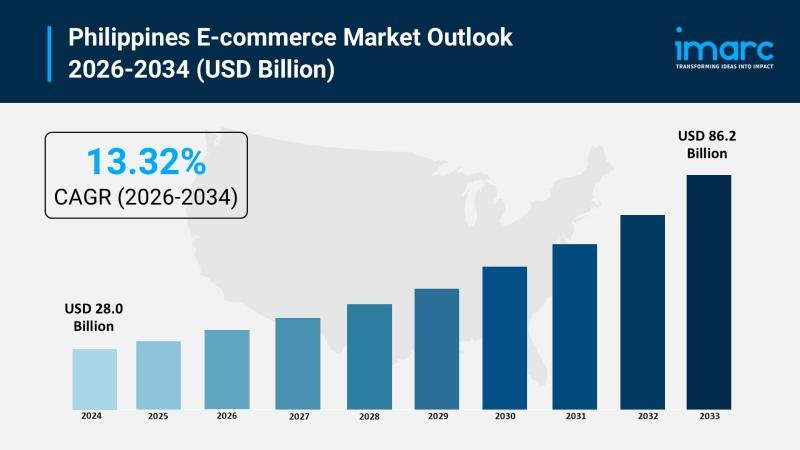

Market Overview

The Philippines e-commerce market reached a size of USD 28.0 Billion in 2025 and is projected to expand to USD 86.2 Billion by 2034. The market is set to grow at a CAGR of 13.32% between 2026 and 2034, driven by increasing internet penetration, extensive smartphone adoption, and growing consumer trust in online payments. The demand is fueled by urbanization, hectic lifestyles, and the convenience of digital shopping. Both B2C and B2B e-commerce models are gaining traction, supported by expanding digital payment infrastructure including e-wallets, mobile banking, and cash-on-delivery options enhancing transaction accessibility across Luzon, Visayas, and Mindanao regions.

Request a Sample Report with the Latest 2026 Edition: https://www.imarcgroup.com/philippines-e-commerce-market/requestsample

How AI is Reshaping the Future of Philippines E-commerce Market:

• AI-driven personalized product recommendations analyze browsing patterns, purchase history, and demographic data to deliver customized shopping experiences, increasing conversion rates and customer satisfaction in the expanding Philippines e-commerce market valued at USD 28.0 Billion.

• Machine learning algorithms power dynamic pricing systems enabling retailers to adjust prices in real-time based on demand fluctuations, competitor pricing, and inventory levels, optimizing revenue while maintaining competitiveness across categories including fashion, electronics, and groceries.

• AI-powered chatbots provide instant customer service through Facebook Messenger, WhatsApp, and platform-integrated messaging, addressing inquiries about products, delivery tracking, and payment issues 24/7, reducing customer service costs while improving response times.

• Data analytics driven by AI supports fraud detection systems analyzing transaction patterns to identify suspicious activities, protecting both merchants and consumers from payment fraud, account takeovers, and counterfeit product listings prevalent in fast-growing digital marketplaces.

• AI facilitates predictive inventory management helping retailers forecast demand patterns based on seasonal trends, social media buzz, and historical sales data, minimizing stockouts during peak shopping events like 11.11 and 12.12 mega sales campaigns.

• AI-assisted logistics optimization algorithms route deliveries efficiently across the Philippines’ 7,641 islands, reducing delivery times and costs by analyzing traffic patterns, weather conditions, and geographic constraints unique to the archipelagic nation.

Market Growth Factors

The Philippines e-commerce industry growth is significantly driven by widespread smartphone adoption and mobile-first consumer behavior. With smartphone household penetration reaching 74.1% and mobile devices generating 78.82% of e-commerce sales in 2024, Filipinos increasingly depend on mobile platforms for online shopping. Low-cost mobile data plans and affordable smartphone options make internet access ubiquitous across urban and rural areas. Social media integration with commerce platforms transforms Facebook, TikTok, and Instagram into discovery and purchasing channels. Mobile wallets like GCash, which amassed 94 million users by early 2025, and Maya facilitate seamless transactions directly from smartphones. Live-selling events broadcast through mobile devices enable real-time interaction between sellers and buyers, creating entertainment-centric shopping experiences particularly popular among younger demographics responsible for 68.6% rise in peer-to-peer wallet transfers.

