The global semiconductors market was valued at US$ 640.6 billion in 2022 and is projected to grow steadily, reaching approximately US$ 1,132.8 billion by 2031, expanding at a CAGR of 7.5% during the 2024-2031 forecast period.

Get a Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/semiconductors-market?kb

✅ TSMC has announced plans to manufacture 3-nanometer advanced semiconductors in Japan, marking a major milestone in the country’s chipmaking ambitions. The cutting-edge chips will be produced at TSMC’s second Kumamoto factory, currently under construction, to support surging AI, robotics, and autonomous driving demand.

✅ The move strengthens Japan’s economic security strategy and aligns with government-backed efforts to regain leadership in advanced semiconductor manufacturing. With AI-driven demand accelerating globally

✅ TSMC is expanding aggressively, boosting capital spending while deepening partnerships in Japan and the U.S. This decision reinforces Japan’s growing role in the global advanced chip supply chain.

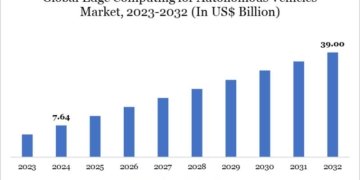

✅ The global semiconductor market is on a steep growth trajectory, projected to exceed $1 trillion by 2030, driven by artificial intelligence (AI), electric vehicles (EVs), renewable energy, and advanced manufacturing.

✅ In 2025, the industry saw sales growth of 22%, with 2026 expected to accelerate to 26%, potentially reaching $2 trillion in annual sales by 2036, according to Deloitte’s 2026 Global Semiconductor Industry Outlook.

✅ This expansion is underpinned by innovations in wide-bandgap materials like silicon carbide (SiC) and gallium nitride (GaN), alongside advancements in power management integrated circuits (ICs) and advanced packaging technologies.

Power Semiconductor Growth: SiC and GaN Lead the Charge

Power semiconductor chips, At the heart of this expansion are core components such as MOSFETs, power MOSFETs, IGBT modules, diodes (1N4007, 1N4004, 1N5404, Schottky diodes), thyristors, JFETs, and BJTs, which remain essential across consumer electronics, automotive systems, renewable energy, and industrial power control. The power semiconductor chip market is forecast to grow at a compound annual growth rate (CAGR) of 15.0% from 2024 to 2031, reaching approximately US$ 171,709 million by 2031

Get the full Power Semiconductor market Report: https://www.datamintelligence.com/download-sample/power-semiconductor-market?kb

Key drivers include:

• Electric Vehicles (EVs): High-power SiC MOSFETs from leaders like Infineon, Wolfspeed, and Qorvo enable efficient inverters and onboard chargers, reducing energy losses and extending range.

• Renewable Energy: Solar and wind power systems rely on SiC and GaN devices for high-efficiency power conversion

• Industrial Automation: Advanced MOSFETs and IGBT modules support motor control and power management in factories, driving energy savings.

• Wide-bandgap semiconductors like SiC and GaN offer superior efficiency, higher power density, and reduced cooling needs compared to traditional silicon-based solutions, making them ideal for data centers, EVs, and fast-charging infrastructure. Companies such as Navitas and Transphorm report rapid adoption, with GaN design wins exceeding $450 million in 2024

Download Sample Report of Gallium Nitride Semiconductor (GaN) high-growth opportunities: https://www.datamintelligence.com/download-sample/gallium-nitride-semiconductor-market?kb

Key Players and Market Dynamics

The semiconductor landscape is dominated by giants like:

• Taiwan Semiconductor Manufacturing Company (TSMC), Intel, Samsung, and Texas Instruments, with TSMC leading advanced node production (e.g., 3nm and 2nm chips).

• TSMC’s sub-5nm price hikes of 3-10% in 2026 reflect soaring demand for AI chips, which now drive nearly half of total revenue despite representing less than 0.2% of unit volume

• Infineon Technologies: A leader in SiC MOSFETs and power modules.

• Wolfspeed: Specializing in SiC wafers and devices.

• Qorvo: Focused on RF and power semiconductors, including SiC and GaN.

• NXP Semiconductors: Strong in automotive and industrial chips.

• STMicroelectronics: A major supplier of power ICs and MOSFETs.

The market is highly competitive, with Chinese companies like Huawei and SMIC expanding capacity, while geopolitical tensions push localization efforts in the U.S., Europe, and Asia. Supply chain disruptions and raw material shortages (e.g., silicon wafers) pose challenges, but investments in domestic manufacturing and advanced packaging mitigate risks.

