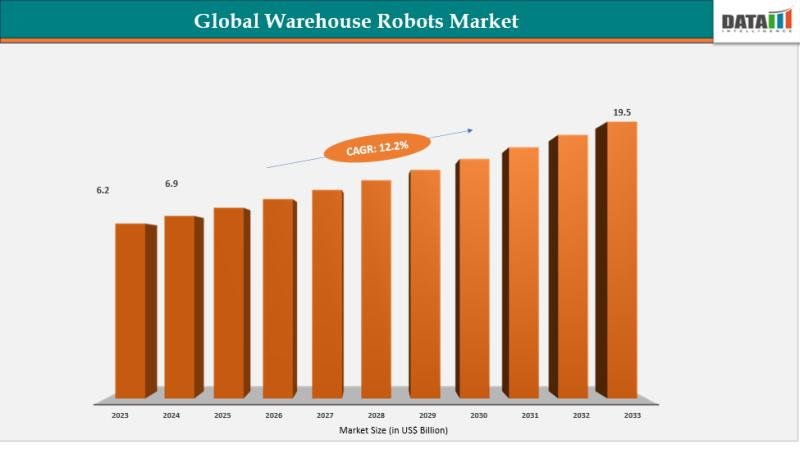

The Global Warehouse Robots Market reached USD 6.2 billion in 2023, with a rise to USD 6.9 billion in 2024, and is expected to reach USD 19.5 billion by 2033, growing at a CAGR of 12.2% during the forecast period 2025-2033.

Market growth is driven by the surge in e-commerce demand, labor shortages in logistics, and the need for operational efficiency in supply chains. Advancements in AI, machine learning, and autonomous navigation technologies, along with expanding adoption in sectors like retail, pharmaceuticals, and food & beverage, are further accelerating market expansion.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/warehouse-robotics-market?ram

Key Industry Developments

United States:

✅ January 2026: Amazon deployed its Blue Jay AI-powered picking robot across major U.S. fulfillment centers, enhancing order processing speed by 30% through advanced vision systems and real-time inventory tracking to meet surging e-commerce demands amid labor shortages.

✅ December 2025: LG Business Solutions USA launched energy-efficient autonomous mobile robots (AMRs) at the MODEX trade show, featuring EPA-compliant low-emission designs for sustainable warehouse operations and scalable integration with existing systems.

✅ October 2025: Geekplus unveiled the Robot Arm Picking Station in U.S. pilot warehouses, incorporating adaptive grippers for mixed-SKU handling and USDA-aligned hygiene standards to support food/agri logistics efficiency.

Asia Pacific / Japan:

✅ January 2026: Geekplus expanded its Robot Arm Picking Station deployment in Japanese warehouses, optimizing AgTech applications for controlled environment agriculture storage with precision picking up to 80 items per hour.

✅ November 2025: Dyna Robotics, backed by Japanese investors, introduced AI-driven manipulation systems post-Series B funding, focusing on resilient supply chains and regulatory-compliant automation for APAC e-commerce hubs.

✅ October 2025: Kao Corporation piloted warehouse cobots integrated with green tech, securing Japanese government subsidies for energy-efficient robots that align with sustainability mandates and boost picking accuracy in high-volume facilities.

Strategic Mergers and Acquisitions:

✅ Symbotic solidified its leadership in warehouse automation by acquiring Walmart’s Advanced Systems and Robotics division for $200 million in January 2025, enhancing AI-driven robotic systems for large-scale fulfillment operations.

Key Players:

ABB Group | KUKA AG | FANUC Corporation | Yaskawa Electric Corporation | Honeywell International Inc. | Omron Corporation | Toyota Material Handling Solutions | Daifuku Co., Ltd. | KION GROUP AG | Geekplus Technology Co., Ltd.

Strategic Leadership Report: Top 5 Players in Warehouse Robots Market 2026

-FANUC Corporation: Deployed the CRX collaborative robot series with advanced palletizing and depalletizing capabilities for high-speed warehouse operations, enabling seamless integration with warehouse management systems to boost throughput and flexibility in dynamic fulfillment centers.

-KUKA AG: Advanced the KMP 600 mobile platform with autonomous navigation and modular payload options for heavy-duty material transport, delivering enhanced order picking efficiency and real-time adaptability in e-commerce and automotive logistics warehouses.

-Yaskawa Electric Corporation: Expanded the MOTOMAN GP series with integrated vision systems for precise sorting and piece picking, supporting high-volume order fulfillment through AI-driven path optimization and reduced cycle times in large-scale distribution facilities.

-Daifuku Co., Ltd.: Strengthened the ELS-AMR autonomous mobile robot fleet with multi-level storage and retrieval features, optimizing space utilization and scalability for vertical warehousing amid surging demand for automated goods-to-person systems.

-Geekplus Technology Co., Ltd.: Upgraded the Roboworks sorting robots with deep learning-based anomaly detection for ultra-high-speed parcel handling, enhancing peak-season performance and error-free operations in hyper-scale logistics networks.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=warehouse-robotics-market?ram

Regional Insights:

-Asia Pacific: 39.52% (Largest share, driven by aggressive exports from Chinese manufacturers and rising wages).

-North America: 25% (Strong growth fueled by e-commerce leaders like Amazon and warehouse automation demand).

-Europe: 20% (Supported by steady investments in logistics and industrial robotics adoption).

Key Growth Drivers:

-E-commerce surge demands fast order fulfillment, with giants like Amazon deploying robots for picking, packing, and same-day delivery.

-Labor shortages and rising costs push adoption of autonomous mobile robots (AMRs) and collaborative robots for inventory tasks.

-Need to optimize warehouse space, throughput, and costs through high-density storage and error reduction via robotics.

-Advancements in AMRs, cobots, and AI integration enable scalable, modular automation for 3PLs and emerging markets.

-Expansion of third-party logistics (3PL) and Industry 4.0 drives robotics investments for precision handling and continuous operations.

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/warehouse-robotics-market?ram

Market Segmentation Analysis:

-By Robot Type: AMRs Lead with Flexibility Edge

Autonomous Mobile Robots (AMRs) dominate at 35% share in 2024, prized for navigation adaptability and scalability in dynamic warehouses without fixed paths.

Automated Guided Vehicles (AGVs) follow at 25%, reliable for high-volume transport on predefined routes.

Collaborative Robots claim 15%, Articulated Robots 10%, Cylindrical Robots 8%, and Others 7%, with articulated excelling in precision tasks but higher complexity.

-By Function: Transportation Tops for Efficiency Gains

Transportation holds 40% share, streamlining goods movement to cut labor and time in large facilities.

Picking & Placing takes 25%, automating order fulfillment accuracy.

Palletizing & Depalletizing and Sorting & Packaging split 20% and 15%, boosting throughput in end-stage operations.

-By Payload Capacity: Up-to 20 Kg Prevails in Light Loads

Up-to 20 Kg leads at 30% share, ideal for small-item handling in e-commerce.

21-100 Kg follows at 28%, 101-200 Kg at 22%, and More than 200 Kg at 20%, with heavier capacities suiting bulky goods in automotive.

-By End-use Industry: Retail & E-Commerce Drives Volume Surge

Retail & E-Commerce commands 25% share, fueled by online order explosions demanding fast fulfillment.

Food & Beverage holds 20%, Automotive 18%, Semiconductors & Electronics 15%, Pharmaceuticals 12%, Chemicals 5%, and Others 5%, with pharma prioritizing hygiene automation.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription?ram

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTW

Contact Us –

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us –

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.