Leander, Texas and Tokyo, Japan – Dec.11.2025

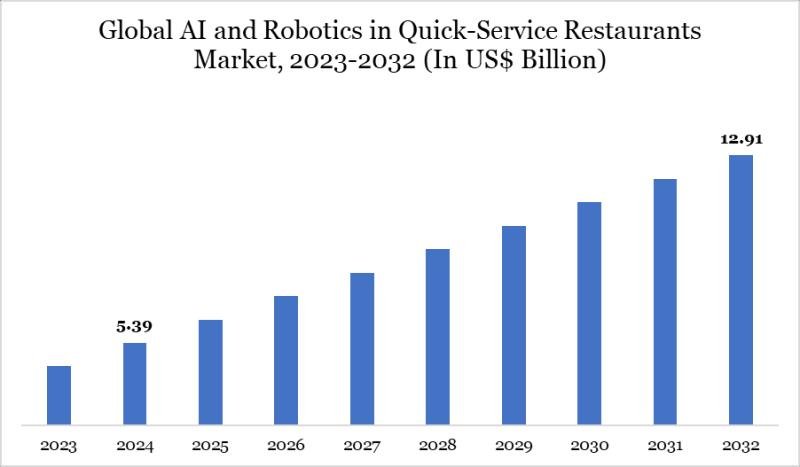

As per DataM intelligence research report” Global AI and Robotics in Quick-Service Restaurants Market reached US$ 5.39 billion in 2024 and is expected to reach US$ 12.91 billion by 2032, growing with a CAGR of 11.54% during the forecast period 2025-2032.” Operational efficiency and contactless service demand are speeding up deployment of AI + robotics in QSRs.

Download your exclusive sample report today: (corporate email gets priority access):

https://www.datamintelligence.com/download-sample/ai-and-robotics-in-quick-service-restaurants-market?Prasad

United States: Recent Industry Developments

✅ In November 2025, Chipotle expanded its “Autocado” robot to 500 locations nationwide The robot cuts, cores, and peels avocados to speed up guacamole preparation It relieves staff of a repetitive task to focus on serving customers

✅ In October 2025, Sweetgreen opened its first fully automated “Infinite Kitchen” in New York The robotic makeline assembles salads faster and more accurately than humans It demonstrates the viability of automation for fresh food assembly

✅ In September 2025, White Castle rolled out “Flippy 3” fry station robots to all company-owned stores The upgraded robot is faster and more reliable than previous versions It addresses the chronic labor shortage in U.S. fast food kitchens

✅ In August 2025, Wendy’s tested an AI drive-thru chatbot powered by Google Cloud The AI handles complex orders and upsells items with natural conversation It improves speed of service and order accuracy

Japan: Recent Industry Developments

✅ In December 2025, Zensho Holdings (Sukiya) deployed tray-carrying robots to all its beef bowl outlets The robots navigate narrow aisles to deliver meals and collect dishes It allows the chain to operate with fewer staff during late-night shifts

✅ In November 2025, Mos Burger introduced a remote-controlled robot avatar for taking orders The avatar is operated by workers with disabilities from their homes It promotes social inclusion while solving labor shortages

✅ In October 2025, Connection Robotics launched a fully automated soba noodle kiosk in train stations The robot boils, drains, and serves noodles in under 90 seconds It offers a high-tech dining option for busy commuters

✅ In September 2025, Kura Sushi updated its “Smart Kura” system with AI tuna grading The AI analyzes images of tuna slices to ensure quality consistency It maintains the brand’s reputation for quality despite high volumes

AI and Robotics in Quick-Service Restaurants Market: Drivers

AI and robotics in quick-service restaurants are revolutionizing operations, order fulfillment, and customer engagement. Automated cooking, order sorting, and delivery systems enhance efficiency, consistency, and cost-effectiveness. AI-driven analytics optimize menu planning, inventory management, and customer personalization.

