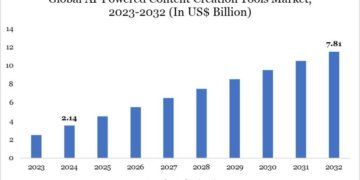

AlphaTON Capital Corp (NASDAQ: ATON), the world’s leading technology public company scaling the Telegram super app, with an addressable market of 1 billion monthly active users, today announced that it has exited the SEC’s “baby shelf rules,” which prohibit companies with a public float of less than $75 million from issuing securities under a shelf registration statement in excess of one-third of such company’s public float in a 12-month period, and filed a $420.69 million shelf registration statement. AlphaTON Capital currently intends to utilize the shelf registration statement to finance the company’s ambitious expansion of AI and high-performance computing (HPC) infrastructure supporting Telegram’s Cocoon AI network, while simultaneously pursuing strategic mergers and acquisitions of revenue-producing companies within the Telegram ecosystem.

Once effective, the shelf registration statement will provide AlphaTON Capital with significant financing flexibility to execute on its dual-pronged growth strategy: expanding its position as a critical infrastructure provider for decentralized AI computing and building a portfolio of cash-flow positive businesses operating within Telegram’s rapidly growing user base of over 1 billion monthly active users.

“Exiting the SEC’s “baby-shelf” limitations on raising capital marks an important milestone in AlphaTON Capital’s transformation into a leading infrastructure provider for the next generation of decentralized AI,” said Brittany Kaiser, Chief Executive Officer of AlphaTON Capital. “Once effective this shelf registration statement gives us the financing flexibility to move quickly and decisively on transformational opportunities. We are seeing exceptional demand for GPU compute power within the Cocoon AI network, and simultaneously, we’re identifying high-quality revenue-generating businesses in the Telegram ecosystem that align perfectly with our strategic vision.”

Strategic Areas:

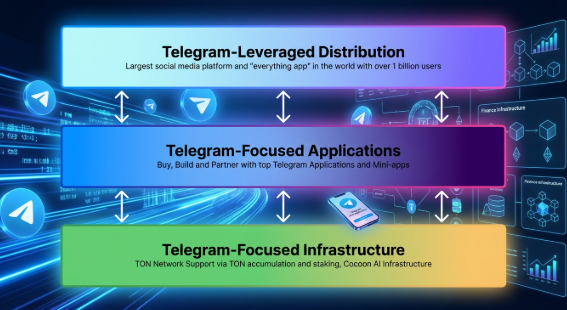

Telegram Distribution:

Forge partnerships with premier Telegram distribution applications and platforms across the fintech, gaming, health, and sports sectors to cultivate strategic revenue streams.

Telegram Applications (Mergers & Acquisitions):

Mergers and Acquisitions: The company has identified numerous high-potential acquisition targets currently generating revenue within the Telegram ecosystem. These targets encompass entities focused on payments, content distribution, and blockchain-enabled services. These strategic acquisitions are projected to deliver immediate cash flow while substantially expanding AlphaTON Capital’s operational footprint across Telegram’s diverse business verticals.

Infrastructure:

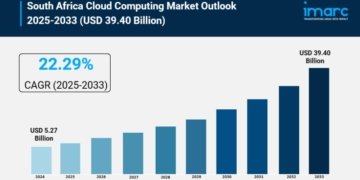

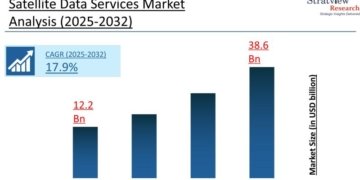

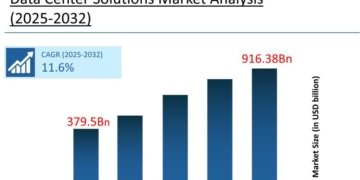

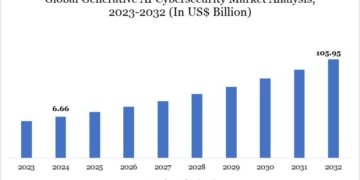

AI/High-Performance Computing (HPC) Infrastructure Expansion: AlphaTON Capital intends to deploy capital strategically to scale its Graphics Processing Unit (GPU) infrastructure in support of Telegram’s Cocoon AI network. This effort builds upon its existing partnerships with CUDO Compute and AtNorth data centers, and its prior deployment of Nvidia B200 GPUs. The company is committed to establishing itself as a foundational infrastructure provider for decentralized AI computing, thereby capitalizing on the prevailing shift toward distributed GPU networks.

