At EA Automatic, the mission is simple but profound: to bridge the gap between human expertise and artificial intelligence.

LONDON, UK / ACCESS Newswire / November 14, 2025 / In today’s fast-paced financial landscape, where markets shift in milliseconds and human emotion often drives impulsive decisions, automation has become not just a convenience but a necessity. Yet, the question remains-how can automation be both intelligent and human-centered? The answer lies in the groundbreaking approach of EA Automatic, a London-based leader in algorithmic trading innovation.

At EA Automatic, the mission is simple but profound: to bridge the gap between human expertise and artificial intelligence. While many automated trading systems promise quick profits or hands-free wealth, EA Automatic takes a different route, one rooted in transparency, discipline, and long-term financial strategy. The company’s approach is designed not to replace traders but to empower them, integrating cutting-edge technology with years of real-world market experience.

Beyond Bots: Building Smart, Adaptive Trading Systems

In an industry saturated with cookie-cutter trading bots and one-size-fits-all strategies, EA Automatic stands apart by creating tailored, multi-algorithm systems designed to match each investor’s unique objectives and risk profile. Whether a client seeks steady monthly returns or aims for more aggressive portfolio growth, each solution is built from the ground up, ensuring precision, adaptability, and resilience.

Every algorithm within EA Automatic’s ecosystem is built to work harmoniously within a broader strategy, optimizing risk exposure, enhancing diversification, and maximizing potential returns even in turbulent market conditions. Instead of chasing fleeting profits, the focus is on sustainable growth and capital protection.

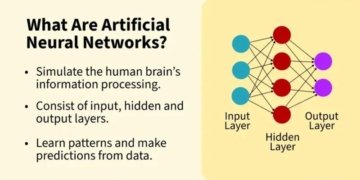

The systems are continuously evolving through machine learning models that analyze patterns, adapt to shifts, and refine performance in real time. This dynamic approach ensures that EA Automatic clients are always positioned ahead of the curve rather than reacting to it.

2.5 Years of Precision Engineering and Testing

EA Automatic’s foundation was not built overnight. It represents more than two and a half years of intense research, coding, back-testing, and live-market validation. The development team, composed of software engineers, financial analysts, and professional traders, spent countless hours stress-testing each algorithm under diverse market conditions, from bull runs to volatile downturns.

This dedication to precision has resulted in a platform that doesn’t just function automatically but intelligently. Every decision, from entry to exit, is guided by both statistical logic and market intuition, fine-tuned by human experts who understand the nuances that data alone can’t always capture.

The Perfect Balance: AI Meets Human Expertise

One of the key differentiators of EA Automatic is its balanced approach to automation. While artificial intelligence is at the core of its operations, human oversight remains indispensable. The systems are designed to enhance human insight, not eliminate it. Each trade, adjustment, or update is informed by a team that understands not only algorithms but also the psychology of trading.

Unlike typical retail bots that rely solely on backtested scripts, EA Automatic combines machine precision with trader intuition. This collaboration minimizes emotional errors and allows for consistent execution, a major advantage in markets often ruled by fear and greed.

“Our goal has never been to sell a dream,” a spokesperson for EA Automatic explained. “It’s to provide intelligent systems that reflect the realities of trading: its risks, rewards, and the discipline required to succeed.”

Transparency and Risk Management: The Core Philosophy

In an industry where exaggerated promises are all too common, EA Automatic takes pride in its commitment to honesty and transparency. Rather than guaranteeing unrealistic profits, the company focuses on delivering data-driven, risk-adjusted growth. Every system is built around the principle that the preservation of capital is the first step toward financial success.

Key elements of their risk management framework include:

Multi-Strategy Diversification: Reducing exposure by combining multiple trading styles and timeframes.

Dynamic Position Sizing: Adjusting trade volumes based on volatility and market behavior.

Stop-Loss and Drawdown Controls: Ensuring every trade is managed within pre-defined safety parameters.

Continuous Monitoring: Systems are actively supervised 24/7, with real-time reporting for clients.

This disciplined approach enables clients to trade confidently, knowing their investments are not left to chance but guided by logic and oversight.

Automation Without Emotion: A New Trading Mindset

Human traders often battle two powerful emotions: fear and greed that can derail even the best strategies. EA Automatic eliminates that psychological burden. By leveraging automation, decisions are executed with precision, consistency, and zero emotional interference.

However, automation doesn’t mean detachment. Each EA Automatic system is crafted with an understanding of market sentiment and behavioral economics, ensuring that it reacts intelligently to momentum shifts, news events, and global economic indicators.

The result is a system that thinks faster than any human can, yet operates with the caution and patience of a seasoned trader.

A Smarter Future for Every Investor

Whether you are a first-time investor looking to diversify your portfolio or an experienced trader seeking to scale your operations, EA Automatic provides tools and insights to help you grow intelligently. Its systems are not plug-and-play gimmicks but sophisticated, evolving solutions that cater to each client’s individual goals.

EA Automatic envisions a future where technology serves as a trusted partner rather than a mysterious black box. The platform’s design ensures that users can monitor and understand what their algorithms are doing, fostering confidence and clarity instead of confusion.

The company’s ethos centers around education and empowerment. Through open communication, detailed performance reports, and continuous improvement, clients gain not only results but a deeper understanding of how their strategies work.

Why EA Automatic Matters in the Future of Finance

As the financial world continues to shift toward automation and AI integration, many investors find themselves caught between skepticism and fascination. EA Automatic offers a middle ground, innovation grounded in integrity.

Its philosophy reflects a larger truth about the modern market: the most successful traders are those who embrace change without abandoning discipline. Automation, when guided by wisdom and ethics, can help level the playing field, making professional-grade strategies accessible to everyone.

The company’s success is a testament to what’s possible when technology is built with purpose. It’s not just about trading faster; it’s about trading smarter, safer, and with a deeper sense of strategy.

Final Thoughts

EA Automatic is not just another name in algorithmic trading; it represents a vision for the future of intelligent investing. With its unique combination of AI-driven precision, human insight, and uncompromising transparency, the company continues to redefine what investors can expect from automated systems.

In a world where markets never sleep, EA Automatic ensures your strategy doesn’t either. It’s automation with heart, intelligence, and integrity, an ally for investors who want more than luck on their side.

For more information or to see EA Automatic in action, visit https://ea-automatic.com or contact [email protected].

Watch the video: Clinton & David Interview https://youtu.be/wuZ7M7ehkyk

Because in the world of modern trading, intelligence isn’t optional, it’s essential.

SOURCE: EA Automatic