Market Outlook

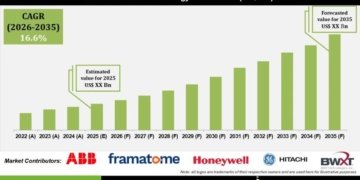

The AI Trading Platform Market continues to gain strong momentum as investors adopt intelligent automation to enhance decision-making and improve trading speed. The market was valued at USD 11,310 million in 2024 and is projected to reach USD 48,114.6 million by 2032, reflecting a CAGR of 19.84% during the forecast period. Growing use of predictive analytics, algorithmic execution, and machine learning models drives demand across retail and institutional segments. Platforms enhance accuracy, reduce human bias, and support real-time analysis across equities, forex, and digital assets. Rising adoption of cloud-based trading tools and API-driven integration further boosts market expansion.

Major financial institutions invest in AI-powered risk management, sentiment analysis, and automated portfolio optimization to improve performance. Adoption rises as traders seek tools that process large datasets and uncover new market signals. Vendors introduce advanced features such as reinforcement learning engines, adaptive trading bots, and intelligent trade alerts. Strong interest from hedge funds, fintech firms, and online brokers accelerates product innovation. As regulatory frameworks evolve to support transparent algorithmic trading, AI trading platforms are set to become core components of modern financial markets.

Key Growth Drivers

Rising demand for automated and data-driven trading remains a major growth catalyst for the AI Trading Platform Market. Traders depend on AI models to analyze large datasets, detect hidden patterns, and generate faster trading signals with higher precision. The shift toward algorithmic execution across equities, commodities, and crypto strengthens market adoption. Retail investors also embrace AI tools for real-time alerts, sentiment tracking, and portfolio optimization, pushing platform providers to expand features.

Financial institutions invest in AI-powered risk assessment, fraud detection, and predictive analytics to improve decision accuracy. Cloud-based deployment and API integration make these platforms easier to scale across global trading operations. Growing interest in natural language processing, reinforcement learning, and adaptive trading bots drives product innovation. Supportive regulations for algorithmic transparency and increasing demand for high-frequency trading further accelerate market growth.

Tailor the report to align with your specific business needs and gain targeted insights. Request – : https://www.credenceresearch.com/report/ai-trading-platform-market

Regional Analysis

North America leads the AI Trading Platform Market, driven by advanced financial infrastructure and strong fintech adoption. The region benefits from high algorithmic trading penetration among hedge funds, brokers, and proprietary trading firms. Europe follows with growing investments in AI-driven risk management and regulatory technology, supported by mature capital markets. Asia Pacific is the fastest-growing region as expanding retail participation, digital brokerage platforms, and rising crypto trading volumes accelerate deployment of AI tools in markets such as China, India, and Southeast Asia. Emerging markets in Latin America and the Middle East & Africa gradually adopt AI trading platforms, supported by digital transformation in banking and capital markets.

Key Player Analysis

• TD Ameritrade Holding Corporation

• Rademade Technologies

• Devexperts LLC

• Interactive Brokers

• TRADE

• Pragmatic Coder

• Empirica

• EffectiveSoft Ltd.

• Profile Software

• Chetu Inc.

Tailor the report to align with your specific business needs and gain targeted insights. Request – : https://www.credenceresearch.com/report/ai-trading-platform-market

Segments

By Type

• Solutions

• Services

By Interface Type

• Web-Based Platforms

• Mobile Applications

• Desktop Applications

By End-Use

• Institutional Investors

• Retail Traders

• Asset Management Firms

By Region

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East & Africa

Tailor the report to align with your specific business needs and gain targeted insights. Request – : https://www.credenceresearch.com/report/ai-trading-platform-market

Credence Research Europe LTD

128 City Road, London,

EC1V 2NX, UNITED KINGDOM

Europe – +44 7809 866 263

North America – +1 304 308 1216

Australia – +61 4192 46279

Asia Pacific – +81 5050 50 9250

+64 22 017 0275

India – +91 6232 49 3207

sales@credenceresearch.com

http://www.credenceresearch.com

Credence Research is a viable intelligence and market research platform that provides quantitative B2B research to more than 2000 clients worldwide and is built on the Give principle. The company is a market research and consulting firm serving governments, non-legislative associations, non-profit organizations, and various organizations worldwide. We help our clients improve their execution in a lasting way and understand their most imperative objectives.

This release was published on openPR.