Digital Asset Treasury for the Telegram / TON (The Open Network) Ecosystem: Maintain a policy of acquiring TON tokens and other associated digital assets, such as GAMEE, within the Telegram ecosystem to provide sustained support for the TON / Telegram / Cocoon network.

About AlphaTON Capital Corp (Nasdaq: ATON)

AlphaTON Capital Corp (NASDAQ: ATON) is the world’s leading technology public company scaling the Telegram super app, with an addressable market of 1 billion monthly active users while managing a strategic reserve of digital assets. The Company implements a comprehensive M&A and treasury strategy that combines direct token acquisition, validator operations, and strategic ecosystem investments to generate sustainable returns for shareholders. Through its operations, AlphaTON Capital provides public market investors with institutional-grade exposure to the TON ecosystem and Telegram’s billion-user platform while maintaining the governance standards and reporting transparency of a Nasdaq-listed company. Led by Chief Executive Officer Brittany Kaiser, Executive Chairman, Chief Investment Officer Enzo Villani, and Chief Business Development Officer Yury Mitin, the Company’s activities span network validation and staking operations, development of Telegram-based applications, and strategic investments in TON-based decentralized finance protocols, gaming platforms, and business applications.

AlphaTON Capital Corp is incorporated in the British Virgin Islands and trades on Nasdaq under the ticker symbol “ATON”. AlphaTON Capital, through its legacy business, is also advancing potentially first-in-class therapies that target known checkpoint resistance pathways to potentially achieve durable treatment responses and improve patients’ quality of life. AlphaTON Capital actively engages in the drug development process and provides strategic counsel to guide development of novel immunotherapy assets and asset combinations. To learn more, please visit https://alphatoncapital.com/.

Forward-Looking Statements

All statements in this press release, other than statements of historical facts, including without limitation, statements regarding the Company’s business strategy, plans and objectives of management for future operations and those statements preceded by, followed by or that otherwise include the words “believe,” “expects,” “anticipates,” “intends,” “estimates,” “will,” “may,” “plans,” “potential,” “continues,” or similar expressions or variations on such expressions are forward-looking statements. As a result, forward-looking statements are subject to certain risks and uncertainties, including, but not limited to: risks related to the development and adoption of AI technologies, risks related to cryptocurrency market volatility, regulatory developments, technical challenges in infrastructure deployment, the risk that the Company may not secure additional financing, the uncertainty of the Company’s investment in TON, the operational strategy of the Company, risks from Telegram’s platform and ecosystem, uncertainties regarding the Company’s ability to remain out of “baby shelf” status, the potential impact of markets and other general economic conditions, the Company’s failure to realize the anticipated benefits of its financing and strategic transaction plans, the risk that the Company may not be able to repay its loan, risks related to debt service obligations, the impact of indebtedness on the Company’s financial condition and other factors set forth in “Item 3 – Key Information-Risk Factors” in the Company’s Annual Report on Form 20-F for the year ended March 31, 2025 and included in the Company’s Form 6-K filed with the Securities and Exchange Commission on September 3, 2025. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, undue reliance should not be placed on them as actual results may differ materially from these forward-looking statements. The forward-looking statements contained in this press release are made as of the date hereof, and the Company undertakes no obligation to update publicly or revise any forward-looking statements or information, except as required by law.

Investor Relations:

AlphaTON Capital Corp

[email protected]

(203) 682-8200

Media Inquiries:

Richard Laermer

RLM PR

[email protected]

(212) 741-5106 X 216