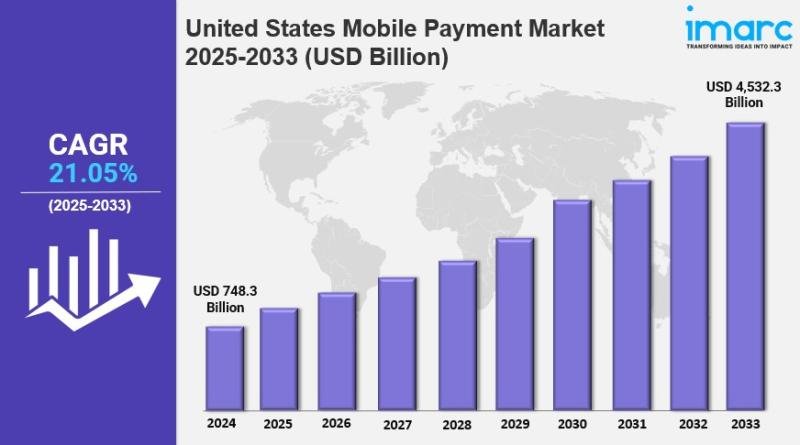

Market Overview 2025-2033

The United States mobile payment market size reached USD 748.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4,532.3 Billion by 2033, exhibiting a growth rate (CAGR) of 21.05% during 2025-2033. The market is experiencing rapid growth, driven by increasing smartphone penetration, rising internet connectivity, and a shift toward cashless transactions. Key trends include the adoption of contactless payments and digital wallets, with major players focusing on enhanced security features and seamless user experiences.

Key Market Highlights:

✔️ Robust growth driven by rising smartphone usage and digital transformation

✔️ Increasing adoption of contactless and QR-based payment technologies

✔️ Growing consumer preference for secure and convenient mobile wallets

✔️ Expanding integration of mobile payments in retail, transit, and hospitality sectors

✔️ Enhanced cybersecurity measures and biometric authentication boosting user trust

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-mobile-payment-market/requestsample

United States Mobile Payment Market Trends and Drivers:

The United States mobile payment market is witnessing a remarkable increase in the adoption of contactless payment methods, driven by consumer preferences for convenience and speed. The COVID-19 pandemic has significantly accelerated this trend, as many consumers have turned to digital payment solutions to minimize physical contact during transactions. Contactless payments, enabled by mobile wallets and Near Field Communication (NFC) technology, allow users to make purchases quickly and securely using their smartphones.

Retailers are increasingly investing in contactless payment infrastructure to meet consumer demand and enhance the shopping experience. Additionally, the popularity of mobile payment applications such as Apple Pay, Google Pay, and Samsung Pay has simplified the adoption of these technologies for consumers. As more businesses implement contactless payment systems, the overall acceptance and usage of mobile payments are expected to rise, further solidifying their role in the retail landscape.

As the United States mobile payment market continues to expand, integrating advanced security features has become a critical priority for both consumers and providers. With rising concerns about data breaches and fraud, mobile payment solutions are focusing on robust security measures to build consumer trust. Technologies such as biometric authentication (including fingerprint and facial recognition), tokenization, and encryption are being deployed to protect sensitive payment information.

These security enhancements not only safeguard user data but also improve the overall user experience by facilitating seamless and secure transaction processes. By 2025, it is anticipated that mobile payment providers will continue to innovate in security, adopting emerging technologies like artificial intelligence (AI) for enhanced fraud detection and prevention. This emphasis on security will be vital for fostering consumer confidence and encouraging broader adoption of mobile payment solutions across various demographics.

The rapid growth of e-commerce in the United States is significantly influencing the mobile payment market, as more consumers embrace online shopping and digital wallets for their transactions. The convenience of mobile payments aligns perfectly with the increasing preference for online shopping, particularly among younger, tech-savvy generations. Digital wallets, which store payment information and facilitate quick transactions, have gained popularity by streamlining the purchasing process.

By 2025, mobile payments are expected to represent a larger share of overall e-commerce transactions, driven by the integration of mobile payment options across various online platforms. Retailers are recognizing the importance of offering diverse payment options to meet consumer preferences, leading to partnerships with mobile payment providers and the development of proprietary payment solutions. This trend not only enhances the shopping experience but also intensifies competition among payment providers to deliver innovative features and incentives that attract consumers.

The United States mobile payment market is undergoing a significant transformation, influenced by various trends that reflect changing consumer behaviors and technological advancements. One of the most notable trends is the growing preference for mobile wallets and contactless payments, as consumers seek convenient and efficient transaction methods. By 2025, the market is expected to see substantial growth in mobile payment adoption, driven by the ongoing digitization of financial services and the integration of mobile payment options across various retail channels.

Additionally, the rise of e-commerce has accelerated the demand for seamless mobile payment solutions, as consumers look for quick and secure ways to complete online purchases. Alongside these trends, the focus on security remains paramount, with mobile payment providers continuously enhancing their security features to protect user data and foster trust. As these trends converge, the mobile payment market is poised for dynamic growth, presenting opportunities for innovation and competition among providers, retailers, and consumers alike.

Buy Report Here: https://www.imarcgroup.com/checkout?id=2864&method=1190

United States Mobile Payment Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Mode of Transaction:

• WAP

• NFC

• SMS

• USSD

• Others

Breakup by Application:

• Entertainment

• Energy and Utilities

• Healthcare

• Retail

• Hospitality and Transportation

• Others

Breakup by Region:

• Northeast

• Midwest

• South

• West

Ask Analyst & Browse full report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=2864&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

About us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create lasting impact. The firm offers comprehensive services for market entry and market expansion.

IMARC’s services include thorough market assessments, feasibility studies, company formation assistance, factory setup support, regulatory approvals and license navigation, branding, marketing and sales strategies, competitive landscape and benchmark analysis, pricing and cost studies, and sourcing studies.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.