Market Overview

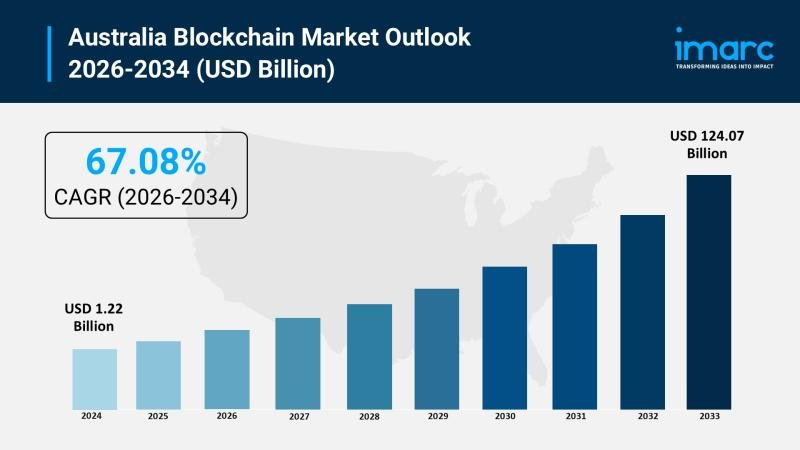

The Australia blockchain market reached a size of USD 1.22 Billion in 2025 and is projected to expand to USD 124.07 Billion by 2034. The market is set to grow at a CAGR of 67.08% between 2026 and 2034, driven by strategic government support through comprehensive policy frameworks, financial sector digital transformation, and rising demand for transparent supply chain solutions. The demand is fueled by increasing cryptocurrency adoption with 32.5% of Australians owning digital assets, convergence of blockchain with AI and IoT technologies, and expanding decentralized finance applications. Both public and private blockchain implementations are gaining traction, supported by cloud-based deployment models and regulatory clarity fostering enterprise confidence across banking, government services, and supply chain management.

Grab a sample PDF of this report: https://www.imarcgroup.com/australia-blockchain-market/requestsample

How AI is Reshaping the Future of Australia Blockchain Market:

• AI-driven threat detection systems analyze blockchain transaction patterns in real-time, identifying anomalies and fraudulent activities to enhance security across the expanding Australia blockchain market valued at USD 1.22 Billion in 2025.

• Machine learning algorithms optimize smart contract execution by predicting gas fees, automating compliance verification, and reducing computational costs for enterprise blockchain deployments in banking and supply chain applications.

• AI-powered blockchain platforms enable predictive analytics for supply chain management, forecasting demand fluctuations and optimizing logistics through intelligent data processing across distributed ledger networks.

• Data analytics driven by AI supports regulatory compliance automation, monitoring blockchain transactions for Anti-Money Laundering and Counter-Terrorism Financing obligations while generating real-time reporting for AUSTRAC requirements.

• AI facilitates intelligent identity verification within blockchain-based digital identity systems, combining biometric authentication with decentralized credential management to prevent identity theft and streamline government service access.

• AI-assisted quantum-resistant cryptography development positions Australia at the forefront of next-generation blockchain security, protecting distributed ledger infrastructure against emerging quantum computing threats.

Market Growth Factors

The Australia blockchain industry growth is significantly driven by comprehensive government strategic support through the National Blockchain Roadmap and substantial funding allocations. The Australian government committed AUD 288.1 million in the 2024-2025 Budget to support digital identity system expansion, while allocating AUD 26.2 million to create Cyber Rapid Assistance for Pacific Incidents and Disasters teams demonstrating blockchain’s role in regional cybersecurity. The May 2024 passage of the Digital ID Bill 2024 marked a pivotal legislative achievement, leveraging blockchain technology for secure identity verification across government services with enhanced data security through cryptographic protection and citizen control over personal information sharing. Government policies provide regulatory clarity that fosters enterprise confidence while encouraging blockchain adoption through clear frameworks balancing innovation with consumer protection, positioning Australia as a regional technology leader.

