According to IMARC Group’s report titled “India IT Hardware Market Size, Share, Trends and Forecast by Product Type, Enterprise Size, Distribution Channel, End User, and Region, 2026-2034”, The report offers a comprehensive analysis of the industry, including market share, growth, trends and regional insights.

Short Summary:

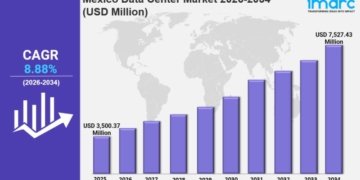

The India IT hardware market size reached USD 4,613.63 Million in 2025. The market is projected to reach USD 8,879.26 Million by 2034, growing at a CAGR of 7.55% during 2026-2034. Market growth is being driven by the government’s Production-Linked Incentive (PLI) 2.0 for electronics manufacturing, increasing domestic production of laptops, servers, and tablets, expanding AI and data center infrastructure, and the Digital India mission accelerating digital adoption across public and private sectors. Cloud migration, remote work technology, and smart city deployment are further widening the India IT hardware market share.

Request Free Detailed Forecast: https://www.imarcgroup.com/india-it-hardware-market/requestsample

Market Overview:

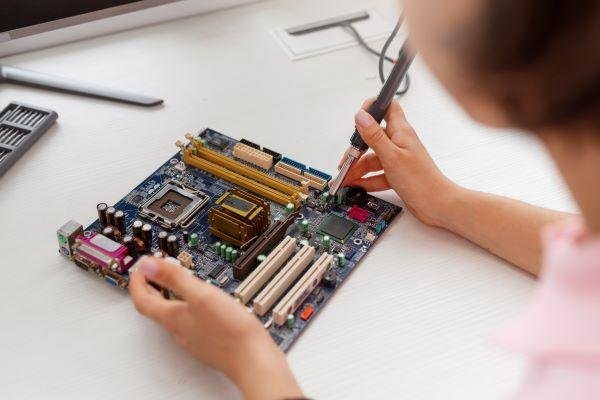

The India IT hardware market is undergoing rapid transformation as the country strengthens its digital backbone and builds resilience across enterprise technology ecosystems. The rising demand for computing devices, networking hardware, servers, and AI-enabled processors highlights India’s shift toward high-performance digital infrastructure.

With global supply chains realigning, India has emerged as a strategic manufacturing destination supported by policy incentives, semiconductor ecosystem development, and growing investment in AI and cloud-capable hardware. Increasing adoption of edge computing, cybersecurity hardware, and hybrid workplace solutions across BFSI, government, education, healthcare, retail, and telecommunications is further propelling market momentum.

Analyst Commentary: India’s IT hardware landscape is expanding beyond traditional personal computing toward cloud-integrated, AI-ready, and enterprise-grade infrastructure solutions. As businesses adopt edge AI, data analytics, and digital governance systems, demand will increasingly shift toward specialized compute architectures and secure, scalable storage systems. Companies with capabilities in chip-level customization, high-speed networking, and localized manufacturing will be better positioned to command long-term market leadership.

Ask an Analyst: https://www.imarcgroup.com/request?type=report&id=43833&flag=C

Scope and Growth Analysis:

• 2024 Market Size: USD 4,613.63 Million

• 2033 Forecast: USD 8,879.26 Million

• CAGR (2025-2033): 7.55%

Growth is supported by:

• Market covers PCs, laptops, servers, tablets, workstations, storage devices, networking systems, and cybersecurity hardware.

• PLI Scheme 2.0 encouraging localized manufacturing of laptops, tablets, servers, and data center equipment.

• Increasing demand from education, BFSI, healthcare, retail, and government digital platforms.

• Growing requirement for enterprise servers and cloud hardware due to rising data center investments.

• Expansion of remote and hybrid work accelerating sales of business laptops and high-performance PCs.

• Significant opportunities in AI accelerators, GPU servers, and edge computing devices.

• IT modernizations in public services, digital identity systems, and e-governance expanding hardware procurement.

