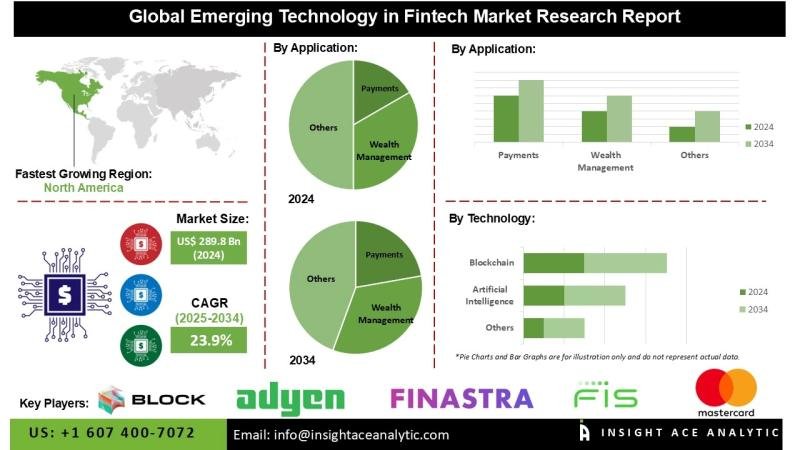

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the “Global Emerging Technology in Fintech Market Size, Share & Trends Analysis Report Technology (Artificial Intelligence, Blockchain, Cloud & Edge Computing, Quantum Computing), Application (Lending, Payments, Wealth Management, Insurance)-Market Outlook And Industry Analysis 2034”

Global Emerging Technology in Fintech Market Size is valued at US$ 289.8 Bn in 2024 and is predicted to reach US$ 2,369.8 Bn by the year 2034 at an 23.9% CAGR during the forecast period for 2025-2034.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/3198

Emerging technologies in the fintech sector are driving significant transformation within financial services by integrating advanced digital solutions, including artificial intelligence (AI), blockchain, open banking frameworks, biometric authentication, and cloud-based platforms. These innovations are enhancing operational efficiency, security, personalization, and accessibility across banking, payments, investment management, and regulatory compliance functions. Market adoption is further supported by initiatives aimed at promoting financial inclusion, particularly among underserved and low-income populations.

AI-enabled credit scoring, blockchain-based payment networks, and mobile banking applications are expanding access to secure and reliable financial services for unbanked and underbanked consumers. The widespread proliferation of smartphones, combined with regulatory frameworks such as open banking mandates in Europe and digital payment policies in Asia, is accelerating market growth. Furthermore, fintech companies are increasingly leveraging cloud computing and API-driven ecosystems to reduce transaction costs, extend market reach, and promote financial democratization, thereby bridging gaps in traditional banking infrastructure and supporting broader economic participation.

List of Prominent Players in the Emerging Technology in Fintech Market:

• PayPal

• Block, Inc.

• Stripe, Inc.

• Ant Group CO., Ltd.

• FIS

• Adyen

• Finastra

• Mastercard

• Revolut Ltd

• Robinhood

• Goldman Sachs

• N26 SE

• Zelle

• Visa

• Chime Financial, Inc.

Read Overview Report- https://www.insightaceanalytic.com/report/emerging-technology-in-fintech-market/3198

Market Dynamics

Drivers:

The emerging technology segment of the fintech market is experiencing robust growth, driven by the rapid adoption of artificial intelligence (AI), blockchain, digital identity solutions, and cloud-native financial platforms. These technologies collectively enhance operational efficiency, strengthen fraud prevention, and improve customer experience. Market expansion is further reinforced by supportive regulatory environments across multiple regions, including innovation sandboxes, open banking directives, and progressive digital finance policies that promote technological advancement while safeguarding consumer interests.

Government and regulatory initiatives aimed at advancing digital transformation in payments, lending, and wealth management enable both startups and established financial institutions to scale efficiently. Such regulatory support fosters market confidence, attracts investment, and accelerates the adoption of next-generation fintech solutions.

Challenges:

Market growth is tempered by the significant costs and complexities associated with implementing advanced technologies, such as AI-driven analytics, blockchain networks, digital identity platforms, and real-time payment systems. Many financial institutions continue to operate on legacy infrastructures, and transitioning to modern solutions often requires extensive system upgrades, reconfigurations, and workforce training.

These requirements involve considerable capital expenditure and operational risk, particularly during integration. Smaller banks, credit unions, and emerging fintech firms may encounter adoption barriers due to these financial and technical challenges, resulting in uneven market penetration.

Regional Trends:

In North America, the fintech sector is expanding rapidly, supported by widespread digital transformation and the integration of advanced technologies, including AI, blockchain, and cloud computing. Financial institutions leverage AI for fraud detection, credit scoring, and personalized financial services, enhancing security and user experience.

Blockchain applications are increasingly employed for secure and transparent transactions, including decentralized finance (DeFi) initiatives, while cloud-based platforms provide scalable, cost-efficient infrastructure for both banks and fintech startups. The growing prevalence of real-time payments, mobile banking, and embedded finance solutions, combined with supportive regulatory frameworks and substantial venture capital investment, reinforces North America’s status as a leading fintech hub.

In Europe, market expansion is similarly driven by rapid digital adoption, regulatory initiatives, and the increasing use of digital financial services. The European Union’s open banking framework (PSD2) fosters competition and innovation by enabling secure data sharing among banks, fintech companies, and third-party providers. Advancements in AI, blockchain, and digital identity solutions improve operational efficiency, enhance fraud prevention, and elevate customer engagement. Additionally, central bank initiatives on digital currencies and growing demand for cashless transactions-spurred by e-commerce and mobile banking adoption-further support the region’s fintech growth trajectory.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customization/3198

Recent Developments:

• January 2025: Adyen unveiled an AI-powered payment suite aimed at optimizing transaction processes, leveraging artificial intelligence to enhance payment efficiency and security for merchants.

• February 2025: FIS introduced its recent Revenue Insight solution, designed to transform accounts receivable management and optimize collections for businesses via cutting-edge analytics and automation.

Segmentation of Emerging Technology in Fintech Market-

By Application-

• Lending

• Payments

• Wealth Management

• Insurance

• Others

By Technology-

• Artificial Intelligence

• Blockchain

• Cloud and Edge Computing

• Cybersecurity

• Quantum Computing

• Others

By Region-

North America-

• The US

• Canada

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Mexico

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: https://www.insightaceanalytic.com/

Tel : +1 607 400-7072

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.