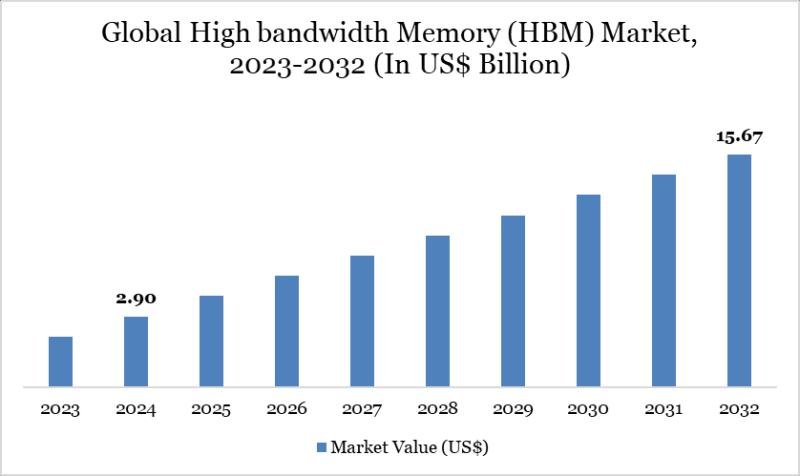

According to DataM Intelligence, the global High Bandwidth Memory (HBM) market reached US$ 2.90 billion in 2024 and is expected to reach US$ 15.67 billion by 2032, growing at a CAGR of 23.63% during 2025-2032. Growth is driven by surging demand for AI accelerators, high-performance computing (HPC), data centers, and advanced GPUs/CPUs, alongside rapid advancements in HBM3E and emerging HBM4 technologies offering higher bandwidth, density, and power efficiency.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID): https://www.datamintelligence.com/download-sample/high-bandwidth-memory-hbm-market?jd

North America Key Industry Developments

✅ January 2026: Continued focus on HBM4 transition, with expectations of doubled bandwidth enabling trillion-parameter AI models.

✅ December 2025: Micron Technology, Inc. reported record Q1 FY2026 results with revenue up 57% YoY, confirming entire HBM production capacity sold out through 2026, including HBM4, amid tight supply and pricing power.

✅ December 2025: Industry reports highlighted HBM supply constraints persisting, with Micron accelerating fab timelines and raising CapEx to $20 billion for FY2026 to address AI-driven demand.

Asia-Pacific Key Industry Developments

✅ January 2026: SK hynix emphasized HBM3E dominance in 2026 while ramping HBM4, with new fab advancements and paid HBM4 samples delivered to key clients.

✅ December 2025: Samsung Electronics and SK hynix accelerated HBM4 mass production schedules to February 2026, responding to NVIDIA demand and planning significant capacity expansions (up to 50% for Samsung).

✅ December 2025: Samsung displayed HBM4 at Korea Tech Festival and reported customer praise for its competitiveness, positioning for major supply deals.

Key Mergers and Acquisitions

✅ Strategic Partnerships: Intensified collaborations between memory suppliers (Samsung, SK hynix, Micron) and AI leaders like NVIDIA for HBM4 qualification and volume commitments.

✅ Capacity Expansions: Major investments in new fabs and packaging lines, including SK hynix’s M15X facility acceleration for HBM4 production starting early 2026.

Purchase this report before year end and unlock an exclusive 30% discount:

https://www.datamintelligence.com/buy-now-page?report=high-bandwidth-memory-hbm-market

(Purchase 2 or more Reports and get 50% Discount)

Market Segmentation Analysis

By Type: HBM3E leads currently, with HBM4 emerging rapidly for next-gen AI; others include HBM, HBM2, HBM2E.

By Memory Capacity: Above 16GB dominates due to AI/HPC needs; segments include Up to 4GB, 4GB to 8GB, 8GB to 16GB.

By Application: Graphics Processing Units (GPUs) hold the largest share, followed by CPUs, FPGAs, ASICs, Networking and Data Centers, and Others.

By End-Users: IT & Telecommunication leads, with growth in Consumer Electronics, Automotive, Healthcare, Defense & Aerospace, and Others.

Regional Insights

Asia-Pacific drives the global High Bandwidth Memory (HBM) market as the largest hub for semiconductor manufacturing and advanced computing adoption, led by South Korea (Samsung, SK hynix) and supported by strong AI/HPC ecosystems. North America follows with high demand from hyperscalers and innovation in AI infrastructure.

Growth Drivers

1. Explosive demand for AI training/inference and HPC requiring massive bandwidth and low latency

2. Transition to advanced HBM3E and HBM4 technologies with higher capacity and efficiency

3. Supply constraints and sold-out capacities through 2026 boosting pricing and investment

4. Integration of HBM in next-gen GPUs/CPUs from NVIDIA, AMD, and others

5. Strategic expansions, sample deliveries, and mass production ramps by key Asian players

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/high-bandwidth-memory-hbm-market?jd

Key Players

The market includes leading companies such as Micron Technology, Inc., Advanced Micro Devices, Inc., Broadcom, Cadence Design Systems, Inc., Marvell, Huawei Technologies, Infineon Technologies AG, SK HYNIX INC., RM Holdings PLC ADR, Intel Corporation, Samsung Electronics, and others.

Key Highlights (Top 5 Key Players)

1. SK HYNIX INC. – Leading HBM market share with world-first HBM4 development complete and mass production acceleration to early 2026 for AI dominance.

2. Samsung Electronics – Resurging with HBM4 customer praise, capacity surge plans (50%+ in 2026), and advanced samples for NVIDIA and others.

3. Micron Technology, Inc. – Record revenues and sold-out HBM through 2026, with HBM4 on track and major CapEx increases for AI supply.

4. Advanced Micro Devices, Inc. (AMD) – Integrating HBM3E/HBM4 in Instinct accelerators for high-performance AI and HPC workloads.

5. Broadcom – Advancing custom HBM solutions and testing, supporting major AI accelerator platforms.

Unlock 360° Market Intelligence with DataM Intelligence Subscription Services:

https://www.datamintelligence.com/reports-subscription?jd

Power your decisions with real time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape Analysis

✅ Company Profile Analysis

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updates

✅ Live Market & Pricing Trends

✅ Regulatory and Supply Chain Analysis

Have a look at our Subscription Dashboard:

https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us –

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us –

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.