• Rising adoption of Industrial IoT and smart infrastructure boosting demand for secure devices.

• Increased local manufacturing of PCB assemblies, SSDs, semiconductors, and motherboard components expected over the decade.

• Growing export potential as India transitions into a global electronics manufacturing hub.

As working populations grow and lifestyles continue shifting, online food delivery is becoming a daily-need service rather than an occasional luxury.

Key Market Trends:

• Adoption of AI-ready hardware, including GPU servers and high-compute chips, for analytics and machine learning workloads.

• Expansion of edge computing devices supporting smart factories, logistics automation, and surveillance.

• Increasing deployment of Made-in-India laptops and tablets under PLI incentives and procurement mandates.

• Growing demand for hyperconverged infrastructure (HCI) in enterprise cloud deployments.

• Surge in data localization policies boosting domestic storage and server infrastructure.

• Emergence of RISC-V and ARM-based processors supporting indigenous chip innovation.

• Modular hardware designs gaining traction for upgradability and long-life enterprise cycles.

• Rising interest in cybersecurity hardware appliances, including firewalls and secure routers.

• Integration of smart city command centers driving purchases of networking and surveillance hardware.

• Growth of refurbished and enterprise-grade re-certified hardware for cost-sensitive segments.

Download Market Insights Snapshot: https://www.imarcgroup.com/request?type=report&id=43833&flag=A

Comprehensive Market Report Highlights & Segmentation Analysis:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest India IT hardware market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Analysis by Product Type:

• Personal Computers

• Servers and Storage Devices

• Networking Equipment

• Printers and Scanners

• Monitors and Displays

• Peripherals

• Others

Analysis by Enterprise Size:

• Small and Medium Enterprises (SMEs)

• Large Enterprises

Analysis by Distribution Channel:

• Online Retailers

• Offline Retailers

• Direct Sales

• Others

Analysis by End User:

• Individual Consumers

• Government and Public Sector

• Educational Institutions

• Healthcare Sector

• Retail

• Others

Analysis by Region:

• North India

• South India

• East India

• West India

Explore the Full Report with Charts, Table of Contents, and List of Figures: https://www.imarcgroup.com/india-it-hardware-market

Other key areas covered in the report:

• COVID-19 Impact on the Market

• Porter’s Five Forces Analysis

• Strategic Recommendations

• Market Dynamics

• Historical, Current and Future Market Trends

• Market Drivers and Success Factors

• SWOT Analysis

• Value Chain Analysis

• Comprehensive Mapping of the Competitive Landscape

• Top Winning Strategies

• Recent Industry News

• Key Technological Trends & Development

Frequently Asked Questions:

Q1: What was the market size of India’s IT hardware market in 2025?

A1: It reached USD 4,613.63 Million in 2025.

Q2: What is the expected market size by 2034?

A2: The market is projected to reach USD 8,879.26 Million by 2034, growing at a CAGR of 7.55%.

Q3: What are the key drivers of this market?

A3: PLI Scheme 2.0, expansion of AI and data center infrastructure, Digital India initiatives, cloud adoption, remote work demand, and smart city deployment.

Q4: Which segments are growing fastest within the IT hardware market?

A4: AI-enabled computing hardware, enterprise servers, security appliances, data center infrastructure, and business laptops.

Q5: How is government policy influencing the market?

A5: Policies such as PLI, Make in India, and Digital India are boosting domestic manufacturing, public procurement, and digital public infrastructure, directly increasing demand for IT hardware.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=43833&flag=E

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Also Browse Related Links:

India Refrigerated Trucks Market: https://www.imarcgroup.com/india-refrigerated-trucks-market/requestsample

India Baby Care Products Market: https://www.imarcgroup.com/india-baby-care-products-market/requestsample

India Decorative Laminates Market: https://www.imarcgroup.com/india-decorative-laminates-market/requestsample

Updated Date: 08 Dec-2025

Author: Gaurav

Sources: IMARC Group

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.