Risk management has always been central to both banking and insurance, but the rapid rise of digital transactions, cyber threats, advanced fraud techniques, and increasingly complex regulatory requirements has pushed traditional risk frameworks to their limits. Today, Artificial Intelligence (AI) is emerging as the most powerful force reshaping how banks and insurers identify, assess, and mitigate risks.

AI-driven capabilities provide a fundamentally new approach to decision-making by enabling real-time analysis, predictive insights, anomaly detection, and automated workflows. Whether it’s detecting fraud as it happens, evaluating creditworthiness using alternative data, or optimizing underwriting decisions, AI helps financial institutions transition from reactive to proactive risk management.

Modernization plays a significant role here as well. Many banks now rely on advanced platforms that support AI-powered monitoring, fraud analytics, and regulatory compliance automation. Solutions offered through banking technology services, such as those at https://appinventiv.com/banking-software-development-services/, reflect this shift toward integrated risk-intelligent architectures.

How AI Reinvents Risk Management Across BFSI

Banks and insurers deal with different types of risks, but what unites them is the dependence on large volumes of data and the need to spot anomalies early. AI amplifies this ability through:

1. Real-Time Fraud Detection

Banks use AI to monitor millions of transactions per second, flagging patterns that human teams may miss. Insurance companies use similar models to detect suspicious claims, repeated submissions, and inconsistent documentation-drastically reducing fraudulent payouts.

2. Predictive Credit & Underwriting Risk

Machine learning models evaluate thousands of traditional and non-traditional signals to predict creditworthiness or claim probability. This enables better loan decisions for banks and more accurate risk scoring for insurers.

3. Automated Compliance & AML

AI-powered KYC and AML solutions extract, validate, and analyze customer information automatically-reducing compliance burden and minimizing the risk of regulatory penalties.

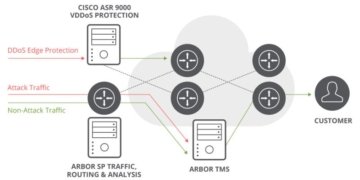

4. Operational & Cyber Risk Management

AI identifies system anomalies, unauthorized access patterns, downtime risks, and internal vulnerabilities. This protects both banks and insurers from operational failures and cyber threats.

Why AI Has Become Essential for the Future of BFSI

AI doesn’t just improve risk detection-it transforms how institutions operate:

Faster decision-making with instant insights

Reduced losses from fraud, defaults, and inaccurate underwriting

Better regulatory alignment through automated monitoring

Enhanced customer trust with safer, more seamless digital experiences

Lower operational costs through automation and intelligent workflows

Together, these advantages form the basis for the next generation of BFSI operations-agile, data-intelligent, and risk-aware.

Shared AI Use-Cases: Where Banking and Insurance Intersect

While banking and insurance serve different purposes, AI brings strong convergence:

• Customer Risk Profiling

Banks assess credit risk; insurers assess claim risk. AI supports both by analyzing behavioral patterns, transaction trails, lifestyle indicators, and external data sources.

• Fraud & Identity Verification

Face recognition, document scanning, OCR, and behavioral biometrics enable real-time identity validation across both industries.

• Claims & Loan Decision Automation

Rules-based engines combined with AI automate loan approval workflows in banking and claims adjudication in insurance-ensuring faster turnaround without sacrificing accuracy.

• Market Risk & Portfolio Insights

AI monitors macroeconomic trends, rate changes, geopolitical movements, and customer exposure-helping BFSI institutions prepare for financial volatility.

Challenges Holding Institutions Back

Despite its advantages, AI adoption comes with hurdles:

Poor data quality leads to inaccurate predictions

Integration issues with legacy systems

Model bias can create unfair decisions

Lack of AI explainability complicates regulatory alignment

Skilled talent shortages slow down AI implementation

To fully leverage AI, institutions must invest in data modernization, model governance, and transparent decision-making frameworks.

AI in Insurance: A Growing Priority

Insurance providers in particular are undergoing rapid digital transformation. AI enables them to price policies more accurately, detect fraud instantly, and offer personalized plans based on individual risk profiles. As demand grows, technology platforms offering end-to-end insurance digitalization-such as https://appinventiv.com/insurance-software-development-services/ play a crucial role in helping insurers modernize their risk engines.

The Future: A Fully Intelligent Risk Ecosystem

The next stage of BFSI evolution is a unified, AI-driven risk ecosystem where:

1. Data Flows Freely Across Systems

With open finance and improved data sharing, AI will combine banking, insurance, and third-party datasets for more holistic risk scoring.

2. Decisions Become Adaptive

Models will evolve in real time based on new data, improving prediction accuracy and reducing blind spots.

3. Human-AI Collaboration Strengthens

Humans will handle strategic interpretation, while AI manages execution and pattern recognition-creating a balanced, transparent risk program.

4. Regulatory Tech (RegTech) Expands

Expect AI solutions that auto-interpret regulatory requirements, generate reports, and audit decisions-making compliance faster and more accurate.

Conclusion

AI-driven risk management is no longer a futuristic concept-it is the technology layer redefining how banking and insurance operate. By enabling early fraud detection, predictive insights, automated compliance, and end-to-end process efficiency, AI equips BFSI institutions with the intelligence they need for long-term resilience.

Banks and insurers that integrate AI into their core systems-supported by modern development partners and next-gen digital platforms-will lead the industry in innovation, risk preparedness, and customer trust. Those who delay adoption risk falling behind in a market where risk evolves daily and technology evolves faster.

Appinventiv

B-25, Sector 58,

Noida – 201301,

Delhi – NCR, India

+ 91 – 844 – 818 – 2018

pr@appinventiv.com

Appinventiv is a global digital engineering and product development company helping businesses build scalable, modern, and AI-driven software solutions. With 1,600+ experts, they deliver end-to-end services-from strategy and design to development, cloud, and digital transformation-for enterprises, startups, and Fortune 500 brands.

This release was published on openPR.