Market Overview

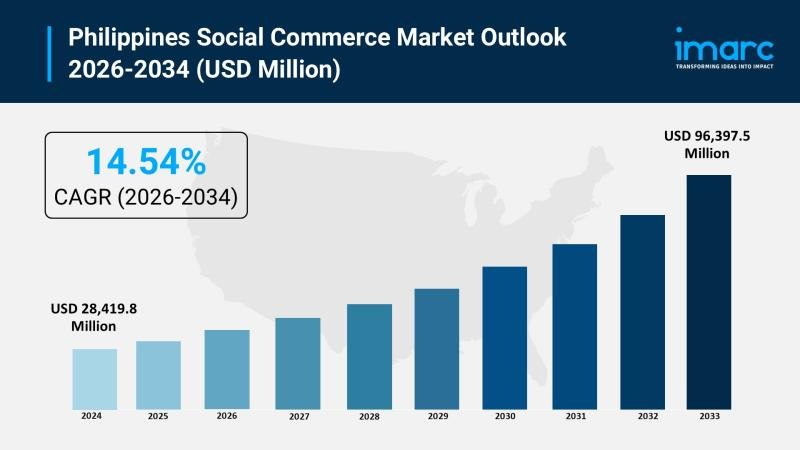

The Philippines social commerce market reached USD 28,419.8 Million in 2025 and is projected to grow to USD 96,397.5 Million by 2034, supported by factors such as increasing internet penetration, rising smartphone usage, expanding e-commerce platforms, and growing digital payment adoption. The forecast period is 2026-2034 with a CAGR of 14.54%. The integration of social networking with online shopping further enhances market growth.

Request a Sample Report with the Latest 2026 Edition: https://www.imarcgroup.com/philippines-social-commerce-market/requestsample

How AI is Reshaping the Future of Philippines Social Commerce Market:

• AI-driven personalization enhances customer engagement and conversion rates by tailoring shopping experiences to individual preferences on social commerce platforms.

• The adoption of AI in social commerce optimizes the integration of digital payment infrastructure, facilitating seamless and secure transactions through platforms like GCash and Maya.

• AI supports influencer marketing and live commerce by analyzing consumer behavior and optimizing influencer-customer interactions for better sales outcomes.

• Government initiatives such as the Internet Transactions Act of 2023 and targets for digital retail payment volumes create a regulatory environment where AI-powered tools can thrive.

• AI-powered chatbots and virtual assistants improve customer service on social media platforms, driving higher user satisfaction and repeat purchases.

• Companies like Temu entering the market are leveraging AI-driven analytics to disrupt existing social commerce ecosystems, enhancing platform competitiveness and consumer choice.

Market Growth Factors

The expansion of digital payment infrastructure is a key driver of the Philippine social commerce market. Digital wallet providers such as GCash and Maya facilitate secure, convenient transactions integrated directly within social media platforms. Features like instant fund transfers, QR code payments, and buy-now-pay-later options reduce transaction barriers, encouraging higher purchase frequency. Increasing digital payment adoption among small and medium enterprises fosters broader market participation. This growing digital inclusion, supported by government policies and increasing consumer trust in digital financial services, enables businesses of all sizes to leverage social commerce channels effectively.

Influencer marketing combined with live commerce is transforming consumer purchasing behaviors. In the Philippines, consumers place strong trust in influencer endorsements, with many purchases driven by such recommendations. Platforms like TikTok Shop, Facebook Live, and Instagram Live offer live-stream shopping experiences, enabling real-time product showcases, interaction, and immediate buying. The rise of affiliate creator programs, which grew by 87 percent in the first half of 2024, highlights the increasing revenue potential for content creators. This dynamic ecosystem of influencers, brands, and consumers drives market demand through authentic engagement and community-driven recommendations.

Supportive government policies and digital economy initiatives play a crucial role in market growth. The Philippine government’s Financial Inclusion Steering Committee and programs like the One Town, One Product initiative encourage SMEs to adopt digital platforms. The Internet Transactions Act of 2023 establishes regulatory frameworks to protect consumers and sellers, building trust in online commerce. Infrastructure improvements, including telecommunications network expansions and 5G rollout, enhance connectivity. A government target aiming for 70 percent digital retail payment volume by 2028 reflects continued policy support. This comprehensive government backing cultivates confidence among businesses and investors, sustaining market momentum.

Browse the full report with TOC and list of figures: https://www.imarcgroup.com/philippines-social-commerce-market

Market Segmentation

Business Model Insights:

• Business to Consumer (B2C)

• Business to Business (B2B)

• Consumer to Consumer (C2C)

Device Type Insights:

• Laptops and PCs

• Mobiles

Product Type Insights:

• Personal and Beauty Care

• Apparel

• Accessories

• Home Products

• Health Supplements

• Food and Beverages

• Others

Regional Insights:

• Luzon

• Visayas

• Mindanao

Key Players

• Temu

• Shopee

• Lazada

• TikTok Shop

Recent Development & News

• August 2025: The Philippine government advances digital economy efforts by reinforcing the implementation of the Internet Transactions Act of 2023, further enhancing regulatory protection and digital trust. This enables safer social commerce transactions and increased market participation.

• September 2025: Temu expanded its presence in Southeast Asia with intensified marketing campaigns in the Philippines, challenging major platforms such as Shopee, Lazada, and TikTok Shop, thus spurring competition and innovation in the social commerce sector.

• October 2025: Market reports indicated increased consumer adoption of digital payments, with digital retail payment volume reaching approximately 55 percent, showcasing positive momentum in social commerce growth and technology adoption.

Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Speak to an analyst for a customized report sample: https://www.imarcgroup.com/request?type=report&id=21954&flag=C

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.