IMARC Group has recently released a new research study titled “Mexico E-Commerce Market Report by Type (Home Appliances, Apparel, Footwear and Accessories, Books, Cosmetics, Groceries, and Others), Transaction (Business-to-Consumer, Business-to-Business, Consumer-to-Consumer, and Others), and Region 2026-2034”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

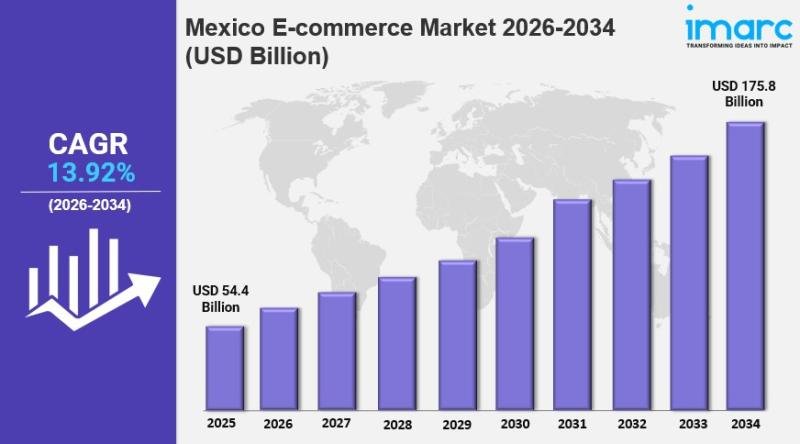

The Mexico e-commerce market size reached USD 54.4 Billion in 2025. Forecasts project the market to grow to USD 175.8 Billion by 2034, exhibiting a robust CAGR of 13.92% during the forecast period of 2026-2034. Growth drivers include increased internet penetration, rising smartphone usage, enhanced consumer trust in online shopping, improved logistics, expanded middle class with higher disposable incomes, and acceleration of online shopping trends by the COVID-19 pandemic.

Study Assumption Years

● Base Year: 2025

● Historical Years: 2020-2025

● Forecast Period: 2026-2034

Mexico E-Commerce Market Key Takeaways

● Current Market Size: USD 54.4 Billion in 2025

● CAGR: 13.92% (2026-2034)

● Forecast Period: 2026-2034

● The growth is propelled by increasing internet penetration and widespread smartphone adoption, enabling easy access to online platforms.

● Consumer trust is bolstered by advances in secure digital transactions and payment systems.

● Improved logistics and delivery services enhance customer satisfaction and repeat purchases.

● The rise of mobile commerce, AI, ML integration, and social commerce are significant market trends.

● Challenges include logistics inefficiencies in rural areas and high delivery costs.

Sample Request Link: https://www.imarcgroup.com/mexico-e-commerce-market/requestsample

Mexico E-Commerce Market Growth Factors

Internet and smartphone growth rates, which provide consumers with easier access to online marketplaces, are creating more opportunities for the Mexico e-commerce market, according to the report. At the beginning of 2024, Mexico’s internet user penetration rate was 83.2 percent, with 107.3 million users, according to the report. These enabled 125.4 million total cellular connections among 97.3% of the population. They caused online commerce to proliferate. This made it widely available and accessible to the population.

Consumer trust growth in e-commerce and payments, with the improved user experience from features like fraud protection, have also contributed to the growth of the online shopping space. In April 2024, Kueski introduced a Kueski Pay in-store version of its product. It lets users pay through the mobile app. Users can pay this way offline in a participating store. This seeks to decrease the share of cash transactions in retail, integrate online and offline interactions better, and increase e-commerce.

The market also benefited from improvements in the logistics and delivery industry which allows for faster and more reliable order fulfillment. In June 2024, COCO SHIPPING Holdings launched an express route to Mexico onboard their ship “Xin Dalian”, which docked at Ensenada Port. It eases trade across the Pacific, building connectivity and economic integration between Asia and Mexico. Infrastructure enhancements such as this help improve consumer satisfaction by ensuring reliable delivery. They also lead to repeat purchases and market expansion.

Buy Report Now: https://www.imarcgroup.com/checkout?id=22173&method=980

Mexico E-Commerce Market Segmentation

Breakup by Type:

● Home Appliances: Demand driven by convenience, competitive pricing, detailed product info, and wide selection facilitating easy brand/model comparison, customer reviews, and home delivery.

● Apparel, Footwear and Accessories: E-commerce demand fueled by fashion trends, extensive variety, easy return policies, personalized recommendations, and online exclusive discounts.

● Books: Thrives on vast selection, availability of rare/international titles, convenience of digital formats, competitive pricing, and personalized recommendations for avid and educational readers.

● Cosmetics: Demand driven by diverse brands, access to product reviews/tutorials, convenience of home delivery, exclusive online deals, and discovery of niche products.

● Groceries: Propelled by the convenience of home delivery, time savings, fresh produce availability, and personalized offers along with subscription services.

● Others

Breakup by Transaction:

● Business-to-Consumer (B2C): Driven by consumer convenience, broad product selection, competitive pricing, personalized shopping, enhanced security, and fast delivery.

● Business-to-Business (B2B): Fueled by streamlined procurement, cost efficiency, wider market reach, improved supply chain management, pricing transparency, and global sourcing.

● Consumer-to-Consumer (C2C): Driven by growth of online marketplaces, ease of listing, broad audience access, trust in peer transactions, and secure payment/dispute mechanisms.

● Others

Breakup by Region:

● Northern Mexico: Demand driven by proximity to U.S. border facilitating cross-border trade and faster deliveries. Strong industrial base, higher incomes, robust logistics, and tech-savvy consumers boost e-commerce.

● Central Mexico: Includes Mexico City; high demand due to dense urban population, major business hubs, improved digital infrastructure, increased disposable income, and vibrant retail market.

● Southern Mexico: Growth propelled by initiatives improving digital connectivity/infrastructure in less developed areas, government efforts bridging digital divide, and localized e-commerce platforms.

● Others

Regional Insights

Northern Mexico is the dominant region in the Mexico e-commerce market, benefiting from its proximity to the U.S. border that enables faster delivery and cross-border trade. The region’s strong industrial base, higher income levels, and dense concentration of tech-savvy consumers support robust e-commerce adoption.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=22173&flag=C

Recent Developments & News

In June 2024, Dollarcity advanced its Mexico expansion via a partnership with Canadian retailer Dollarama, planning a pilot store launch by 2026 under Mexican Commercial Investment (ICM) with ownership shares split between Dollarama (80%) and Dollarcity founders (19.9%). In March 2024, Amazon launched Amazon Business, catering to B2B sourcing needs across organizations. December 2023 saw LTIMindtree open a delivery center in Mexico City to boost Latin America presence and workforce localization. In June 2024, Clip secured US$100 million investment from Morgan Stanley Tactical Value and a major West Coast mutual fund to enhance digital payments and commerce enablement in Mexico.

Key Players

● MercadoLibre

● Amazon

● Walmart

Competitive Landscape

The market research report covers a comprehensive competitive landscape analysis including market structure, key player positioning, winning strategies, competitive dashboards, and company evaluation quadrants. Detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.