The 3D Printed Electronics market reached US$ 9.35 billion in 2023 and is expected to reach US$ 28.07 billion by 2031, growing at a CAGR of 14.73% during the forecast period 2024-2031. Market growth is driven by rising demand for efficient, lightweight, and customizable electronic components across consumer electronics, automotive, aerospace, and industrial applications. 3D-printed electronics enable the direct fabrication of complex circuitry onto substrates, reducing material waste, production time, and enabling rapid prototyping.

Strong momentum is coming from increased R&D in advanced conductive materials and printing techniques, along with regulatory standards that ensure quality and environmental compliance. Asia-Pacific is the fastest-growing region, led by China, Japan, and South Korea, where automotive and electronics sectors are leveraging 3D printing for rapid prototyping and mass customization. Technological investments in the region, projected to exceed US$ 1.5 trillion annually by 2025, are further supporting adoption and positioning Asia-Pacific as a market leader, while North America and Europe continue steady growth driven by innovation and industrial applications.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/3d-printed-electronics-market?sai-v

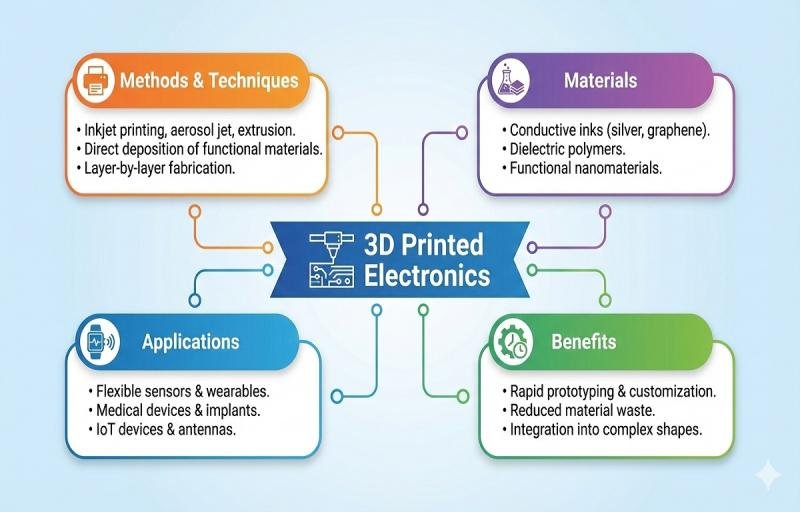

The 3D Printed Electronics market refers to the sector of technologies and solutions that use 3D printing to manufacture electronic components and devices, enabling rapid prototyping, complex designs, and customized circuitry.

Key Developments

✅ January 2026: In North America, adoption of 3D printed electronics accelerated across aerospace, defense, and consumer electronics sectors as companies such as 3D Systems, Optomec, Nano Dimension, and GE Additive deployed additive manufacturing platforms capable of printing conductive traces, antennas, and sensors, improving design flexibility and reducing prototype‐to‐production timelines.

✅ January 2026: In Europe, industrial and automotive manufacturers including Siemens, Volkswagen Group, Bosch, and Fraunhofer IGD expanded R&D in 3D printable electronic structures and hybrid additive processes to integrate printed circuits directly into structural components and smart surfaces.

✅ December 2025: In Asia‐Pacific, rapid innovation in consumer devices and IoT accelerated use of 3D printed electronics technologies by Huawei, Samsung Electronics, Toshiba Machine, and LG Electronics, focusing on compact sensor integration, flexible circuits, and embedded antennas for wearable and mobile products.

✅ December 2025: Globally, integration of advanced materials-such as conductive inks, functional polymers, and nanomaterials-with multi‐material additive systems improved electrical performance and device reliability, supported by partnerships between DuPont Electronics, Henkel AG, Conductive Compounds Inc., and materials research institutions.

✅ November 2025: In Latin America, adoption of 3D printed electronics grew in industrial prototyping and educational sectors, with companies like NanoLab Technologies, Tecnológico de Monterrey research labs, UFABC 3D Electronics Consortium, and regional startups promoting accessible additive electronics platforms.

✅ October 2025: Worldwide, emphasis on printable energy solutions such as embedded batteries, printed sensors, and energy‐harvesting components advanced multi‐function 3D printed electronic assemblies, with contributions from MIT Lincoln Laboratory, University of Nottingham Additive Manufacturing, and industry consortia improving integration of power systems with printed circuits.

Mergers & Acquisitions

✅ January 2026: Nano Dimension Ltd. acquired PrintCircuit Solutions, a developer of advanced 3D printed PCB and embedded electronics platforms, to broaden its additive electronics portfolio and accelerate industrial adoption.

✅ December 2025: Optomec, Inc. acquired Conductive3D Materials, a specialist in high‐performance conductive pastes and ink formulations, to strengthen its materials ecosystem and improve electronic printing performance.

✅ November 2025: 3D Systems Corp. acquired MultiMat PrintTech, a provider of multi‐material additive electronics systems and software, to expand its capabilities in integrated electronic and mechanical component printing.

