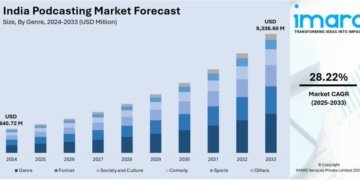

The global crypto asset management market is witnessing strong growth, projected to expand from USD 1.1 billion in 2024 to USD 2.28 billion by 2031. With a robust CAGR of 22.4%, this market is driven by the increasing institutional adoption of cryptocurrencies, regulatory developments, and the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) for optimizing portfolio performance.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.persistencemarketresearch.com/samples/34765

As digital assets become more mainstream, investors are seeking structured, compliant, and secure platforms for crypto asset management. The increasing need for risk mitigation, efficient trading, and transparency in blockchain transactions further contributes to the market’s expansion.

Key Highlights of the Market

• Based on deployment, the cloud segment is set to dominate due to its scalability and flexibility.

• North America’s market growth is fueled by regulatory clarity, institutional investment, and technological innovation.

• Asia Pacific is growing rapidly thanks to widespread crypto adoption among tech-savvy populations.

• Japan, South Korea, Singapore, and Australia are at the forefront of progressive crypto regulation.

• The custodian solution category is estimated to hold a 62% revenue share in 2024.

• Integration of AI and ML enhances portfolio management, trade automation, and fraud detection.

Market Segmentation

The crypto asset management market is segmented by deployment mode, solution type, end-user, and region. Deployment-wise, cloud-based solutions are increasingly favored due to cost-effectiveness, scalability, and seamless integration with other financial technologies.

In terms of solution, custodian solutions lead the market with a 62% share, offering secure storage and management of crypto assets. Investment management platforms and trading solutions are also gaining traction, particularly among hedge funds and high-net-worth individuals seeking diversified crypto portfolios.

Regional Insights

North America holds a significant share of the market, supported by a mature financial ecosystem, proactive regulatory frameworks, and strong institutional interest. The United States, in particular, has seen growing participation from traditional asset managers entering the crypto space.

Asia Pacific is emerging as a dynamic market, with countries like Japan, Singapore, and South Korea advancing supportive regulatory policies. Tech-driven adoption and increasing crypto-savvy retail investors are driving regional growth.

Market Drivers

Growing institutional investment in digital assets and improved regulatory clarity are key drivers for the market. Technological advancements, especially in AI and ML, support intelligent decision-making and real-time asset monitoring, improving investor confidence and operational efficiency.

Market Restraints

Volatile regulatory environments in certain countries, cybersecurity threats, and concerns over the custody of digital assets pose significant challenges. Market participants must navigate evolving compliance requirements and ensure robust security protocols.

Market Opportunities

There is considerable potential in developing region-specific platforms that comply with local regulations and offer localized user experiences. Opportunities also lie in expanding services such as decentralized finance (DeFi) integration, tokenized asset management, and AI-driven advisory solutions.

Frequently Asked Questions (FAQs)

How big is the Crypto Asset Management Market in 2024?

What is the projected CAGR for the market through 2031?

Who are the key players in the global crypto asset management space?

Which region dominates the crypto asset management industry?

What are the major technological trends in crypto asset management?

Company Insights

• Coinbase, Inc.

• Gemini Trust Company, LLC

• Crypto Finance AG

• BitGo, Inc.

• Fidelity Digital Assets

• Bakkt Holdings, Inc.

• Anchorage Digital

• Trustology

• Ledger Enterprise Solutions

• Hex Trust

Recent Developments:

1. In 2024, Fidelity Digital Assets expanded its custodial services to support a broader range of altcoins.

2. Anchorage Digital announced AI-based enhancements to its asset monitoring and compliance automation platform.

This report offers actionable insights for technology providers, institutional investors, and regulators seeking to understand and engage with the fast-evolving crypto asset management ecosystem.

Contact Us:

Persistence Market Research

G04 Golden Mile House, Clayponds Lane

Brentford, London, TW8 0GU UK

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies’ clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we’ve built over the years.

This release was published on openPR.