Load Balancer As A Service Market Size Outlook for 2025

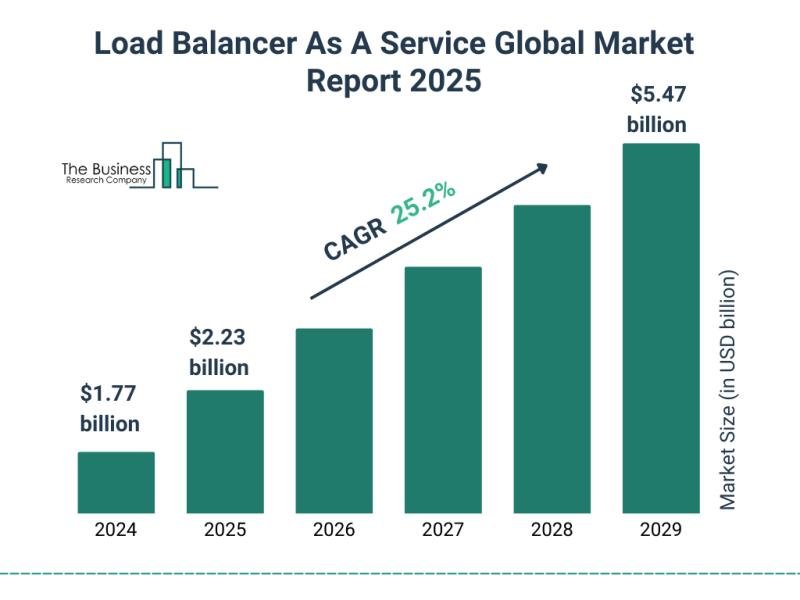

The load balancer as a service market is experiencing notably strong growth, with its valuation anticipated to rise from $1.77 billion in 2024 to $2.23 billion in 2025, supported by a significant CAGR of 25.6%. This prior-period expansion is primarily attributed to rapid cloud migration, surging internet traffic volumes, the increasing requirement for scalable digital applications, the widespread adoption of microservices and container-based deployments, expanding reliance on e-commerce and digital platforms, the heightened need for dependable network performance, and a broader organizational shift toward hybrid and multi-cloud system architectures.

Projected Expansion of the Load Balancer As A Service Market by 2029

Looking ahead, the load balancer as a service market is expected to maintain its rapid upward trajectory, reaching $5.47 billion by 2029 with a projected CAGR of 25.2%. Growth across this forecast horizon is supported by rising demand for edge computing capabilities, continual advancements in 5G networks, escalating use of Internet of Things (IoT) devices, accelerating digital transformation within enterprises, and greater integration of serverless and cloud-native workloads. Major trends likely to shape this period include AI-enhanced traffic management, deeper alignment with edge computing ecosystems, adoption of intent-based networking approaches, more advanced orchestration and automation functions, multi-cloud load balancing support, broader application of zero-trust security methodologies, and the incorporation of predictive analytics to optimize application performance.

Access the full Load Balancer As A Service Market report here:

https://www.thebusinessresearchcompany.com/report/load-balancer-as-a-service-global-market-report

Key Drivers Powering the Load Balancer As A Service Market’s Growth Momentum

Rising adoption of cloud infrastructure continues to act as a primary force driving the expansion of the load balancer as a service landscape. Cloud computing delivers processing power, storage, databases, networking, applications, and analytical capabilities through online delivery models, enabling faster innovation cycles, flexible resource scaling, and reduced hardware investment. This rapid adoption is largely due to the scalability advantages that allow organizations to adjust computing demands seamlessly while reducing capital expenditures. Load balancer as a service solutions align strongly with this shift by automating traffic distribution and adapting to fluctuating workloads, enhancing reliability and ensuring smoother performance for applications experiencing variable demand.

