Remittance Market Overview

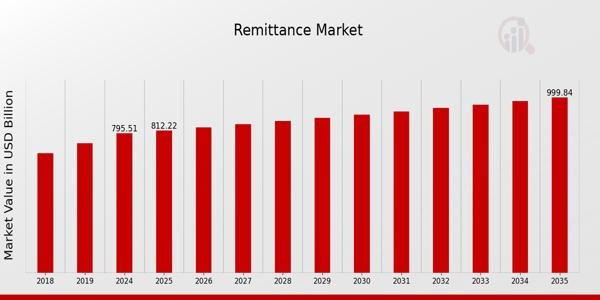

The global remittance market has become a cornerstone of international financial systems, enabling the secure transfer of money across borders. Remittances represent a significant flow of funds sent by migrants to support families, businesses, and investments in their home countries. With globalization accelerating and the workforce becoming increasingly mobile, remittances have transitioned from informal systems to advanced digital platforms. Remittance Market Size is expected to grow from 795.51 (USD Billion) in 2024 to 1,000 (USD Billion) by 2035.

The rise of mobile payment solutions, fintech innovations, and government initiatives has significantly enhanced the transparency, speed, and cost-effectiveness of remittance services. Additionally, the increasing migration trends, especially from developing nations to high-income countries, have boosted the volume and frequency of remittance transactions globally. The market continues to experience steady growth, making it a critical element of the global financial infrastructure.

Market Dynamics and Growth Drivers

Several factors are driving the expansion of the remittance market. First, the growing number of migrant workers worldwide has significantly increased the need for cross-border money transfers. Economic disparities between developed and developing countries encourage labor migration, and remittances act as a lifeline for many families. Second, technological advancements, such as blockchain, artificial intelligence, and cloud computing, are transforming remittance services by reducing transaction costs and enhancing security. The shift from traditional bank transfers to mobile wallets and digital platforms has also improved accessibility for unbanked and underbanked populations. Furthermore, partnerships between financial institutions, fintech companies, and mobile network operators have streamlined the remittance process, offering users faster and cheaper alternatives. Governments and regulatory authorities in many regions are also implementing policies to reduce transfer fees and improve financial inclusion, further fueling market growth.

Click Here to Get Sample Premium Report – https://www.marketresearchfuture.com/sample_request/11999

Impact of Digitalization on Remittance Services

Digitalization has been a game-changer for the remittance market. Mobile apps, online payment gateways, and blockchain-based systems are replacing cash-based and informal transfer methods. Digital channels not only offer convenience but also reduce the risk of fraud and money laundering through enhanced monitoring and compliance. Mobile money platforms have become especially popular in regions like Africa and Southeast Asia, where banking infrastructure may be limited but mobile penetration is high. Companies such as fintech startups and established remittance service providers are investing heavily in technology to expand their customer base and improve operational efficiency. The use of artificial intelligence for fraud detection and blockchain for transparent transactions ensures that digital remittance services are secure, reliable, and cost-effective. As internet connectivity continues to expand globally, the adoption of digital remittance solutions is expected to accelerate further, reshaping the competitive landscape of the industry.

Market Challenges and Restraints

Despite its growth, the remittance market faces several challenges. High transfer fees remain a critical issue in many regions, particularly for low-income migrants sending small amounts of money. Although digital platforms have reduced costs in some corridors, certain routes, especially those involving developing nations, still incur significant charges. Regulatory compliance and anti-money laundering (AML) requirements also pose challenges for service providers, often leading to delays or additional costs. Currency fluctuations and geopolitical tensions can further impact remittance flows, creating uncertainty for both senders and receivers. Additionally, limited digital literacy and internet access in remote areas may hinder the adoption of modern remittance solutions. Service providers must navigate these challenges while continuing to innovate and expand their offerings to meet diverse customer needs.

Future Outlook of the Remittance Market

The future of the remittance market looks promising, with significant opportunities for growth and innovation. Digital wallets, peer-to-peer platforms, and blockchain-based solutions are expected to dominate the market in the coming years. Artificial intelligence and machine learning will play a crucial role in personalizing services, optimizing exchange rates, and detecting fraudulent activities. The adoption of central bank digital currencies and the integration of cryptocurrencies into remittance services could further revolutionize cross-border transactions by reducing costs and settlement times. Emerging markets in Asia-Pacific, Africa, and Latin America are projected to experience the highest growth rates due to rising migration and increasing smartphone penetration. Strategic collaborations between fintech companies, banks, and telecom providers will be essential for capturing market share and delivering seamless customer experiences.

