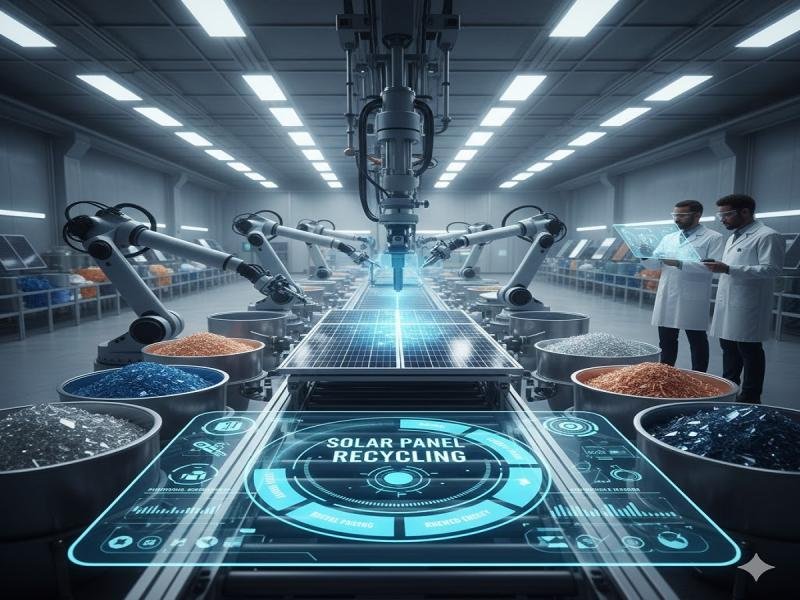

Solar Panel Recycling Market Overview

The global solar panel recycling market reached US$ 155.5 million in 2023 and is projected to reach US$ 419.6 million by 2031, growing at a CAGR of 13.3% during 2024-2031. The market is witnessing strong growth globally, driven by the rapid expansion of photovoltaic (PV) installations and the increasing emphasis on sustainable waste management. As the global PV market expands, managing end-of-life (EOL) PV modules has become a critical concern for maintaining the environmental benefits of solar energy. Most PV modules have an average lifespan of approximately 30 years, and the increasing deployment of solar panels is expected to lead to a significant rise in the number of modules reaching their EOL in the coming decades.

According to the International Energy Agency Photovoltaic Power Systems Programme (IEA PVPS) and the International Renewable Energy Agency (IRENA), the cumulative global PV waste is projected to reach 1.7-8.0 million tons by 2030 and 60-78 million tons by 2050, highlighting the urgent need for effective solar panel recycling solutions. The market growth is further supported by regulatory mandates, environmental policies, and technological advancements in recycling processes that allow the recovery of valuable materials such as silicon, silver, and aluminum from decommissioned solar panels.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/solar-panel-recycling-market?Juli

Recent Developments:

✅ October 2025: First Solar, Inc. launched an advanced solar panel recycling facility in the U.S., capable of recovering over 90% of semiconductor materials, glass, and aluminum from end-of-life PV modules, reducing landfill dependency.

✅ September 2025: Veolia Group expanded its solar PV recycling operations in Europe, introducing automated separation technologies to efficiently recover high-purity silicon and other metals from decommissioned panels.

✅ August 2025: Reclaim PV Solutions partnered with major solar installation firms in Asia-Pacific to implement collection and recycling programs for aging PV modules, aiming to manage the projected surge in end-of-life panels by 2030.

✅ June 2025: TES-AMM inaugurated a circular economy initiative in India, focusing on recycling and refurbishing solar panels for reuse in industrial and commercial applications.

✅ March 2025: Renewable Energy Recycling (RER) launched an R&D program for chemical-free recycling technologies, enabling environmentally sustainable recovery of materials from crystalline and thin-film solar panels.

Mergers & Acquisitions:

✅ November 2025: Veolia Group acquired a European solar PV recycling startup, strengthening its portfolio in sustainable end-of-life module management and expanding operations across the EU.

✅ September 2025: First Solar, Inc. acquired a solar materials recovery firm in the U.S. to enhance its recycling capabilities and improve the efficiency of reclaiming valuable components from decommissioned panels.

✅ July 2025: TES-AMM merged with a regional solar waste management company in India, boosting its recycling capacity and regional market presence.

✅ May 2025: Renewable Energy Recycling (RER) acquired a chemical-free PV recycling technology startup, allowing for environmentally friendly recovery of silicon, silver, and other metals from solar modules.

✅ March 2025: Reclaim PV Solutions entered a strategic partnership with a solar installation company in Asia-Pacific, combining collection, logistics, and recycling capabilities to manage the growing end-of-life PV module market.

