States Digital Lending Market

The United States Digital Lending Market reached USD 303.07 billion in 2025 and is projected to grow to USD 560.97 billion by 2030, registering a CAGR of 13.1%. Growth is driven by the increasing adoption of mobile-first lending platforms and AI-powered underwriting, along with rising demand for faster, flexible loan approval processes among consumers and small businesses.

Get more insights: https://www.mordorintelligence.com/industry-reports/united-states-digital-lending-market?utm_source=openpr

Payday Lending Market

The Payday Lending Market was valued at USD 41.12 billion in 2025 and is expected to reach USD 51.68 billion by 2030, growing at a CAGR of 4.68%. The market is driven by increasing demand for short-term, quick-access credit and the growing integration of digital platforms that simplify loan application and approval processes for consumers.

Get more insights: https://www.mordorintelligence.com/industry-reports/payday-lending-market?utm_source=openpr

Europe Crowdlending and Crowd Investing Market

The Europe Crowdlending and Crowd Investing Market is estimated at USD 13.68 billion in 2025 and is projected to reach USD 14.92 billion by 2030, growing at a CAGR of 1.76%. Growth is supported by the rising adoption of online investment platforms and increased participation from retail and institutional investors seeking alternative financing options.

Get more insights: https://www.mordorintelligence.com/industry-reports/europe-crowd-lending-and-crowd-investing-market?utm_source=openpr

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana – 500032, India.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

This release was published on openPR.