Financial services sector digital transformation is catalyzing blockchain adoption through operational blockchain deployments beyond exploratory pilots. Major Australian banks have progressed from early experimentation to production-grade implementations, with Commonwealth Bank successfully issuing blockchain-based bonds and subsequently developing platforms for sustainable investment product management and tokenized biodiversity credit trading. The September 2024 Reserve Bank of Australia commitment to prioritizing wholesale central bank digital currency research signals institutional validation of blockchain’s potential to enhance payment infrastructure with improved automation through smart contracts, enhanced interoperability between financial institutions, and real-time settlement capabilities reducing counterparty risk. The November 2024 launch of Kraken’s licensed crypto derivatives product targeting wholesale clients marked a significant milestone in institutional blockchain adoption and sophisticated financial product development.

Expanding cryptocurrency and decentralized finance adoption drives structural market growth as Australian digital asset ownership reaches record levels. In 2025, WhiteBIT, Europe’s largest cryptocurrency exchange by traffic, officially launched its platform in Australia after securing AUSTRAC registration as a Digital Currency Exchange Provider, offering fast and secure transactions with advanced crypto trading tools catering to both novice and experienced traders. The Australian Treasury’s March 2025 white paper announced an ambitious whole-of-government approach to regulating and integrating digital assets into the broader economy, embracing tokenization, real-world assets, and central bank digital currencies as part of broader financial system modernization. Pilot trials using tokenized money including stablecoins to settle transactions in wholesale tokenized markets demonstrate government commitment to blockchain infrastructure development, with markets for tokenized assets expected to increase automation, reduce settlement risk, and provide broader access to traditionally illiquid assets.

Browse the full report with TOC and list of figures: https://www.imarcgroup.com/australia-blockchain-market

Market Segmentation

Component Insights:

• Platforms

• Services (Professional Services, Managed Services)

Provider Insights:

• Application Provider

• Infrastructure Provider

• Middleware Provider

Type Insights:

• Public

• Private

• Hybrid

• Consortium

Deployment Mode Insights:

• On-Premises

• Cloud

• Hybrid

Organization Size Insights:

• SMEs

• Large Enterprises

Vertical Insights:

• Transportation and Logistics

• Agriculture and Food

• Manufacturing

• Energy and Utilities

• Healthcare and Life Sciences

• Media, Advertising, and Entertainment

• Banking and Financial Services

• Insurance

• IT and Telecom

• Retail and Ecommerce

• Government

• Real Estate and Construction

• Others

Regional Insights:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Key Players

Major multinational technology corporations compete alongside domestic innovators and specialized blockchain startups across enterprise solutions, financial services platforms, and infrastructure providers with ongoing technological innovation and strategic government partnerships.

Recent Developments & News

• January 2025: CSIRO’s Data61 announced breakthrough in quantum-resistant blockchain protocols positioning Australia at the forefront of next-generation cryptographic security, developing technologies to protect blockchain infrastructure against emerging quantum computing threats while maintaining distributed ledger functionality.

• January 2025: Research published in Financial Innovation examined the intersection of blockchain technology and crowdfunding through analysis of 219 publications, demonstrating blockchain’s role in transforming capital raising through enhanced transparency mechanisms and democratized investment access.

• October 2025: ETNCrypto, an Australian-registered blockchain technology firm, unveiled its High-Efficiency Hashrate Leasing Bitcoin Mining Contract, marking advancement in automated and smart cryptocurrency mining operations with enhanced energy efficiency and resource optimization.

• May 2025: KPMG Australia announced the separation of its blockchain-based track-and-trace compliance platform, KPMG Origins, into an independent startup named OriginsNext. The platform serves construction, agriculture, and waste management industries, demonstrating blockchain’s practical supply chain transparency applications.

• April 2025: WhiteBIT, Europe’s largest cryptocurrency exchange by traffic, officially launched its platform in Australia after securing AUSTRAC registration as a Digital Currency Exchange Provider, offering fast and secure transactions with advanced crypto trading tools addressing growing demand among Australian digital asset owners.

• March 2025: The Australian Treasury published a comprehensive white paper announcing a whole-of-government approach to regulating and integrating digital assets, embracing tokenization, real-world assets, and central bank digital currencies while planning pilot trials using tokenized money including stablecoins for wholesale market settlement.

Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask an Analyst for Your Customized Sample Report: https://www.imarcgroup.com/request?type=report&id=34894&flag=C

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.