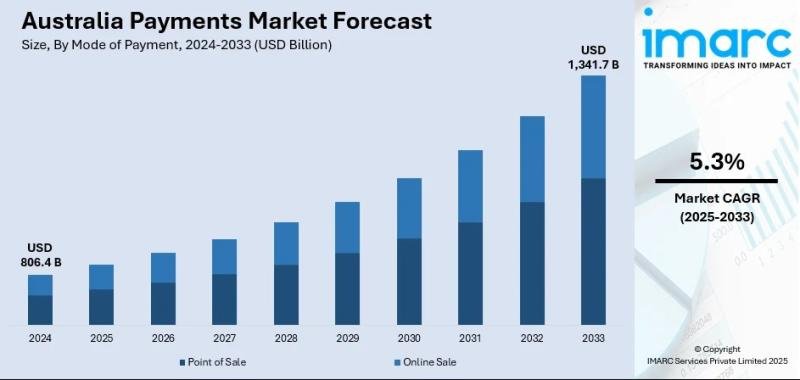

The latest report by IMARC Group, titled “Australia Payments Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033,” provides a comprehensive analysis of the Australia payments market growth. The report includes competitor and regional analysis along with a breakdown of market segments within the industry. The Australia payments market size reached USD 806.4 Billion in 2024. Looking forward, IMARC Group expects the market to grow to USD 1,341.7 Billion by 2033, exhibiting a CAGR of 5.3% during 2025-2033.

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 806.4 Billion

Market Forecast in 2033: USD 1,341.7 Billion

Market Growth Rate (2025-2033): 5.3%

Australia Payments Market Overview

The Australia payments market is growing quickly due to widespread digital use, increased mobile payment adoption, and new services like buy-now-pay-later (BNPL). The rise in smartphone use and contactless payments is leading consumers to prefer fast and easy transactions. The New Payments Platform (NPP) allows real-time money transfers, which improves convenience and efficiency. AI and machine learning improve payment security and fraud prevention, building trust for both businesses and consumers. The growth of e-commerce and omni-channel retailing further increases payment volumes. Government support and open banking initiatives encourage competition and innovation in payment solutions.

Request For Sample Report:

https://www.imarcgroup.com/australia-payments-market/requestsample

Australia Payments Market Trends

• Explosive growth in mobile wallet transactions and contactless payments.

• Increasing adoption of biometric authentication for secure payments.

• Enhanced real-time payments via New Payments Platform (NPP) and PayID systems.

• Emerging fintech and challenger bank ecosystem reshaping payment methods.

• Expanding buy-now-pay-later services driving consumer spending flexibility.

Australia Payments Market Drivers

• Proliferation of smartphones and digital banking apps.

• Growth of e-commerce and demand for omni-channel payment solutions.

• Regulatory support for innovation and consumer protection.

• Advancements in AI and cybersecurity technologies.

• Consumer desire for seamless, secure, and fast payments.

Australia Payments Market Growth

• Rapid digital adoption and innovation driven by fintech and mobile technologies.

• Strong government support through Open Banking and real-time payment infrastructure like NPP.

• Shift in consumer preference toward cashless, seamless, and mobile-first transactions.

• Expansion of e-commerce accelerating demand for integrated digital payment solutions.

• Increasing business digitalization enabling faster, automated B2B and SME payments.

Challenges and Opportunities

Challenges:

• Managing risks related to cybersecurity and data privacy.

• Reducing cash dependency in certain segments.

• Integrating payments across diverse platforms and regions.

Opportunities:

• Expanding payments to underserved rural and elderly populations.

• Leveraging AI and machine learning for fraud detection and personalized experience.

• Developing cross-border payment capabilities and multi-currency support.

• Integrating loyalty, rewards, and value-added services into payment systems.

Australia Payments Market Segmentation

By Mode of Payment:

• Point of Sale (Card Payments, Digital Wallets, Cash, Others)

• Online Sales (Card Payments, Digital Wallets, Others)

By End Use Industry:

• Retail

• Entertainment

• Healthcare

• Hospitality

• Others

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-payments-market

Australia Payments Market News

• Over 500 million mobile wallet transactions recorded in October 2024.

• ATM withdrawals and cash usage declining sharply in favor of digital payments.

• Growing collaboration between banks and fintech players.

• Expansion of biometric and tokenization technologies to enhance security.

Key highlights of the Report:

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=32712&flag=F

Q&A Section

Q1: What drives the growth of the Australia payments market?

A1: Digital adoption, mobile wallets, real-time payments, regulatory backing, and e-commerce expansion.

Q2: What are the major trends?

A2: Contactless payments, biometrics, BNPL usage, open banking, and AI-enhanced security.

Q3: What are the challenges?

A3: Cybersecurity risks, cash reduction hurdles, and platform integration complexities.

Q4: What are the opportunities?

A4: Financial inclusion, fraud prevention innovation, cross-border payments, and value-added service integration.

Contact

IMARC Group

134 N 4th St, Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel: +1-201-971-6302

About Us

IMARC Group is a leading market research company dedicated to providing data-driven insights and expert consulting services to support businesses in achieving their strategic objectives across diverse industries.

This release was published on openPR.