Market Overview

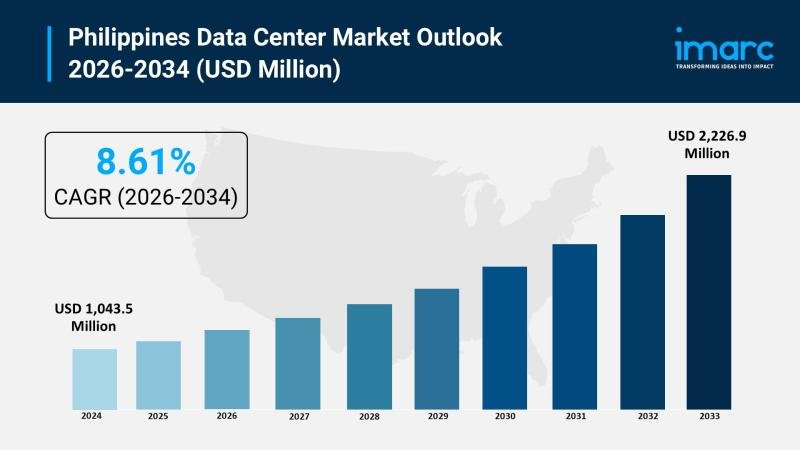

The Philippines data center market reached a size of USD 1,043.5 Million in 2025 and is projected to expand to USD 2,226.9 Million by 2034. The market is set to grow at a CAGR of 8.61% between 2026 and 2034, driven by digital transformation creating massive data volumes, rising frequency and sophistication of cybersecurity threats, and accelerating cloud computing adoption. The demand is fueled by government digital infrastructure initiatives, expanding internet penetration reaching 73.6% of the population, and growing investments from both local and international operators. Both colocation and hyperscale data center models are gaining traction, supported by favorable government policies including the CREATE MORE Act and expanding submarine cable connectivity enhancing the Philippines’ position as a regional digital hub.

Request a Sample Report with the Latest 2026 Edition: https://www.imarcgroup.com/philippines-data-center-market/requestsample

How AI is Reshaping the Future of Philippines Data Center Market:

• AI-driven workload optimization enables data center operators to distribute computational tasks efficiently across servers, reducing energy consumption and improving resource utilization in the expanding Philippines data center market valued at USD 1,043.5 Million in 2025.

• Machine learning algorithms power predictive maintenance systems monitoring critical infrastructure including cooling systems, power distribution units, and backup generators, detecting anomalies early to prevent costly downtime and equipment failures in mission-critical facilities.

• AI-powered energy management platforms optimize power usage effectiveness (PUE) by analyzing real-time data from thousands of sensors, automatically adjusting cooling systems and workload distribution to minimize electricity consumption in a country with Southeast Asia’s highest commercial power rates.

• Data analytics driven by AI supports capacity planning forecasts enabling operators to anticipate demand spikes from cloud migration, edge computing deployments, and AI workloads, optimizing infrastructure investments across Metro Manila, Clark, Cebu, and emerging provincial hubs.

• AI facilitates intelligent security systems combining facial recognition, behavioral analysis, and anomaly detection to protect physical facilities and detect unauthorized access attempts, addressing heightened cybersecurity requirements from BFSI and government sectors.

• AI-assisted cooling optimization leverages machine learning to predict thermal loads and adjust airflow dynamically, enabling facilities like Digital Edge’s NARRA1 to achieve PUE ratings below 1.2 through precision climate control and liquid cooling innovations.

Market Growth Factors

The Philippines data center industry growth is significantly driven by surging cloud computing and over-the-top (OTT) content demand transforming enterprise IT infrastructure. According to 451 Research, cloud services are expanding at a 15.4% CAGR from 2021 to 2026, while an Alibaba Cloud-commissioned survey revealed 85% of Philippine businesses expect complete cloud migration by 2026. This massive shift requires scalable, low-latency infrastructure supporting hybrid cloud deployments, SaaS applications, and regional content delivery networks. Hyperscale cloud providers including Alibaba Cloud, which opened its second Philippine availability zone in July 2025, and major global platforms are localizing workloads to reduce latency and comply with data residency requirements. The National Cloud First Policy mandating public agencies migrate workloads creates steady demand for multi-tenant capacity across government, education, and healthcare sectors.

