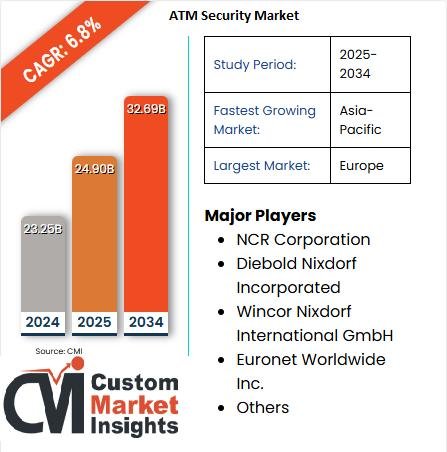

Global ATM Security MarketATM Security Market size is expected to grow substantially from 2025 to 2034, driven by rising global demand for secure financial transactions and increasing cases of ATM-related fraud.

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 6.8% during the forecast period, with the market size estimated at USD 24.90 Billion in 2025 and anticipated to reach USD 32.69 Billion by 2034.

➤ Request Free Sample PDF Report @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=61271

➤ Market Size

• The global ATM Security Market represents a significant segment of the banking and financial security industry.

• Market growth is driven by the increasing deployment of ATMs across urban and rural regions.

• Rising concerns related to ATM fraud, theft, and cyberattacks are strengthening market demand.

• Continuous investments by banks and financial institutions are supporting steady market expansion over the forecast period.

➤ Market Overview

• ATM security refers to a range of hardware, software, and surveillance solutions designed to protect automated teller machines from physical and cyber threats.

• These solutions include CCTV systems, alarm systems, biometric authentication, encryption software, and anti-skimming devices.

• The market serves banks, credit unions, independent ATM deployers, and financial service providers.

• Increasing digitization of banking services and rising ATM penetration globally have elevated the need for advanced security systems.

• Regulatory compliance and customer trust remain critical factors influencing market adoption.

➤ Key Market Growth Drivers

• Rising incidents of ATM fraud, card skimming, cash theft, and vandalism worldwide.

• Expansion of ATM networks in emerging economies and underserved regions.

• Increasing adoption of contactless banking and digital transaction security solutions.

• Stringent government regulations and compliance requirements for banking security.

• Growing awareness among financial institutions regarding customer data protection and transaction safety.

➤ Explore Full Report here: https://www.custommarketinsights.com/report/atm-security-market/

➤ Analysis of Key Players – Key Player Strategies

• Key players focus on developing integrated security solutions combining physical and digital protection.

• Continuous investment in research and development to introduce advanced authentication technologies.

• Strategic partnerships with banks and ATM manufacturers to expand product reach.

• Emphasis on AI-enabled surveillance, real-time monitoring, and predictive threat detection.

• Expansion into emerging markets to capitalize on growing ATM deployment.

➤ Market Challenges & Opportunities

➤ Challenges

• High installation and maintenance costs of advanced ATM security systems.

• Complex integration of new security technologies with legacy ATM infrastructure.

• Rapidly evolving cyber threats requiring frequent system upgrades.

• Operational challenges in remote or rural ATM locations.

➤ Opportunities

• Growing adoption of biometric authentication and multi-factor security solutions.

• Rising demand for AI-based monitoring and real-time fraud detection systems.

• Increasing focus on cloud-based ATM security software.

• Expansion of digital banking infrastructure in developing economies.

➤ Recent Developments

• Increasing deployment of AI-powered surveillance and fraud detection systems.

• Introduction of advanced anti-skimming and encryption technologies.

• Enhanced integration of biometric verification such as fingerprint and facial recognition.

• Growing adoption of remote monitoring and centralized security management platforms.

➤ Investment Landscape and ROI Outlook

• The ATM Security Market presents strong investment potential due to consistent demand from financial institutions.

• Investments in advanced software solutions offer higher long-term returns through reduced fraud losses.

• Public-private partnerships support large-scale ATM security infrastructure upgrades.

• Adoption of scalable and cloud-based systems improves operational efficiency and return on investment.

• Increasing regulatory pressure ensures sustained spending on security solutions.

➤ Download Full PDF Sample Copy of Market Report @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=61271

➤ Market Segmentations (With Region)

➤ By Component

• Hardware

• Software

• Services

➤ By Security Type

• Physical security

• Logical and cyber security

➤ By ATM Type

• Onsite ATMs

• Offsite ATMs

• Mobile ATMs

➤ By End User

• Banks

• Financial institutions

• Independent ATM deployers

➤ By Region

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East & Africa

➤ Why Buy This Report?

• Provides detailed insights into current and future market trends.

• Offers in-depth analysis of key players and competitive strategies.

• Helps identify growth opportunities and emerging technologies.

• Supports strategic decision-making for investors and stakeholders.

• Delivers comprehensive segmentation and regional analysis.

➤ FAQs

Q. What is ATM security and why is it important?

• ATM security includes physical and digital solutions designed to protect ATMs from fraud, theft, and cyber threats, ensuring secure transactions and customer trust.

Q. What factors are driving growth in the ATM Security Market?

• Rising ATM fraud incidents, expanding ATM networks, regulatory requirements, and technological advancements are key growth drivers.

Q. Which technologies are commonly used in ATM security systems?

• Technologies include CCTV surveillance, biometric authentication, encryption software, alarm systems, and AI-based monitoring tools.

Q. What challenges do ATM security providers face?

• High implementation costs, evolving cyber threats, and compatibility with older ATM systems are major challenges.

Q. Which regions show strong growth potential?

• Asia Pacific and emerging economies show strong growth due to expanding banking infrastructure and increasing ATM installations.

➤ More Related Reports by Custom Market Insights-

Global Accident Insurance Market 2025 – 2034

https://www.custommarketinsights.com/report/accident-insurance-market/

Global Insurance Agency Portal Market 2025 – 2034

https://www.custommarketinsights.com/report/insurance-agency-portal-market/

Global Sustainable Supply Chain Finance Market 2025 – 2034

https://www.custommarketinsights.com/report/sustainable-supply-chain-finance-market/

Global Letter Of Credit Confirmation Market 2025 – 2034

https://www.custommarketinsights.com/report/letter-of-credit-confirmation-market/

➤ Conclusion

The ATM Security Market continues to grow steadily as financial institutions prioritize fraud prevention and customer data protection. Increasing ATM deployments, rising cyber and physical threats, and strict regulatory frameworks are driving the adoption of advanced security solutions. Innovations such as biometric authentication, AI-enabled surveillance, and cloud-based monitoring systems are transforming market dynamics. While high implementation costs pose challenges, growing investments in digital banking infrastructure and emerging markets present significant opportunities. With continuous technological advancements and rising security awareness, the ATM Security Market is expected to remain a critical component of the global financial services ecosystem.

Contact Us:

Joel John

Custom Market Insights

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI is a one-stop solution for data collection and investment advice. Our company’s expert analysis digs out essential factors that help us understand the significance and impact of market dynamics. The professional experts advise clients on aspects such as strategies for future estimation, forecasting, opportunities to grow, and consumer surveys.

This release was published on openPR.