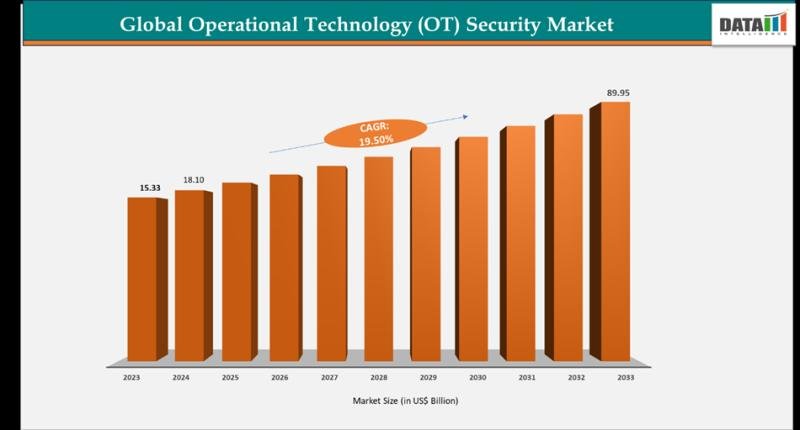

The Global Operational Technology (OT) security market reached USD 15.33 billion in 2023, with a rise to USD 18.10 billion in 2024, and is expected to reach USD 89.95 billion by 2033, growing at a CAGR of 19.50% during the forecast period 2025-2033.

Market growth is driven by escalating cyberattacks on industrial infrastructure, rising digitization of manufacturing and utilities, and stringent regulatory mandates for cybersecurity. Advancements in AI-powered threat detection, integration of OT with IT systems (convergence), growing adoption of zero-trust architectures, and surging investments in critical infrastructure protection are further accelerating market expansion.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/operational-technology-ot-security-market?ram

Key Industry Developments

United States:

✅ January 2026: Dragos launched OT Security Platform 5.0, introducing AI-driven anomaly detection tailored for AgTech irrigation systems, enhancing real-time threat response and EPA-compliant data logging for precision agriculture operations.

✅ November 2025: Fortinet released FortiGate OT Rugged 601F, a hardened firewall for food processing plants, featuring AgTech-specific protocols like Modbus and CIP for intrusion prevention.

✅ October 2025: Censys introduced ICS/OT Internet Intelligence, scanning exposed AgTech assets nationwide for EPA/USDA regulatory audits.

Asia Pacific / Japan:

✅ January 2026: NEC Corporation unveiled OT Shield AI for Japanese manufacturing, incorporating AgTech modules for greenhouse automation security with METI-approved encryption standards.

✅ December 2025: Mitsubishi Electric launched MELSEC iQ-R OT Security Gateway in Japan, focusing on AgTech robotics with built-in anomaly detection for livestock monitoring.

✅ November 2025: Trend Micro expanded its TippingPoint OT Security for Asia Pacific utilities, adding AgTech firmware analysis amid regional ICS advisories.

Key Players:

Siemens | Cisco Systems | Fortinet | Palo Alto Networks | Zscaler | SentinelOne | Kyndryl

Strategic Leadership Report: Top 5 Players in Operational Technology (OT) Security Market 2026

-Siemens AG: Launched SINEC Secure Connect platform with Zero Trust security for industrial OT networks, enabling secure remote access and unified management of communication connections to protect critical infrastructure from evolving cyber threats.

-Cisco Systems: Enhanced Cyber Vision platform with advanced OT visibility and SecureX integrations, providing real-time threat detection across IT/OT convergence and zero-trust segmentation to mitigate lateral movement in industrial environments.

-Fortinet: Expanded FortiGate OT security solutions with purpose-built firewalls for ICS protocols, delivering deep packet inspection and automated threat response tailored for manufacturing and utility OT systems.

-Palo Alto Networks: Advanced Next-Generation Firewalls with OT-specific IoT Security features, offering granular policy enforcement and AI-driven anomaly detection to secure legacy OT devices without disrupting operations.

-SentinelOne: Deployed Singularity Platform for OT endpoints with autonomous AI-powered protection, featuring behavior-based detection and ransomware rollback capabilities designed for industrial control systems and SCADA environments.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=operational-technology-ot-security-market?ram

Regional Insights:

-North America: 37.7% (Largest share, driven by advanced industrial infrastructure, strict regulatory compliance, and significant cybersecurity investments).

-Asia Pacific: 29.8% (Fastest growing, fueled by rapid industrialization, Industrial IoT adoption, and rising cyber threats in China, India, and Japan).

-Europe: 24.2% (Supported by directives like NIS2, digital reforms, and steady investments in energy and manufacturing sectors).

-LAMEA: 8.3% (Emerging growth from infrastructure development, digitized processes, and regulatory policies in energy and utilities).

Key Growth Drivers:

-Rising cyber threats targeting industrial control systems and critical infrastructure, prompting urgent adoption of protective measures.

-Rapid digitalization and Industry 4.0 initiatives, including IIoT integration, which expand attack surfaces and demand advanced security.

-Convergence of IT and OT networks, creating vulnerabilities that require unified cybersecurity frameworks.

-Stringent government regulations and compliance mandates for sectors like energy, manufacturing, and utilities.

-Increasing adoption of cloud-based solutions, AI-driven threat detection, and smart automation in emerging industrial hubs.

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/operational-technology-ot-security-market?ram

Market Segmentation Analysis:

-By Offering: Solutions Lead with Robust Protection Tools

Solutions dominate at 72% market share in 2024, encompassing network security for traffic monitoring, endpoint security against device threats, application security for software vulnerabilities, IAM for controlled access, encryption for data safeguarding, and threat intelligence for predictive analytics-critical for OT threat mitigation. Services follow at 28%, including managed services for ongoing monitoring and professional services like consulting, integration, deployment, training, and support to optimize implementations.

-By Deployment: On-Premises Holds Majority for Legacy Systems

On-premises deployment claims 58% share, preferred in industrial settings for data sovereignty, customization, and integration with legacy OT infrastructure like SCADA and PLCs. Cloud-based takes 42%, rising fast for scalability, remote access, and AI-driven threat detection in modern hybrid environments.

-By Organization Size: Large Enterprises Command Scale

Large enterprises lead with 68% share, investing heavily in comprehensive OT security amid regulatory pressures and cyber risks in critical operations. SMEs capture 32%, increasingly adopting affordable cloud solutions to protect growing digital footprints.

-By End-User: Manufacturing Tops Due to Cyber Vulnerabilities

Manufacturing holds 25% share, driven by Industry 4.0 connectivity exposing PLCs to ransomware. Energy & Utilities follow at 20%, prioritizing grid protection; Oil & Gas at 15% for remote asset security; Transportation & Logistics at 12%; Government at 10%; Healthcare at 8%; Others at 10%. Manufacturing has the highest market share.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription?ram

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTW

Contact Us –

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us –

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.