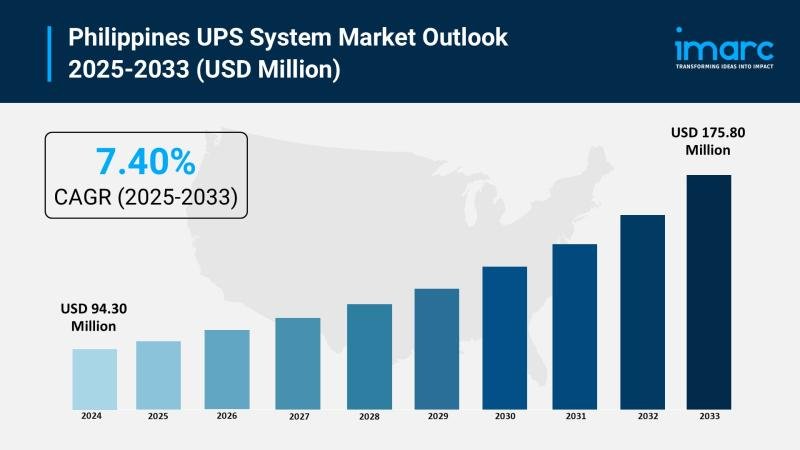

The latest report by IMARC Group, “Philippines UPS System Market Size, Share, Trends and Forecast by Product Type, Capacity, Application, End-User, and Region, 2025-2033,” provides an in-depth analysis of the Philippines UPS system market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Philippines UPS system market size reached USD 94.30 million in 2024 and is projected to grow to USD 175.80 million by 2033, exhibiting a robust growth rate of 7.40% during the forecast period.

Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 94.30 Million

Market Forecast in 2033: USD 175.80 Million

Growth Rate (2025-2033): 7.40%

Philippines UPS System Market Overview:

The Philippines UPS system market is experiencing exceptional growth driven by increasing data center investments, expanding IT infrastructure, and rising demand for reliable power protection solutions. The market is rapidly evolving with government digitalization initiatives and growing hyperscale data center developments fueling sustained expansion. Advancements in UPS technology, particularly in efficiency and scalability capabilities, are making UPS systems the critical choice for data center operators and commercial facilities. The sector demonstrates remarkable resilience with major data center investments exceeding USD 3 billion and capacity expansions reaching 124,000 rack spaces, while digital transformation initiatives across industries accelerate adoption rates.

Request For Sample Report: https://www.imarcgroup.com/philippines-ups-system-market/requestsample

Philippines UPS System Market Trends:

• Data Center Expansion Acceleration driving primary market demand with hyperscale facilities and AI-ready data centers requiring advanced UPS systems for mission-critical operations

• Digital Transformation Integration strengthening through cloud computing adoption, digital infrastructure modernization, and enterprise IT system upgrades requiring reliable power protection

• Industrial Automation Growth expanding with manufacturing facility upgrades, process automation systems, and smart factory implementations requiring uninterrupted power supply solutions

• Telecommunications Infrastructure Development supporting 5G network deployment, fiber optic expansion, and telecommunications equipment installations demanding high-reliability UPS systems

• Healthcare Facility Modernization growing with hospital equipment upgrades, medical device installations, and healthcare IT system deployments requiring critical power backup solutions

• Banking and Financial Services Digitalization increasing demand for UPS systems protecting ATM networks, banking data centers, and financial transaction processing facilities

• Energy Efficiency Technology Advancements enhancing UPS performance through improved power conversion efficiency, intelligent battery management, and smart monitoring capabilities

Philippines UPS System Market Drivers:

• Data Center Investment Surge driving primary market growth as hyperscale data centers and AI-ready facilities require sophisticated UPS systems for critical infrastructure protection

• Government Digitalization Initiatives accelerating market expansion through Digital Cities 2025 program, smart city projects, and public sector IT infrastructure modernization investments

• IT Infrastructure Expansion creating substantial demand for UPS systems as businesses invest in servers, networking equipment, and cloud computing infrastructure requiring power protection

• Power Grid Reliability Challenges promoting UPS system adoption due to power quality issues, voltage fluctuations, and outage risks affecting business continuity operations

• Business Continuity Requirements supporting market growth through regulatory compliance needs, operational risk management, and disaster recovery planning across industries

• Telecommunications Network Expansion generating consistent demand for UPS systems supporting 5G infrastructure, fiber optic networks, and telecommunications facility deployments

• Manufacturing Sector Modernization creating opportunities through industrial automation, process control systems, and smart manufacturing initiatives requiring reliable power backup

Market Challenges:

• High Initial Investment Costs limiting adoption rates among small and medium enterprises due to capital expenditure requirements for quality UPS systems and installation

• Battery Replacement and Maintenance affecting total cost of ownership with periodic battery replacements, maintenance requirements, and technical service needs

• Technical Expertise Shortage constraining market growth due to limited availability of skilled technicians for UPS system installation, maintenance, and troubleshooting services