The expansion of digital payment infrastructure revolutionizes transaction convenience and security across Philippine e-commerce. Mobile wallets controlled 65.34% of B2C e-commerce payment value in 2024, while digital payments reached 52.8% of retail transaction volume in 2023 according to Bangko Sentral ng Pilipinas. The World Bank’s USD 750 Million digital transformation development policy loan approved in 2024 strengthens e-commerce trust and advanced payments infrastructure. Innovations including encryption, two-factor authentication, and biometric verification reduce fraud risks. Buy-Now-Pay-Later (BNPL) credit options projected to grow at 15.89% CAGR through 2030 enable consumers to make purchases without immediate full payment. Visa integrations allow 87% of surveyed Filipinos to fund wallets using cards. Cash-on-delivery continues serving underbanked populations while real-time bank transfers receive regulatory backing under the InstaPay rail, creating inclusive payment ecosystems supporting diverse consumer preferences.

Government initiatives and entrepreneurial ecosystem support accelerate e-commerce adoption nationwide. The Department of Trade and Industry’s Philippine e-Commerce Platform (PEP Store) launched in July 2025 with 350 domestic brands linking local MSMEs to overseas consumers while balancing import influx. The ‘e-Commerce Philippines 2022 Roadmap’ promotes adoption among small and medium-sized enterprises while boosting consumer confidence. Policy targets position digital trade as core engine for the PHP 1.2 trillion e-commerce sector. Low entry barriers for establishing online shops on marketplace platforms enable home-based entrepreneurs and full-fledged online brands to reach broader audiences. Merchant digitization programs accelerated SME onboarding providing warehousing, delivery services, and targeted advertising support. Regional Comprehensive Economic Partnership (RCEP) facilitates tariff-free cross-border shipments expanding addressable markets. These combined factors create favorable conditions for sustained market expansion supporting both established retailers and emerging digital-first businesses.

Browse the full report with TOC and list of figures: https://www.imarcgroup.com/philippines-e-commerce-market

Market Segmentation

Business Model Insights:

• B2C

• B2B

• C2C

• Others

Mode of Payment Insights:

• Payment Cards

• Online Banking

• E-Wallets

• Cash-On-Delivery

• Others

Service Type Insights:

• Financial

• Digital Content

• Travel and Leisure

• E-Tailing

• Others

Product Type Insights:

• Groceries

• Clothing and Accessories

• Mobiles and Electronics

• Health and Personal Care

• Others

Regional Insights:

• Luzon

• Visayas

• Mindanao

Key Players

• Carousell

• IKEA Philippines

• Kimstore

• Lazada Group

• Sephora Digital SEA Pte Ltd

• Shopee

• Sterling Galleon Corporation

• Temu Philippines

• Zalora

Recent Developments & News

• January 2025: According to industry data, the Philippine e-commerce industry is expected to generate USD 24 Billion in revenue in 2025, demonstrating a compound annual growth rate of 17%. Digital buyers are projected to reach 53.4 million in 2025, up from 42.5 million in 2021, driven by internet penetration reaching 83.8% and widespread mobile wallet adoption.

• January 2025: GCash reached 94 million registered users by early 2025, while Maya expanded its wallet offerings with credit extensions including the Maya Black card. Digital payment adoption in the Philippines continues accelerating, with mobile wallets dominating the payment landscape and supporting e-commerce transaction growth.

• July 2024: The Department of Trade and Industry launched the Philippine e-Commerce Platform (PEP Store) with 350 domestic brands to balance import influx and connect local MSMEs to overseas consumers. The platform aims to promote Filipino businesses and help them expand online, supporting government objectives to increase e-commerce contribution to GDP.

Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask an Analyst for Your Customized Sample Report: https://www.imarcgroup.com/request?type=report&id=28734&flag=C

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.