Leander, Texas and Tokyo, Japan – Feb.06.2026

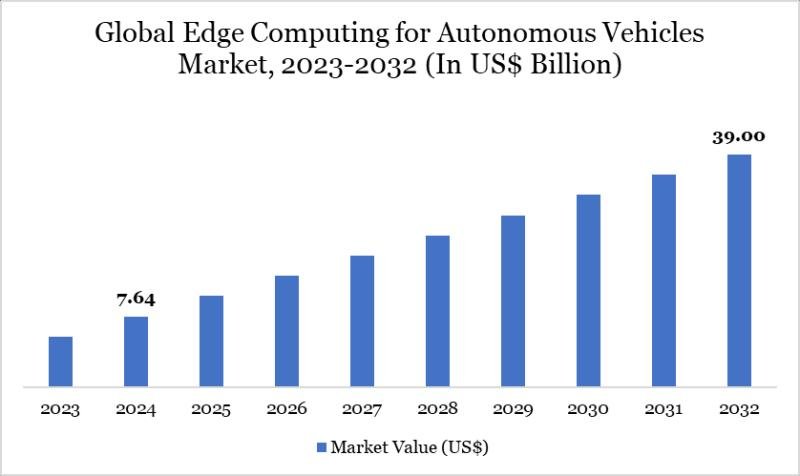

As per DataM intelligence research report “Global edge computing for autonomous vehicles Market reached US$ 7.64 billion in 2024 and is expected to reach US$ 39.00 billion by 2032, growing with a CAGR of 22.60% during the forecast period 2025-2032.”

Growth is supported by real-time data processing needs in autonomous driving systems. Hardware accelerators and edge AI platforms dominate adoption. Automotive OEMs and technology providers are key end-users. Low latency and safety requirements drive market expansion.

Download your exclusive sample report today: (corporate email gets priority access):

https://www.datamintelligence.com/download-sample/edge-computing-for-autonomous-vehicles-market?prasad

(Single User Report: USD 4350 & One Year Database Subscription: USD 12K)

Edge computing for autonomous vehicles Market: Competitive Intelligence

NVIDIA Corporation, Intel Corporation (Mobileye), Qualcomm Technologies, Inc., Tesla, Baidu Apollo

In the Edge Computing for Autonomous Vehicles Market, a strategic group of technology and automotive innovators NVIDIA Corporation, Intel Corporation (Mobileye), Qualcomm Technologies, Inc., Tesla, and Baidu Apollo are collectively accelerating the deployment of real‐time, on‐vehicle computing architectures that are essential for safe, efficient autonomy. NVIDIA’s high‐performance AI‐optimized platforms deliver the processing power needed to interpret sensor data and make split‐second driving decisions, reinforcing the market’s ability to scale to complex real‐world environments. Intel’s Mobileye brings specialized vision‐centric edge computing and advanced driver‐assistance systems that enhance perception and safety, deepening industry trust in autonomous functions. Qualcomm Technologies’ connectivity‐focused silicon and edge AI solutions support low‐latency data handling and communication between vehicle subsystems, while Tesla’s vertically integrated compute hardware and software stack demonstrates the commercial viability of edge‐centric autonomy. Baidu Apollo’s open autonomous driving platform further extends the market’s reach by enabling developers, OEMs, and mobility providers to integrate edge processing into tailored autonomy solutions.

Individually and together, these companies reinforce the Edge Computing for Autonomous Vehicles Market’s evolution toward robust, scalable, and safe autonomous systems. NVIDIA’s broad ecosystem of hardware, software, and developer tools helps standardize edge computing architectures that support multiple autonomy tiers, increasing interoperability across platforms. Intel Mobileye’s focus on vision processing and redundancy supports critical safety functions and regulatory compliance, strengthening the market’s operational reliability. Qualcomm Technologies extends edge compute capability with power‐efficient platforms that balance performance with vehicle energy constraints, while Tesla’s over‐the‐air updates and fleet‐level data utilization illustrate how edge compute can improve system performance over time. Baidu Apollo’s modular approach encourages wide adoption and regional customization, highlighting how collaborative platforms can accelerate innovation and deployment across global markets.

Get Customization in the report as per your requirements:

https://www.datamintelligence.com/customize/edge-computing-for-autonomous-vehicles-market?prasad

(Single User Report: USD 4350 & One Year Database Subscription: USD 12K)

Technological Advancements

✅ Feb 2026 – Real-Time Edge AI for Vehicle Decision-Making

Automotive technology providers enhanced edge computing platforms to enable autonomous vehicles to process sensor data locally, improving real-time decision-making and reducing latency in critical driving scenarios.

✅ Jan 2026 – Advanced Sensor Fusion and Edge Analytics

Developers integrated multi-modal sensor fusion with edge analytics, allowing autonomous vehicles to combine data from lidar, radar, and cameras for improved object detection and navigation accuracy.

✅ Nov 2025 – Low-Power High-Performance Edge Chips

Semiconductor companies launched next-generation low-power, high-performance edge processors optimized for autonomous vehicle workloads, supporting complex AI inference while minimizing energy consumption.

Product Launches & Innovations

✅ Feb 2026 – Edge Computing Platforms for Fleet Management

Automotive tech firms introduced commercial edge computing platforms for connected and autonomous vehicle fleets, enabling real-time monitoring, predictive maintenance, and over-the-air software updates.

