Blockchain in Insurance Market analysis, according to DataM Intelligence, offers more than just an overview; it investigates the underlying aspects of the sector. The study provides an overview, the research explores the hidden aspects of the sector, breaking down its intricate dynamics, charting regional dominance, spotting demand patterns, and spotting prospective breakthroughs that could influence how businesses operate in the future.

Will the Blockchain in Insurance market emerge as the sector’s next great thing? To discover the answer, look at the Blockchain in Insurance market analysis and projections. In-depth insight of the opportunities, difficulties, and trends now impacting the Machinery landscape is provided by this market research study, empowering industry participants to make informed decisions in a changing environment. Take advantage of the opportunity in the Blockchain in Insurance market! (2031)

Download Free Sample PDF: https://datamintelligence.com/download-sample/blockchain-in-insurance-market

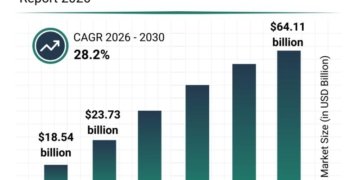

Global Blockchain in Insurance Market reached US$ 1.4 Billion in 2023 and is expected to reach US$ 15.0 Billion by 2031, growing with a CAGR of 34.5% during the forecast period 2024-2031.

Blockchain in Insurance refers to the application of blockchain technology to the insurance industry to improve transparency, efficiency, and security. By utilizing decentralized ledgers, it allows for secure data sharing, smart contracts, and streamlined claims processes. Blockchain helps reduce fraud, increase automation, and create faster, more transparent transactions, making it a valuable tool for enhancing customer experience, compliance, and operational efficiency in the insurance sector.

Key Players:

Profiles of some of the major players in the global Blockchain in Insurance market, which include:

Mapfre, Max Life Insurance, Auxesis Group, KM Business Information US, Inc, Bitfury, IBM, SAP oracle, MetLife and Consensys.

Industry Development:

On January 11, 2024, Nayms launched the first institutional tokenized (Re)insurance marketplace on Base, a secure and affordable Ethereum layer-2 solution. This platform aims to provide investors with easy access to yield-generating (re)insurance options offered as tokenized assets. This innovation enhances the potential for seamless investment opportunities in the evolving insurance market.

The purpose of the report is to offer a comprehensive analysis of the market, along with insightful conclusions, statistical data, historical information, market data that has been confirmed by the industry, and predictions based on a sound methodology. By identifying and examining market segments and forecasting global market size, the study also contributes to understanding the dynamics and structure of the global Blockchain in Insurance market.

Get this Premium Report: https://www.datamintelligence.com/buy-now-page?report=blockchain-in-insurance-market

Market Segments:

The report covers the segmentation of the market into different segments based on various classifications such as applications, end users, product types, and others. The segmentation is divided into two sections, one for development and the other for different roles, needs, and behaviours.

By Component: Solution, Services

By Type: Private Blockchain, Public Blockchain

By Enterprise Size: Large Enterprises, Small and Medium-sized Enterprises

By Application: GRC Management, Death and Claims Management, Identity Management and Fraud Detection, Payments, Others

Regional Break out:

The global Blockchain in Insurance Market report focuses on six major regions: North America, South America, Europe, Asia Pacific, the Middle East, and Africa.

☞ North America – US, Canada, Mexico

☞ Europe- Germany, Russia, UK, France, Italy, Rest of Europe

☞ Asia Pacific- China, India, Japan, Australia, Rest of Asia Pacific

☞ South America- Brazil, Argentina, Colombia, Rest of South America

☞ Middle East and Africa- Saudi Arabia, UAE, Oman, Bahrain, Qatar, Kuwait, Israel

Points Covered:

⏩ Market Overview: It contains five chapters, as well as information about the research scope, major manufacturers covered, market segments, Blockchain in Insurance market segments, study objectives, and years considered.

⏩ Market Landscape: The competition in the Global Blockchain in Insurance Market is evaluated here in terms of value, turnover, revenues, and market share by organization, as well as market rate, competitive landscape, and recent developments, transaction, growth, sale, and market shares of top companies.

⏩ Companies Profiles: The global Blockchain in Insurance market’s leading players are studied based on sales, main products, gross profit margin, revenue, price, and growth production.

⏩ Market Outlook by Region: The report goes through gross margin, sales, income, supply, market share, CAGR, and market size by region in this segment. North America, Europe, Asia Pacific, Middle East & Africa, and South America are among the regions and countries studied in depth in this study.

⏩ Market Segments: It contains the deep research study which interprets how different end-user/application/type segments contribute to the Blockchain in Insurance Market.

⏩ Market Forecast: Production Side: In this part of the report, the authors have focused on production and production value forecast, key producers forecast, and production and production value forecast by type.

⏩ Research Findings: This section of the report showcases the findings and analysis of the report.

⏩ Conclusion: This portion of the report is the last section of the report where the conclusion of the research study is provided.

Speak to our Analyst and Get Customization in the report as per your requierments: https://datamintelligence.com/customize/blockchain-in-insurance-market

FAQ’s

Q.1. What are the primary drivers of the Blockchain in Insurance Industry?

Q.2. What are the main factors propelling and impeding the growth of the Blockchain in Insurance market?

Q.3. What are the general structure, risks, and opportunities of the market?

Q.4. How do the prices, revenue, and sales of the leading Blockchain in Insurance market firms compare?

Q.5. What are the main segments of the market and how is it divided up?

Contact Us –

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us –

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.