The Bitcoin payments ecosystem market is entering a pivotal phase, shaped by institutional adoption, regulatory clarity, rapid innovation in Layer-2 scaling, and the expansion of global merchant acceptance. As Bitcoin transitions from a speculative asset to a viable medium of exchange, leading companies are building infrastructure that supports fast, low-cost, borderless transactions. This strategic article examines the top companies shaping the market, provides a detailed SWOT analysis, and highlights key investment opportunities emerging across the Bitcoin payments ecosystem.

➤ Request Free Sample PDF Report @https://www.researchnester.com/sample-request-8171

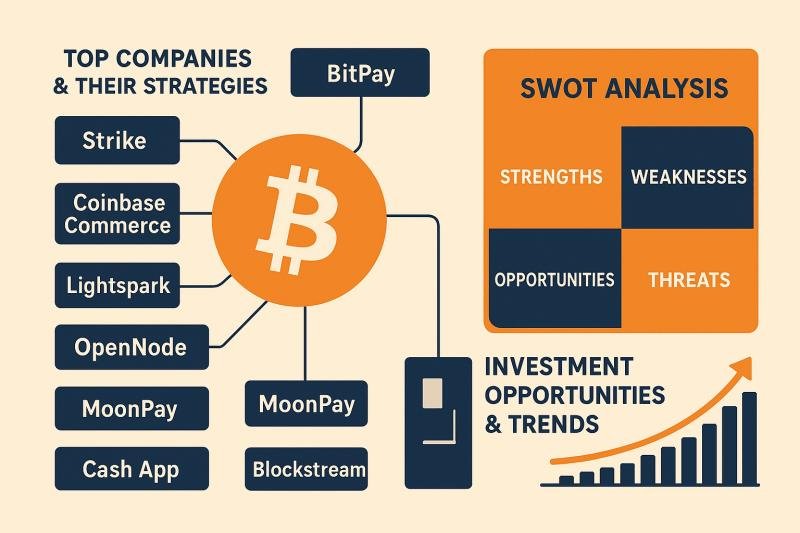

Top Companies & Their Strategies

1. BitPay

BitPay remains one of the most recognizable players in the Bitcoin payments ecosystem, offering merchant processing services, settlement tools, and crypto debit card products. Its strength lies in its well-established merchant network, advanced fraud detection capabilities, and long-standing regulatory compliance frameworks. BitPay continues to expand globally through integrations with ecommerce platforms such as Shopify and WooCommerce, strengthening its leadership position.

2. Strike

Strike, built on the Lightning Network, has gained prominence due to its ultra-low-cost payment rails and focus on remittances. The company differentiates itself through instant cross-border Bitcoin transactions, seamless fiat conversion, and strategic alliances with countries in Latin America. Strike’s competitive advantage lies in leveraging Bitcoin’s Lightning Network to undercut traditional payment processors and money transfer services.

3. Coinbase Commerce

Coinbase Commerce enables merchants worldwide to accept Bitcoin directly into their wallets without intermediaries. Its integration within Coinbase’s broader ecosystem makes it highly attractive for businesses and enables easy conversion between crypto and fiat. Coinbase Commerce continues to scale by partnering with global brands and expanding support for Bitcoin-native payment features.

4. Lightspark

Lightspark is an emerging leader focused on enterprise-grade Lightning Network infrastructure. Founded by former Meta executives, Lightspark aims to create a new standard for Bitcoin-powered payments by offering APIs, liquidity management tools, and fraud mitigation technologies. Its strategy focuses on infrastructure-as-a-service, making it easier for financial institutions to adopt Lightning-powered payments.

➤ Get deeper insights into competitive positioning and strategic benchmarking: Download our sample Bitcoin Payments Ecosystem Market report here → https://www.researchnester.com/sample-request-8171

5. OpenNode

OpenNode is a growing payments processor specializing in Bitcoin-only merchant solutions, customizable APIs, and payout systems. The company prioritizes an easy-to-integrate platform for businesses of all sizes, making it a preferred choice for enterprise-level commerce. Its operational footprint in the U.S., Europe, and Middle East enables broad international reach.

6. MoonPay

MoonPay supports Bitcoin buying, selling, and payment processing across 160+ countries. Although known primarily for its on-ramp services, MoonPay is increasingly moving into merchant acceptance and crypto-to-fiat settlement tools. Its major strength is its global network of partnerships with fintech platforms, mobile apps, and cryptocurrency wallets.

7. Cash App

Cash App has evolved from a simple peer-to-peer payment tool into one of the most influential Bitcoin-centric platforms. Through its Bitcoin Lightning integrations and user-friendly design, Cash App has played a major role in mainstreaming Bitcoin payments. Its access to millions of users provides significant scale for onboarding consumers into the Bitcoin payments ecosystem.