Favorable government policies and economic incentives are accelerating infrastructure investments nationwide. The CREATE MORE Act (RA 12066) provides data centers registered with BOI or PEZA comprehensive fiscal benefits including 4-7 year income tax holidays, 5% special corporate income tax or 20% standard rate with enhanced deductions covering 100% of power, labor, and R&D expenses, zero-rated VAT on local purchases, duty-free equipment importation, and RBELT capping local levies at 2% of gross income. The recently amended Public Service Act allowing 100% foreign ownership of telecommunications and data infrastructure has attracted multinational operators including Equinix, which acquired three TIM facilities in 2025 for approximately USD 180 Million, and EdgeConneX entering the market. Government initiatives like the Digital Cities 2025 program identifying 25+ priority cities including Batangas, Naga, and Iligan, combined with the National Broadband Plan expanding connectivity infrastructure, are creating regional data center ecosystems beyond Metro Manila.

Expanding mobile and internet penetration coupled with strategic submarine cable deployments are creating robust digital infrastructure foundations. The Philippines reached 86.98 million internet users representing 73.6% population penetration as of early 2024, with affordable smartphones and improving 5G coverage driving data consumption across video streaming, online gaming, fintech, and e-commerce platforms. Eight trans-Pacific submarine cable systems including Jupiter, Bifrost, CAP-1, APRICOT, and SEA-H2X are landing in the Philippines by 2025, increasing available international bandwidth from 60 Tbps to over 130 Tbps and reducing latency to West Coast United States hubs. Converge ICT’s landing station in Davao introduces route diversity positioning Mindanao as a global gateway, while operators pre-lease data hall capacity near cable stations in Batangas, Aurora, and Baler. This enhanced connectivity infrastructure supporting redundancy, edge deployments, and regional failover systems establishes the Philippines as a strategic ASEAN digital traffic node.

Browse the full report with TOC and list of figures: https://www.imarcgroup.com/philippines-data-center-market

Market Segmentation

Component Insights:

• Solution

• Services

Type Insights:

• Colocation

• Hyperscale

• Edge

• Others

Enterprise Size Insights:

• Large Enterprises

• Small and Medium-sized Enterprises

End User Insights:

• BFSI

• IT and Telecom

• Government

• Energy and Utilities

• Others

Regional Insights:

• Luzon

• Visayas

• Mindanao

Key Players

• Alibaba Cloud

• Digital Edge (Singapore) Holdings Pte. Ltd

• EdgeConneX Inc

• Equinix, Inc.

• Space DC Pte Ltd.

• VITRO Inc.

Recent Developments & News

• January 2026: The Philippines data center market is projected to surge from USD 735 Million in 2025 to USD 2.48 Billion by 2031 at a 22.50% CAGR. Manila hosts approximately 28 operational colocation facilities with 20 active data centers and 5+ upcoming projects, while the cost advantage of USD 6.5-7.5 Million per MW makes the Philippines attractive for regional expansion.

• February 2025: Around USD 3 Billion worth of data centers are planned in the Philippines by the end of 2025, adding more than 124,000 rack spaces representing 2.5 times existing capacity. Over 350,000 square feet of data center space is expected to be added, demonstrating unprecedented infrastructure expansion to meet surging digital demand.

• February 2025: Philippines data center market analysis reports indicate the sector was valued at USD 633 Million in 2024 and is projected to reach USD 1.97 Billion by 2030, rising at a CAGR of 20.89%. The rapid growth reflects accelerating cloud adoption, AI workload deployment, and government digital transformation initiatives.

• December 2024: ePLDT announced plans to construct a new AI-ready hyperscale data center in South Luzon with approximately 100 MW power capacity, demonstrating commitment to supporting artificial intelligence and machine learning workloads requiring advanced cooling and high-density computing infrastructure.

• July 2025: Alibaba Cloud announced plans to open its second data center region/cloud availability zone in the Philippines, enhancing cloud capacity and supporting faster, more secure digital services for enterprises across Southeast Asia through localized infrastructure.

Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask an Analyst for Your Customized Sample Report: https://www.imarcgroup.com/request?type=report&id=23525&flag=C

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.