Key Players

LG Chem | HP Development Company, L.P. | DuPont | Molex, LLC | Nissha Co., Ltd. | BASF | Nova Centrix | E Ink Holdings | The Cubbison Company | Pasternack Enterprises Inc. | Others

Key Highlights

LG Chem holds 20% market share, driven by its strong portfolio in advanced materials, conductive polymers, and flexible electronics components for display and printed electronics applications.

DuPont accounts for 17% market share, supported by its high-performance polymers, conductive inks, and material science innovations widely adopted across electronics and industrial applications.

HP Development Company, L.P. represents 15% market share, leveraging its expertise in printing technologies, flexible displays, and integration of advanced materials into commercial devices.

Molex, LLC holds 12% market share, driven by its specialty interconnect solutions, electronic components, and strong presence in printed and flexible electronic markets.

E Ink Holdings captures 10% market share, supported by its electrophoretic display technology, e-paper solutions, and partnerships across consumer electronics and industrial applications.

BASF accounts for 8% market share, benefiting from its portfolio of specialty coatings, functional materials, and conductive additives used in flexible electronics.

Nissha Co., Ltd. holds 6% market share, driven by its precision printing, films, and functional electronic components for displays and sensor applications.

Nova Centrix represents 5% market share, supported by its advanced sintering equipment and material processing solutions for printed electronics manufacturing.

The Cubbison Company and Pasternack Enterprises Inc. together account for 5% market share, focusing on niche electronic components, specialty materials, and industrial solutions.

Other players collectively hold 2% market share, comprising emerging material providers, regional manufacturers, and innovative startups in printed and flexible electronics.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=3d-printed-electronics-market?sai-v

(Single User Report: USD 4350 & One Year Database Subscription: USD 12K)

Market Drivers

– Growing demand for miniaturized, lightweight, and highly integrated electronic components driving adoption of 3D printed electronics in consumer electronics, automotive, aerospace, and medical devices.

– Rising need for rapid prototyping and customized manufacturing solutions enabling faster product development cycles and reduced time‐to‐market.

– Advancements in additive manufacturing technologies, conductive inks, and multi‐material printing enhancing the performance and reliability of 3D printed electronic components.

– Increasing focus on flexible, wearable, and IoT devices requiring unique form factors and embedded electronics that traditional manufacturing cannot easily achieve.

– Expansion of Industry 4.0 initiatives and smart factory implementations supporting adoption of digital manufacturing, automation, and integrated 3D printing workflows.

Industry Developments

– Integration of advanced materials, such as conductive polymers, metallic nanoparticle inks, and hybrid composites, to enhance electrical performance and mechanical stability.

– Emergence of multi‐material and multi‐axis 3D printing systems capable of simultaneously depositing structural and functional (conductive) materials.

– Strategic collaborations between additive manufacturing firms, electronics manufacturers, and research institutions to accelerate technology adoption and standardization.

– Development of scalable production‐grade 3D printed electronics solutions for high‐volume manufacturing, including antennas, sensors, and circuit boards.

Introduction of AI‐driven process control, real‐time monitoring, and simulation tools to optimize print quality, yield, and repeatability.

Regional Insights

North America – 42% share: “Driven by strong R&D investment, early adoption of additive manufacturing, presence of advanced electronics OEMs, and supportive industry‐academic partnerships.”

Europe – 27% share: “Supported by established manufacturing sectors, growing automotive and aerospace electronics demand, and focus on advanced production technologies.”

Asia Pacific – 24% share: “Fueled by rapid electronics industry growth, expanding IoT and consumer device markets, and increased investment in digital manufacturing infrastructure.”

Latin America – 5% share: “Driven by growing interest in additive manufacturing, expanding prototype and industrial applications, and emerging digital production hubs.”

Middle East & Africa – 2% share: “Supported by nascent additive manufacturing initiatives, rising technology adoption, and investments in industrial diversification.”

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/3d-printed-electronics-market?sai-v

Key Segments

By Technology

Inkjet printing holds a leading position due to its high precision, low material waste, and compatibility with a wide range of conductive inks. Aerosol jet printing is gaining traction for its ability to print fine features on complex and non-planar surfaces. Screen printing remains relevant for high-volume production and cost-effective fabrication, while other technologies such as extrusion-based and gravure printing address specialized and emerging use cases.

By Type

Conductive inks account for the largest share, driven by their extensive use in creating circuits, antennas, and interconnects. Dielectric inks are widely adopted for insulation and multilayer structures, whereas semiconductor inks are increasingly used in advanced electronic components. Substrates and other materials support structural integrity and flexibility in printed electronic designs.

By Application

Consumer electronics dominate the application landscape, supported by rising demand for lightweight, compact, and flexible devices. Automotive applications are expanding with the integration of printed sensors, lighting, and interior electronics. Healthcare is a fast-growing segment, leveraging 3D printed electronics for wearable devices, medical sensors, and diagnostics. Aerospace & defense, industrial electronics, and energy applications continue to grow as manufacturers seek rapid prototyping and design customization.

By End-User

Original equipment manufacturers represent the largest end-user segment, utilizing 3D printed electronics for product innovation and faster time-to-market. Research institutes and academic organizations drive technology development and material innovation. Contract manufacturers and other end-users adopt these solutions to reduce production costs, enable customization, and support small-batch or complex electronic manufacturing.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us –

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us –

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.