8. Blockstream

Blockstream focuses on Bitcoin infrastructure, including the Liquid sidechain and Lightning development tools. While not a merchant processor, its technologies support faster and more secure Bitcoin transactions for enterprises. Its strategy revolves around building the technical backbone that enables secure, scalable Bitcoin payments across global financial networks.

➤ View our Bitcoin Payments Ecosystem Market Report Overview: https://www.researchnester.com/reports/bitcoin-payment-ecosystem-market/8171

SWOT Analysis

Strengths

Leading companies in the Bitcoin payments ecosystem market benefit from advanced blockchain infrastructure, strong developer communities, and increasing merchant acceptance. Many firms leverage the Lightning Network, enabling high-speed, low-cost transactions that outperform traditional payment rails. Their global reach allows them to operate across regions underserved by banks, and their brands have built significant trust with both consumers and businesses.

Weaknesses

A major challenge for many Bitcoin payments providers is regulatory uncertainty, particularly in regions where digital assets face ambiguous classifications. Some companies struggle to balance innovation with compliance, slowing product deployments and limiting adoption. Merchant onboarding remains uneven across industries, and user education continues to be a barrier in emerging markets. Volatility also affects companies that rely on direct Bitcoin acceptance rather than instant fiat conversion.

Opportunities

Growth opportunities are expanding across remittances, cross-border commerce, microtransactions, and enterprise-grade settlement systems. Companies can capitalize on increasing regulatory acceptance in key regions such as Europe, Singapore, and parts of Latin America. Adoption of Bitcoin’s Lightning Network presents massive potential for scaling payments, especially for fintechs and ecommerce platforms. Additionally, partnerships with banks, payment processors, and mobile wallet providers present new channels for expansion.

Threats

Bitcoin payment companies face ongoing threats from regulatory restrictions, traditional financial incumbents entering the crypto sector, and competitive pressure from stablecoin payment solutions. Emerging blockchain networks offering faster or cheaper alternatives may divert merchant attention away from Bitcoin. Cybersecurity risks remain a constant threat, particularly as transaction volumes scale. Market sentiment volatility could weaken consumer interest, impacting transaction-based revenue models.

➤ Access a complete SWOT breakdown with company-specific scorecards: Claim your sample report → https://www.researchnester.com/sample-request-8171

Investment Opportunities & Trends

Increasing M&A Activity

The Bitcoin payments ecosystem is witnessing rising merger and acquisition interest as larger financial institutions seek to integrate blockchain-based payment capabilities. Companies specializing in Lightning infrastructure, fraud detection, and AI-driven compliance tools are becoming attractive acquisition targets. Over the past year, several crypto payment startups have been acquired by global fintech leaders to accelerate their entry into the blockchain space.

Venture Funding in Infrastructure & Cross-Border Payments

Venture capital continues flowing into companies developing Lightning Network infrastructure, merchant APIs, and cross-border settlement platforms. Startups focusing on remittances in Latin America, Africa, and Southeast Asia are receiving significant investment due to Bitcoin’s efficiency in bypassing high-fee traditional remittance routes. Infrastructure providers such as Lightspark and OpenNode also attract capital due to their scalability and enterprise-focused product lines.

Technology Integration & Enterprise Adoption

Enterprise adoption of Bitcoin payments is becoming more common as companies recognize its operational advantages-real-time settlement, lower processing costs, and chargeback elimination. Major global brands are integrating Bitcoin processing tools through APIs from Coinbase Commerce, BitPay, and OpenNode. Lightning Network integrations are accelerating, allowing real-time micropayments for digital goods, gaming, content monetization, SaaS billing, and cross-border payroll.

Regions Attracting the Most Capital

• Latin America: High remittance volumes and favorable crypto regulations are driving investment in companies building Bitcoin remittance and merchant networks.

• Europe: Clear regulatory frameworks under MiCA are fueling enterprise adoption and infrastructure development.

• Southeast Asia: Mobile-first commerce and fragmented banking systems create strong demand for Bitcoin-based settlement networks.

• U.S. tech hubs: Venture-backed Bitcoin payments startups remain concentrated in New York, Miami, Austin, and Silicon Valley.

Notable Innovations in the Last 12 Months

• Expansion of Lightning Network enterprise-grade infrastructure by multiple companies.

• Launch of Bitcoin-powered remittance corridors across Latin America and Africa.

• Integration of Bitcoin payments into ecommerce platforms such as Shopify and WooCommerce.

• Policy developments in Europe and Asia that provide clearer regulatory pathways for Bitcoin payment providers.

• New APIs enabling faster merchant onboarding and instant crypto-to-fiat settlement.

These innovations signal accelerating adoption and position the Bitcoin payments ecosystem for continued maturation.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8171

➤ Related News –

https://www.linkedin.com/pulse/what-factors-driving-global-growth-beta-testing-tools-xqxyf

https://www.linkedin.com/pulse/what-future-digital-transformation-consulting-services-ehsyf

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.