Identify Silicon Carbide (SiC) Semiconductor Market Growth Outlook: https://www.datamintelligence.com/download-sample/silicon-carbide-semiconductor-market?kb

Applications Across Industries

✦ Semiconductors permeate every sector, from consumer electronics to automotive and industrial systems. Discrete components like 1N4007 diodes, BAT54 Schottky diodes, and MOSFETs (e.g., FQP30N06L) are ubiquitous in power supplies and rectifiers.

✦ Nordic Semiconductor’s NRF5340 and NRF52 series enable Bluetooth Low Energy (BLE) in IoT devices, while Cypress PSoC and Lattice FPGA chips power embedded systems. Automotive applications leverage SiC power modules for EV traction inverters, reducing losses by up to 50% compared to silicon IGBTs.

Future Outlook and Opportunities

✦ By 2030, the semiconductor market will be shaped by AI-driven design, chiplets, 3D IC packaging, and sustainability initiatives. Advanced packaging technologies like CoWoS and 3D stacking will enhance performance while reducing footprint.

✦ The SiC wafer market is poised for expansion, with 4H-SiC substrates gaining traction for high-voltage applications. Emerging materials like gallium oxide and cubic boron arsenide promise even higher efficiency.

✦ Investors and manufacturers should focus on high-growth segments: power semiconductors, AI accelerators, and advanced packaging equipment from suppliers like ASML and KLA Corporation. The used semiconductor equipment market offers cost-effective entry points for new fabs, while raw material suppliers (e.g., Merck) ensure steady wafer production. With the industry’s resilience and innovation, the semiconductor market remains a cornerstone of the global tech economy, driving progress in energy efficiency, connectivity, and automation.

Key Highlights at a Glance

1• Semiconductor market driven by chips, MOSFETs, diodes, and power devices

2• SiC and GaN technologies reshaping power electronics

3• Wafer fabrication and advanced packaging gaining strategic importance

4• Automotive, AI, and renewable energy fueling semiconductor demand

5• Global investments Strengthening Semiconductor Manufacturing Capacity

Leading SiC & GaN Power Semiconductor Players

✅ Infineon Technologies (Germany): Broad SiC MOSFET, diode, and GaN power IC portfolio with strong automotive and industrial leadership.

✅ Wolfspeed (USA): Pure-play SiC leader offering wafers, MOSFETs, and modules at scale.

✅ STMicroelectronics (Switzerland): High-volume SiC MOSFETs and modules powering EV, solar, and industrial systems.

✅ ON Semiconductor / onsemi (USA): Major automotive-focused supplier of SiC MOSFETs, JFETs, and power modules.

✅ ROHM Semiconductor (Japan): Strong lineup of SiC MOSFETs, Schottky diodes, and emerging GaN power devices.

✅ Texas Instruments (USA): GaN-based power ICs and RF solutions for consumer and industrial power applications.

✅ NXP Semiconductors (Netherlands): GaN RF and power-management solutions supporting automotive and 5G infrastructure.

✅ Navitas Semiconductor (USA): GaN power ICs driving fast-charging, data-center, and high-efficiency power systems.

✅ GaN Systems (Canada): High-power GaN transistors and modules for EVs, renewables, and industrial markets.

✅ Efficient Power Conversion – EPC (USA): Enhancement-mode GaN FETs enabling ultra-high-frequency power conversion.

✅ Mitsubishi Electric (Japan): SiC power modules for traction systems and heavy industrial drives.

✅ Panasonic (Japan): SiC and GaN devices supporting automotive electrification and industrial efficiency.

2027 Semiconductor Market Growth Outlook

1. AI momentum: AI chips, including GPUs and accelerators, could generate over $100 billion in annual revenue by 2027.

2. Equipment spending: Semiconductor equipment sales are forecast to grow from $133B (2025) to $156B (2027).

3. Memory expansion: NAND equipment spending is expected to rise from $14B in 2025 to $16.9B by 2027, driven by 3D NAND and HBM.

4. Regional dominance: Taiwan, South Korea, and China are set to remain the top equipment-spending regions through 2027.

Related Reports 2026

Semiconductor Yield Management Solutions Market

https://www.datamintelligence.com/download-sample/semiconductor-yield-management-solutions-market?kb

Semiconductor Manufacturing Equipment Market

https://www.datamintelligence.com/download-sample/semiconductor-manufacturing-equipment-market?kb

Semiconductor Packaging Services Market

https://www.datamintelligence.com/download-sample/semiconductor-packaging-services-market?kb

Semiconductor and IC Packaging Materials Market

https://www.datamintelligence.com/download-sample/semiconductor-and-ic-packaging-materials-market?kb

Automotive Semiconductor Market

https://www.datamintelligence.com/download-sample/automotive-semiconductor-market?kb

India Semiconductor Manufacturing Market

https://www.datamintelligence.com/download-sample/india-semiconductor-manufacturing-market?kb

Contact Us –

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us –

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.