✅ Dec 2025 – Autonomous Vehicle Simulation with Edge Integration

Simulation software providers launched edge-enabled virtual testing environments that accelerate autonomous vehicle validation and allow near real-world scenario testing with AI algorithms deployed at the edge.

✅ Nov 2025 – Vehicle-to-Everything (V2X) Edge Solutions

Companies released V2X edge solutions integrating vehicle-to-vehicle and vehicle-to-infrastructure communications, enhancing safety and enabling real-time traffic and hazard response for autonomous mobility.

Mergers & Acquisitions

✅ Jan 2026 – Acquisition of Edge AI Startup by Automotive Tier 1 Supplier

A major automotive tier-1 supplier acquired an edge AI startup specializing in autonomous driving perception and decision-making, expanding its technology capabilities in edge computing for AVs.

✅ Dec 2025 – Strategic Merger Between Edge Computing and AV Software Firms

Two companies merged to combine expertise in edge computing hardware and autonomous driving software, creating an integrated platform for next-generation autonomous vehicle solutions.

✅ Nov 2025 – Expansion of Regional Edge Processing Operations

A global automotive technology provider acquired a regional edge computing firm to strengthen deployment and support for autonomous vehicle projects in Europe and Asia.

Segment Covered in the Edge computing for autonomous vehicles Market:

By Component

The market is segmented into Hardware 45%, Software 35%, and Services 20%, with Hardware dominating due to high demand for edge processors, sensors, AI accelerators, and embedded systems that enable real-time data processing in autonomous vehicles. Software plays a critical role in AI algorithms, data analytics, and vehicle decision-making systems. Services include system integration, maintenance, and updates, gaining traction as OEMs move toward software-defined vehicles.

By Deployment

Based on deployment, the market is categorized into On-Vehicle Edge 60% and Infrastructure Edge 40%, with On-Vehicle Edge leading as autonomous vehicles require ultra-low latency processing for perception, navigation, and safety functions. Infrastructure edge deployment supports traffic management, V2X communication, and fleet coordination. Increasing smart city investments accelerate infrastructure-based edge adoption.

By Connectivity

Connectivity segments include 5G 40%, LTE/4G 30%, DSRC 20%, and Others 10%, with 5G dominating due to its high bandwidth, low latency, and ability to support real-time autonomous decision-making. LTE remains relevant for transitional deployments, while DSRC supports vehicle-to-vehicle and vehicle-to-infrastructure communication. Advancements in V2X technologies support connectivity growth.

By Vehicle Type

The market is segmented into Passenger Vehicles 55%, Commercial Vehicles 30%, and Others 15%, with Passenger Vehicles leading due to rising adoption of autonomous driving features in premium and mid-segment cars. Commercial vehicles show strong growth driven by autonomous trucks, delivery vehicles, and logistics fleets. Increasing focus on safety and efficiency drives vehicle adoption.

By Application

Applications include Advanced Driver Assistance Systems (ADAS) 35%, Autonomous Navigation 25%, Fleet Management 15%, Predictive Maintenance 15%, and Infotainment & Others 10%, with ADAS dominating due to widespread integration of real-time edge computing for collision avoidance, lane assistance, and adaptive cruise control. Autonomous navigation is gaining traction with higher autonomy levels. Fleet management and predictive maintenance benefit from real-time analytics at the edge.

By End-User

End-users include Automotive OEMs 45%, Fleet Operators 25%, Technology Providers 20%, and Others 10%, with Automotive OEMs dominating as edge computing becomes a core component of vehicle architecture. Fleet operators increasingly adopt edge solutions to improve operational efficiency and safety. Technology providers support AI, cloud-edge integration, and analytics solutions.

Buy Now & Unlock 360° Market Intelligence:

https://www.datamintelligence.com/buy-now-page?report=edge-computing-for-autonomous-vehicles-market

(Single User Report: USD 4350 & One Year Database Subscription: USD 12K)

Regional Analysis

North America – 30% Share

North America leads with 30% share, driven by strong presence of autonomous vehicle developers, advanced 5G infrastructure, and high investments in AI and edge computing in the U.S. and Canada. Passenger vehicles dominate adoption, while commercial autonomous fleets gain momentum. Supportive regulatory frameworks accelerate market growth.

Europe – 25% Share

Europe accounts for 25% share supported by strong automotive manufacturing, smart mobility initiatives, and regulatory emphasis on vehicle safety. Countries such as Germany, France, and the UK drive demand. ADAS and passenger vehicles dominate applications. Investments in smart infrastructure boost edge deployment.

Asia Pacific – 20% Share

Asia Pacific holds 20% share driven by rapid adoption of connected vehicles, expanding 5G networks, and strong automotive production in China, Japan, and South Korea. Commercial vehicles and autonomous mobility solutions see rising demand. Government-led smart transportation initiatives support growth.

Request for 2 Days FREE Trial Access:

https://www.datamintelligence.com/reports-subscription?prasad

✅ Competitive Landscape

✅ Technology Roadmap Analysis

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Consumer Behavior & Demand Analysis

✅ Import-Export Data Monitoring

✅ Live Market & Pricing Trends

Contact Us –

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us –

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.