Key Players:

Recycle Solar Technologies | Silicontel | First Solar | Veolia | Reclaim PV | Echo Environmental | Silicontel Ltd | Cleanlites | Rinovasol Group | SMA Solar Technology

Key Highlights:

• Recycle Solar Technologies – Holds a 14% share, driven by innovative PV recycling processes and high-efficiency material recovery.

• Silicontel – Holds a 12% share, supported by advanced silicon recovery technologies and large-scale recycling operations.

• First Solar – Holds a 15% share, leveraging proprietary recycling facilities and circular economy initiatives for end-of-life PV modules.

• Veolia – Holds a 13% share, fueled by automated separation technologies and regional expansion across Europe.

• Reclaim PV – Holds a 10% share, focusing on collection programs and recycling partnerships in Asia-Pacific.

• Echo Environmental – Holds a 7% share, offering specialized PV waste management and environmentally friendly recycling solutions.

• Silicontel Ltd – Holds a 6% share, emphasizing high-purity material recovery from crystalline PV panels.

• Cleanlites – Holds a 6% share, driven by sustainable PV module processing and refurbishment initiatives.

• Rinovasol Group – Holds a 6% share, supporting circular economy solutions and chemical-free recycling methods.

• SMA Solar Technology – Holds a 5% share, focusing on solar module recycling integrated with energy solutions and inverter manufacturing.

Buy Now & Unlock 360° Market Intelligence:-https://www.datamintelligence.com/buy-now-page?report=solar-panel-recycling-market?Juli

Market Segmentation:

➥ By process, mechanical recycling dominates with approximately 50% share, driven by its cost-effectiveness, scalability, and ability to recover glass, aluminum, and silicon efficiently. Thermal recycling accounts for 30%, leveraging high-temperature processes to separate and recover metals and semiconductor materials. Laser-based recycling holds 20%, offering precise material recovery and minimal waste, though it is still emerging due to higher costs.

➥ By panel type, monocrystalline silicon panels hold 40% share, reflecting their high deployment rate globally and demand for material recovery from premium PV modules. Polycrystalline panels account for 35%, as they are widely used in residential and commercial installations. Thin-film panels hold 15%, driven by recycling of cadmium telluride (CdTe) and other materials, while amorphous panels represent 10%, reflecting their smaller market penetration and lower recycling volume.

Regional Insights:

Europe leads the solar panel recycling market with approximately 35% share, driven by strict environmental regulations, extended producer responsibility (EPR) mandates, and established recycling infrastructure in countries such as Germany, France, and the Netherlands.

North America accounts for 30% share, supported by rapid growth in PV installations, government incentives, and investments in advanced recycling facilities in the U.S. and Canada.

Asia-Pacific holds 25% share, emerging as a high-growth region due to rapid solar deployment in China, India, and Japan, and increasing adoption of recycling programs for end-of-life modules.

The Rest of the World (RoW), including Latin America, the Middle East, and Africa, represents around 10% share, driven by growing solar energy projects and awareness of sustainable PV waste management.

Speak to Our Analyst and Get Customization in the report as per your requirements:-https://www.datamintelligence.com/customize/solar-panel-recycling-market?Juli

Market Dynamics:

Drivers

The solar panel recycling market is primarily driven by the rapid growth of photovoltaic (PV) installations worldwide, the limited lifespan of PV modules (~30 years), and increasing government regulations on electronic waste management. The rising awareness of environmental sustainability and the need to recover valuable materials such as silicon, silver, and aluminum from decommissioned panels are also propelling market growth. Additionally, the projected surge in end-of-life PV modules, estimated at 1.7-8.0 million tons by 2030, underscores the need for efficient recycling solutions.

Restraints

High capital investment for advanced recycling facilities, technological complexity in processing diverse panel types, and inconsistent recycling regulations across regions may restrain market growth. Additionally, the logistics of collecting and transporting end-of-life panels from distributed solar installations pose operational challenges.

Opportunities

Significant opportunities exist in developing cost-effective, automated, and chemical-free recycling technologies, as well as expanding regional collection networks. Emerging markets in Asia-Pacific, Latin America, and the Middle East present high growth potential due to rapid solar adoption and rising awareness of circular economy practices. Collaboration between PV manufacturers, recyclers, and governments can further enhance market development.

Trends

The market is witnessing a shift toward sustainable and circular economy approaches, including closed-loop recycling and reuse of recovered materials. Advances in mechanical, thermal, and laser recycling processes are improving efficiency and recovery rates. Additionally, regulatory compliance and corporate sustainability initiatives are driving innovation and adoption of eco-friendly recycling solutions globally.

📌 Request for 2 Days FREE Trial Access: https://www.datamintelligence.com/reports-subscription

☛ Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

☛ Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg?Juli

Contact Us –

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us –

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.