Regional Analysis

• North America: The remittance market in North America is driven by a large immigrant population and a strong financial infrastructure. The United States remains one of the largest sources of remittance outflows, particularly to Latin America and Asia. Digital remittance platforms are increasingly preferred for their convenience and cost-effectiveness.

• Europe: Europe’s remittance market benefits from cross-border labor migration within the European Union as well as from non-EU countries. Regulatory frameworks promoting transparency and competition have led to lower fees and faster transactions. Countries like the UK, Germany, and France are key hubs for remittance outflows.

• Asia-Pacific: Asia-Pacific is the largest recipient of remittances, with countries such as India, China, and the Philippines leading global inflows. The region’s rapidly growing population, combined with high levels of overseas employment, supports market expansion. Mobile wallets and digital solutions are increasingly popular in Southeast Asia and South Asia.

• Middle East and Africa: The Middle East serves as a significant remittance source for South Asia and Africa, with Gulf Cooperation Council (GCC) countries employing millions of migrant workers. In Africa, remittances are a vital economic lifeline, and mobile money services like M-Pesa have transformed the market.

• Latin America: Latin America experiences robust remittance inflows, particularly from the United States and Europe. Countries such as Mexico, Guatemala, and El Salvador are key beneficiaries. The growing use of fintech platforms has simplified the process and reduced costs in the region.

Buy this Premium Research Report | Immediate Delivery Available at – https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=11999

Competitive Landscape

The remittance market is highly competitive, with a mix of established financial institutions, money transfer operators, and fintech startups vying for market share. Major players include Western Union, MoneyGram, Ria Financial, and digital platforms like Wise (formerly TransferWise), Remitly, and PayPal’s Xoom. These companies are focusing on expanding their digital capabilities, forming strategic partnerships, and entering emerging markets to gain a competitive edge. Innovations such as real-time payments, multi-currency wallets, and integration with e-commerce platforms are being introduced to attract new customers. The growing emphasis on user experience, lower fees, and faster transaction times is reshaping competition in the industry.

Opportunities for Market Participants

The shift toward digital solutions presents vast opportunities for remittance service providers. Expanding into underserved regions with high remittance demand but limited financial infrastructure can unlock new revenue streams. Developing user-friendly mobile apps, offering multi-language support, and ensuring competitive exchange rates can enhance customer acquisition and retention. Leveraging blockchain technology and artificial intelligence can improve operational efficiency, reduce costs, and enhance security. Additionally, partnerships with local banks, microfinance institutions, and telecom operators can help providers reach wider audiences. Providers who prioritize transparency, affordability, and customer trust will be well-positioned to capitalize on the growing remittance market.

Browse In-depth Market Research Report – https://www.marketresearchfuture.com/reports/remittance-market-11999

Market Trends

Several emerging trends are shaping the remittance market. The growing adoption of peer-to-peer remittance platforms allows users to transfer money directly, bypassing traditional intermediaries. The integration of cryptocurrencies and stablecoins into remittance services is gaining traction as a means to reduce transaction fees and speed up cross-border transfers. Contactless payment solutions and mobile wallets are becoming the norm, particularly in regions with high smartphone usage. Additionally, governments and international organizations are working to improve remittance corridors by lowering fees and increasing competition among service providers. The focus on financial inclusion has encouraged innovation, making remittance services accessible to previously unbanked populations.

Explore Our Latest Trending Reports:

• Internet of Things Testing Market – https://www.marketresearchfuture.com/reports/internet-of-things-testing-market-2510

• IoT Professional Services Market – https://www.marketresearchfuture.com/reports/iot-professional-services-market-7849

• Data Center Virtualization Market – https://www.marketresearchfuture.com/reports/data-center-virtualization-market-3207

• Asset Reliability Software Market – https://www.marketresearchfuture.com/reports/asset-reliability-software-market-5072

• Law Enforcement Software Market – https://www.marketresearchfuture.com/reports/law-enforcement-software-market-6440

• Real-Time Bidding Market – https://www.marketresearchfuture.com/reports/real-time-bidding-market-7674

• Servicenow Store Apps Market – https://www.marketresearchfuture.com/reports/servicenow-store-apps-market-12029

• Digital Identity in Government Sector Market – https://www.marketresearchfuture.com/reports/digital-identity-in-government-sector-market-12146

• No Code AI Platform Market – https://www.marketresearchfuture.com/reports/no-code-ai-platform-market-11647

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Also, we are launching “Wantstats” the premier statistics portal for market data in comprehensive charts and stats format, providing forecasts, regional and segment analysis. Stay informed and make data-driven decisions with Wantstats.

Contact Us:

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com

This release was published on openPR.