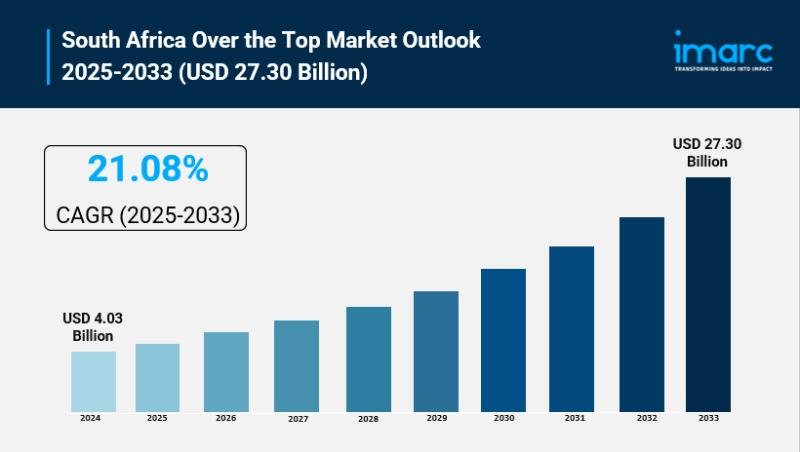

South Africa Over the Top Market Overview

Market Size in 2024: USD 4.03 Billion

Market Size in 2033: USD 27.30 Billion

Market Growth Rate 2025-2033: 21.08%

According to IMARC Group’s latest research publication, “South Africa Over the Top Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033”, the South Africa over the top (OTT) market size was valued at USD 4.03 Billion in 2024. The market is projected to reach USD 27.30 Billion by 2033, exhibiting a growth rate (CAGR) of 21.08% during 2025-2033.

How AI is Reshaping the Future of South Africa Over the Top Market:

● With hyper-personalization embedded at the heart of major players like Showmax and Netflix, AI helps provide viewers with suggestions based on what they have watched and their preferences, keeping them watching longer when competition is fierce in the streaming services market.

● For instance, local OTT players like Showmax are using AI to effectively translate and dub subtitles into local languages like Swahili and Nigerian languages, and thereby expanding even further the reach of global and pan-African content.

● The National AI Plan of the South African Government, with the assistance of the AI Institute of South Africa (AIISA), can indirectly contribute to better content delivery and OTT services because of improved digital infrastructure and skillsets leading to improved AI systems.

● Demands from South Africa’s internet and digital media workloads drive AI data center growth, especially for the rapid expansion of real-time OTT streaming personalization and generative AI that create engaging video content for end users.

● Machine learning has also been used to aid content moderation, optimize bandwidth, and improve the user experience. Applications in these areas have helped the growth of the OTT market in South Africa with increased subscribers and on-demand video views.

Grab a sample PDF of this report: https://www.imarcgroup.com/south-africa-over-the-top-market/requestsample

Market Growth Factors

The continued growth of the internet and mobile infrastructure continues to be the largest catalyst for the growth of South Africa’s OTT market. Improved access to broadband, and the continued roll out of faster broadband network infrastructure, such as 5G, has enabled content streaming in urban and rural areas. Most consumers prefer the availability of video and audio content on demand over the Internet, supporting a variety of viewing and listening habits, devices ranging from smartphones to smart televisions, and the bypassing of linear broadcasting’s constraints. As a result, providers, foreign and domestic, are investing in improved services and expansion. Partnerships with telecommunications companies have also increased the availability of bundled data for streaming, making such services attractive for consumers to use.

This is reflected in the growth of OTT services in South Africa, helped by lower-priced smartphones and a growing user base of technically-skilled consumers, particularly in the younger generations, that demand localized OTT content on mobile devices. Slow speeds have led streamers to consider implementing mobile-optimized user interfaces and offline download options. Viewers who eschew appointment viewing and lean toward on-demand programming have spurred growing demand for such a service that fits their busy lives. In the domestic and international spaces, the competition with other streamers drives improvement in the UI and recommendations, while the nature of digital media lends itself to regular home use.

Growing demand for localized and varied offerings has prompted the South African OTT industry to develop rapidly. Original African stories, series, films and shows attract audiences as they reflect the viewers’ cultural context and languages. This local focus allows OTT platforms to differentiate from global counterparts, and forge collaborations between producers, telcos, and streaming firms, leading to improved production values and distribution efficiency. Consumers perceive the combination of international hits and local programming as offering inclusivity and relevance, and while providing some sustainability for the market, it is also considered a developing area of growth.

Ask Analyst for Sample Report: https://www.imarcgroup.com/request?type=report&id=42230&flag=C

Market Segmentation

Component:

● Solution

● Services

Platform Type:

● Smartphones

● Smart TV’s

● Laptops, Desktops, and Tablets

● Gaming Consoles

● Set-Top Boxes

● Others

Deployment Type:

● Cloud

● On-Premise

Content Type:

● Voice Over IP

● Text and Images

● Video

● Others

Revenue Model:

● Subscription

● Procurement

● Rental

● Others

Service Type:

● Consulting

● Installation and Maintenance

● Training and Support

● Managed Services

Vertical:

● Media and Entertainment

● Education and Training

● Health and Fitness

● IT and Telecom

● E-Commerce

● BFSI

● Government

● Others

Region:

● Gauteng

● KwaZulu-Natal

● Western Cape

● Mpumalanga

● Eastern Cape

● Others

Recent Development & News

● February 2026: Following its acquisition of MultiChoice, Canal+ is considering launching its own streaming app for South African MultiChoice subscribers, to replace Showmax, which the company considers a money loser, as part of a larger drive to optimize operations and offer better content.

● January 2026: South African telecommunications operators, through the Association of Communications and Technology (ACT), demand that OTT services like Netflix and YouTube contribute to infrastructure, as they use high bandwidth without contributing to broadband rollout costs.

● January 2026: In addition to linear TV and premium OTT, FAST (Free Ad-Supported Streaming Television) emerges in the OTT field in South Africa, providing greater targeting, data collection, and monetization opportunities than linear TV as part of a hybrid OTT-broadcasting model emerging in Africa.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

This release was published on openPR.