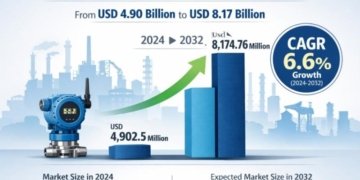

Global Doorstep Banking Market size was valued at USD 1,864.9 Million in 2025 and is expected to reach USD 5,188.9 Million by 2034 at a CAGR of 12.01% from 2025 – 2034.

Doorstep banking solutions are technology platforms deployed by banks and financial institutions to enable bank customers to carry out routine banking activities like delivery and pick-up of documents, financial services, digital life certificates for pensioners, etc., without the need to visit the bank branches.

➤ Request Free Sample PDF Report @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=61238

➤ Market Size

• The global Doorstep Banking Market was valued at USD 1,864.9 million in 2025.

• The market is projected to reach USD 5,188.9 million by 2034.

• The market is expected to grow at a CAGR of 12.01% from 2025 to 2034.

• Growth is driven by increasing demand for convenient, personalized, and accessible banking services.

➤ Market Overview

• Doorstep banking involves the delivery of banking and financial services directly at a customer’s residence or workplace.

• Services include cash delivery, cash pick-up, cheque collection, document delivery, account servicing, and non-financial support.

• This model improves customer convenience, reduces dependency on physical branches, and enhances service reach.

• Doorstep banking plays a crucial role in promoting financial inclusion, especially in remote and underserved regions.

• Integration of digital platforms, mobile applications, and secure authentication technologies is transforming service delivery.

➤ Key Market Growth Drivers

• Rising demand for customer-centric and convenience-based banking services.

• Government initiatives and regulatory frameworks promoting financial inclusion and digital banking adoption.

• Expansion of banking services into rural and semi-urban areas through agent-based service models.

• Increasing use of advanced technologies such as artificial intelligence, cloud computing, IoT, and mobile platforms.

• Improved transaction security, real-time tracking, and automated verification enhancing customer trust.

➤ Analysis of Key Players – Key Player Strategies

• Market participants include banking software providers, fintech companies, and technology solution vendors.

• Key players focus on strategic partnerships and collaborations with banks and financial institutions.

• Continuous investment in research and development to enhance platform security, scalability, and customization.

• Expansion into emerging markets to tap into unbanked and underbanked populations.

• Emphasis on modular and flexible solutions to support diverse banking requirements.

➤ Explore Full Report here: https://www.custommarketinsights.com/report/doorstep-banking-market/

➤ Market Challenges & Opportunities

➤ Challenges

• Data privacy and cybersecurity risks due to handling sensitive customer information.

• Regulatory compliance complexities across different regions increasing operational costs.

• Infrastructure limitations and shortage of skilled personnel in certain markets.

➤ Opportunities

• Strong government push toward universal banking access and digital financial services.

• Growing collaboration between banks and fintech companies to develop integrated service ecosystems.

• Adoption of analytics and AI for personalized customer experiences and operational efficiency.

➤ Recent Developments

• Strategic partnerships aimed at enhancing technology platforms for banking and wealth management services.

• Expansion of operational facilities by leading providers to strengthen regional presence and innovation capabilities.

• Increased focus on workforce expansion and talent acquisition to support digital transformation initiatives.

➤ Investment Landscape and ROI Outlook

• The market presents attractive investment opportunities due to rising demand for doorstep and digital banking solutions.

• Supportive regulatory environments and government initiatives strengthen long-term investment prospects.

• Recurring revenue models from software and service contracts improve return on investment.

• Cloud-based and scalable solutions help reduce infrastructure costs and improve profitability.

➤ Download Full PDF Sample Copy of Market Report @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=61238

➤ Market Segmentations (With Region)

➤ By Component

• Software

• Services

➤ By Deployment Model

• On-premise

• Cloud-based

➤ By Services

• Financial services such as cash delivery, deposits, and cheque services

• Non-financial services including document pick-up and delivery

➤ By Application

• Personal banking

• Business banking

➤ By End-User

• Banks

• Financial institutions

• Credit unions

➤ By Region

• North America

• Europe

• Asia Pacific

• Middle East & Africa

• Latin America

• North America holds the largest market share due to advanced banking infrastructure.

• Asia Pacific is the fastest-growing region driven by digital transformation and financial inclusion initiatives.

➤ Why Buy This Report?

• Offers comprehensive insights into market size, growth trends, and future outlook.

• Provides detailed analysis of competitive landscape and key player strategies.

• Covers extensive segmentation and regional analysis for strategic decision-making.

• Helps identify growth opportunities and potential risks in the evolving banking ecosystem.

• Supports investors, banks, and service providers in planning expansion and innovation strategies.

➤ FAQs

Q. What is doorstep banking?

• Doorstep banking refers to the delivery of banking and financial services directly to customers at their location, eliminating the need for branch visits.

Q. What factors are driving the growth of the Doorstep Banking Market?

• Increasing demand for convenience, government financial inclusion initiatives, and adoption of digital technologies are key growth drivers.

Q. Which region dominates the Doorstep Banking Market?

• North America dominates due to strong banking infrastructure and high adoption of digital banking solutions.

Q. What are the main challenges faced by the market?

• Data security concerns, regulatory compliance requirements, and infrastructure limitations pose challenges.

Q. Who are the primary end-users of doorstep banking services?

• Banks are the primary end-users, followed by financial institutions and credit unions.

➤ More Related Reports by Custom Market Insights-

Global Currency Sorter Market 2025 – 2034

https://www.custommarketinsights.com/report/currency-sorter-market/

European Embedded Finance Market 2025 – 2034

https://www.custommarketinsights.com/report/european-embedded-finance-market/

Global Core Banking Software Market 2025 – 2034

https://www.custommarketinsights.com/report/core-banking-software-market/

Global Final Expense Insurance Market 2025 – 2034

https://www.custommarketinsights.com/report/final-expense-insurance-market/

➤ Conclusion

The Doorstep Banking Market is experiencing strong growth as financial institutions increasingly focus on convenience, customer engagement, and financial inclusion. Valued at USD 1,864.9 million in 2025, the market is projected to reach USD 5,188.9 million by 2034, growing at a CAGR of 12.01%. Advancements in digital technologies, supportive government policies, and rising demand for personalized banking services are key growth enablers. While challenges such as data security and regulatory compliance remain, ongoing innovation, strategic partnerships, and expanding service reach position the market for sustained growth and attractive long-term investment opportunities.

Contact Us:

Joel John

Custom Market Insights

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI is a one-stop solution for data collection and investment advice. Our company’s expert analysis digs out essential factors that help us understand the significance and impact of market dynamics. The professional experts advise clients on aspects such as strategies for future estimation, forecasting, opportunities to grow, and consumer surveys.

This release was published on openPR.