• Power Quality Variations creating operational challenges for UPS systems due to grid instability, voltage fluctuations, and power quality issues across different regions

• Environmental Compliance Requirements demanding proper battery disposal, recycling programs, and environmental safety standards adherence for UPS system operations

• Technology Evolution Pace requiring continuous upgrades as UPS technology advances and legacy systems become obsolete, affecting replacement planning cycles

• Competition from Alternative Solutions intensifying as battery energy storage systems, fuel cells, and renewable energy solutions compete for power backup applications

Market Opportunities:

• Hyperscale Data Center Development targeting major technology companies establishing large-scale data centers requiring multi-megawatt UPS systems and power protection solutions

• Edge Computing Infrastructure developing distributed computing facilities across cities requiring smaller-scale UPS systems for edge data center and telecommunications applications

• Industrial IoT Implementation creating opportunities for UPS systems supporting connected manufacturing, sensor networks, and automated production line equipment

• Smart Grid Integration implementing UPS systems as distributed energy resources supporting grid stability, peak shaving, and renewable energy integration initiatives

• Healthcare Infrastructure Expansion establishing medical facilities, diagnostic centers, and healthcare IT systems requiring critical power backup for patient safety applications

• Financial Services Network Expansion developing banking infrastructure, payment processing centers, and financial technology facilities requiring high-reliability UPS protection

• Renewable Energy Storage Integration combining UPS systems with solar panels, battery storage, and microgrids for comprehensive energy management solutions

Browse The Full Report with TOC & List of Figures:https://www.imarcgroup.com/philippines-ups-system-market

Philippines UPS System Market Segmentation:

By Product Type:

• Standby UPS

• Line-Interactive UPS

• Online UPS

• Others

By Capacity:

• Less than 5 kVA

• 5-20 kVA

• 20-60 kVA

• Above 60 kVA

By Application:

• Data Centers

• Telecommunications

• Healthcare

• Banking & Finance

• Manufacturing

• Others

By End-User:

• Commercial

• Industrial

• Residential

• Government

By Regional Distribution:

• Luzon

• Visayas

• Mindanao

Philippines UPS System Market News:

September 2025: The Philippines data center market is projected to reach 564.30 MW capacity in 2025 with a robust 18.10% CAGR expected through 2030, driving substantial demand for UPS systems as critical power infrastructure components.

June 2025: The government’s Digital Cities 2025 program identified over 25 priority cities including Batangas, Naga, Cabanatuan, and Iligan for targeted digital infrastructure investment, creating significant opportunities for UPS system deployments.

February 2025: ePLDT announced plans for a 100 MW AI-ready hyperscale data center in South Luzon, representing major UPS system requirements for mission-critical infrastructure protection in advanced computing facilities.

January 2025: The Philippines data center power market was valued at USD 462.90 million in 2025 and is expected to reach USD 833.78 million by 2030, indicating strong UPS system demand growth across the sector.

Key Highlights of the Report:

• Comprehensive market analysis projecting growth from $94.30 million in 2024 to $175.80 million by 2033

• Detailed examination of data center expansion driving primary UPS system demand with hyperscale facility developments

• Strategic assessment of digital transformation initiatives creating opportunities for commercial and industrial UPS applications

• In-depth analysis of government digitalization programs supporting market development through infrastructure investment policies

• Regional market evaluation covering Luzon, Visayas, and Mindanao digital infrastructure development and UPS deployment patterns

• Technology advancement assessment highlighting efficiency improvements and intelligent monitoring capabilities

• End-user segment insights revealing data center, telecommunications, and healthcare sector UPS system requirements

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Philippines’ UPS system market growth to $175.80 million by 2033?

A1: The market is driven by data center investment surge, government digitalization initiatives, IT infrastructure expansion, and power grid reliability challenges. These factors contribute to the robust 7.40% growth rate during the forecast period, with data center capacity expected to reach 564.30 MW in 2025.

Q2: How is data center expansion influencing the UPS system market?

A2: Data center expansion is the primary market driver, with over USD 3 billion in planned investments and 124,000 additional rack spaces expected. Major developments include ePLDT’s 100 MW AI-ready hyperscale data center and the Digital Cities 2025 program targeting 25 priority cities for digital infrastructure investment.

Q3: What role does government digitalization policy play in market development?

A3: Government digitalization initiatives are crucial for market growth, with the Digital Cities 2025 program leading targeted investments in digital infrastructure across priority cities. These initiatives are creating substantial opportunities for UPS system deployments supporting smart city projects and public sector IT infrastructure modernization.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=23616&flag=C

Other Market Reports By IMARC Group:

https://www.imarcgroup.com/philippines-gaming-market

https://www.imarcgroup.com/philippines-football-market

https://www.imarcgroup.com/philippines-board-games-market

https://www.imarcgroup.com/philippines-bottled-water-market

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.