Additional Drivers Supporting Market Growth

Further illustrating this momentum, Eurostat data released in December 2023 revealed that 45.2% of European Union businesses were utilizing cloud services, with adoption rates of 77.6% among large enterprises, 59% for mid-sized organizations, and 41.7% for smaller firms. This widening use of cloud platforms directly accelerates the need for load balancer as a service offerings that can improve uptime, manage heavy traffic efficiently, and prevent bottlenecks, thereby strengthening overall application delivery.

Download your free Load Balancer As A Service Market sample now:

https://www.thebusinessresearchcompany.com/sample.aspx?id=29833&type=smp

Key Trends Redefining the Load Balancer As A Service Market

Major vendors in the load balancer as a service space are advancing cloud-native, autonomous traffic management solutions designed to increase application responsiveness, enhance system security, and cut down on manual configuration requirements. These intelligent systems dynamically distribute incoming traffic across server pools, maximizing resource use while preventing overload conditions. An illustrative example comes from Alkira Inc., which launched its Load Balancer-as-a-Service (LBaaS) offering in February 2025. Developed to modernize traffic handling across cloud and on-premise environments, this unified solution incorporates automated diagnostics, precise traffic routing, and centralized governance across hybrid and multi-cloud infrastructures, enabling streamlined scaling and consistent application uptime without constant operator involvement.

Leading Segment Types Boosting Load Balancer As A Service Market Performance

The load balancer as a service market covered in this report is segmented –

1) By Component:

Software, Hardware, Services

2) By Deployment Mode:

Public Cloud, Private Cloud, Hybrid Cloud

3) By Enterprise Size:

Small And Medium Enterprises, Large Enterprises

4) By End-User:

Banking, Financial Services, And Insurance (BFSI), Information Technology (IT) And Telecommunications, Healthcare, Retail, Government, Media And Entertainment, Other End-Users

Subsegments:

1) By Software:

Virtual Load Balancers, Cloud-Native Or Load-Balancer-As-Software, Application Delivery Controller (ADC) Software, Open-Source Or Load Balancer Projects, API Gateway And Edge-Proxy Software, SSL Or TLS Offload And Crypto Acceleration Modules, DNS-Based Load Balancing Software

2) By Hardware:

Dedicated Hardware Load Balancer Appliances (ADC Appliances), SSL Or TLS Hardware Off loaders, Application Acceleration Appliances, DDoS Mitigation Appliances, High-Throughput Ethernet Or ASIC-Accelerated Load Balancers, Edge Or Edge-Gateway Hardware Devices

3) By Services:

Managed LBaaS (Fully Managed Load Balancer Operations), Professional Services, Integration And Implementation Services, Support And Maintenance Services (SLA, Patching), Monitoring And Performance Tuning Services, Migration And Deployment Services, Security Services

Companies Setting the Pace in the Load Balancer As A Service Market

Major companies operating in the load balancer as a service market include Amazon.com Inc.; Google LLC; Microsoft Corporation; Alibaba Cloud Computing Ltd.; Huawei Technologies Co. Ltd.; Tencent Cloud Computing (Beijing) Co. Ltd.; International Business Machines Corporation (IBM); Oracle Corporation; Fortinet Inc.; Akamai Technologies Inc.; Citrix Systems Inc.; F5 Inc.; Cloudflare Inc.; DigitalOcean Holdings Inc.; OVH Groupe SA; Radware Ltd.; A10 Networks Inc.; Array Networks Inc.; Progress Software Corporation; HAProxy Technologies LLC; Loadbalancer.org Ltd.

Regions Dominating the Load Balancer As A Service Market Landscape

North America held the leading share of the load balancer as a service market in 2024, while Asia-Pacific is projected to show the fastest growth during the forecast period. The regions analyzed in the report include Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa.

Purchase your detailed Load Balancer As A Service Market report now:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=29833

This Report Supports:

Business Leaders & Investors – To identify growth opportunities, assess risks, and guide strategic decisions.

Manufacturers & Suppliers – To understand market trends, customer demand, and competitive positioning.

Policy Makers & Regulators – To track industry developments and align regulatory frameworks.

Consultants & Analysts – To support market entry, expansion strategies, and client advisory work.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.