Adoption is fueled by labor shortages, rising demand for fast service, and consumer interest in tech-driven dining experiences. Integration with mobile ordering, predictive maintenance, and real-time data improves operational performance. Innovation in robotic kitchen assistants, self-service kiosks, and smart delivery solutions continues to reshape the QSR sector globally.

Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/ai-and-robotics-in-quick-service-restaurants-market?Prasad

AI and Robotics in Quick-Service Restaurants Market: Major Players

McDonald’s Corporation, Yum! Brands (Taco Bell, KFC, Pizza Hut), Domino’s Pizza, Inc., Starbucks Corporation, Wendy’s Company, Burger King (Restaurant Brands International), Chipotle Mexican Grill, Inc., Panera Bread, White Castle, and CaliBurger.

Segment Covered in the AI and Robotics in Quick-Service Restaurants Market:

By Function

The market is segmented into order management & processing 55% and food preparation & cooking 45%. Order management & processing dominates due to high adoption of AI-powered kiosks, voice assistants, and digital ordering platforms. Food preparation & cooking grows steadily with robotic fryers, automated grills, and robotic chefs enhancing efficiency, consistency, and speed. Rising consumer demand for faster service and contactless operations drives adoption across both functions.

By Deployment Type

Deployment types include cloud-based 60% and on-premises 40%. Cloud-based solutions dominate due to scalability, centralized management, and integration with digital ordering and analytics platforms. On-premises deployment grows steadily for data-sensitive operations and in regions with limited cloud infrastructure. Hybrid deployments are emerging to balance operational flexibility with security and real-time monitoring.

By Technology

Technologies include AI-based solutions 55% and robotic solutions 45%. AI-based solutions dominate due to demand for predictive analytics, dynamic pricing, personalized promotions, and enhanced customer experience. Robotic solutions grow steadily for cooking, assembling, and packaging food. Continuous innovations in machine learning, robotics, and computer vision accelerate adoption across restaurant operations.

Regional Analysis

North America – 35% Share

North America leads with 35% share due to high technology adoption, advanced digital infrastructure, and strong QSR presence. AI-based solutions dominate order management, while robotics enhance food preparation. Cloud deployment is preferred. Consumer demand for convenience and contactless service drives market growth.

Europe – 25% Share

Europe holds 25% share with adoption in the UK, Germany, France, and Spain. AI and robotics solutions are used across order processing and cooking. Cloud deployment dominates. Growing QSR chains, automation initiatives, and labor optimization strategies support steady growth.

Asia Pacific – 30% Share

Asia Pacific accounts for 30% share with rapid adoption in China, Japan, South Korea, and India. Robotic cooking solutions and AI-based ordering systems dominate. Cloud deployment is widely preferred. Rising urbanization, technology adoption in QSRs, and labor cost optimization drive regional growth.

Latin America – 5% Share

Latin America records 5% share with emerging adoption in Brazil, Mexico, and Argentina. AI-based order management dominates. Cloud deployment is growing. QSR chains and pilot automation projects support gradual adoption.

Middle East and Africa – 5% Share

MEA holds 5% share with gradual adoption in UAE, Saudi Arabia, South Africa, and Egypt. AI and robotics solutions are being implemented for order processing and food preparation. Cloud deployment dominates. Investments in digital kitchens, smart restaurants, and labor optimization drive market penetration.

Purchase this report before year-end and unlock an exclusive 30% discount:

https://www.datamintelligence.com/buy-now-page?report=ai-and-robotics-in-quick-service-restaurants-market

(Purchase 2 or more Repots and get 50% Discount)

Request for 2 Days FREE Trial Access:

https://www.datamintelligence.com/reports-subscription?Prasad

✅ Competitive Landscape

✅ Technology Roadmap Analysis

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Consumer Behavior & Demand Analysis

✅ Import-Export Data Monitoring

✅ Live Market & Pricing Trends

Have a look at our Subscription Dashboard:

https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us –

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us –

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.