The RF interconnect market is on a remarkable growth trajectory, projected to more than double over the next decade. Valued at USD 36.5 billion in 2025, it is expected to reach USD 75.2 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5%. This growth is being driven by the rapid expansion of high-speed communication networks, the global rollout of 5G infrastructure, and increasing reliance on connected devices across commercial, industrial, and defense sectors.

From telecommunications to aerospace, the need for high-performance RF cables, connectors, and assemblies has never been greater. Innovations in material science, precision engineering, and miniaturization are enhancing durability, signal integrity, and frequency handling capacity, allowing manufacturers to meet the increasingly stringent demands of mission-critical applications.

Full Market Report available for delivery. For purchase or customization, please request here: https://www.futuremarketinsights.com/reports/sample/rep-gb-16646

RF Cable Segment Dominates

Within the RF interconnect market, RF cables are projected to account for 48.7% of revenue in 2025, establishing them as the leading product type. Their dominance is attributed to low signal loss, high shielding effectiveness, and flexibility, which are essential for reliable transmission across communication, broadcasting, and critical signal applications.

Continuous innovations in cable materials, insulation technologies, and compact designs have further reinforced RF cables’ position as the backbone of high-speed data and signal transmission. Their versatility across industries-from defense to smart cities-ensures a steady and growing demand for these essential components.

Frequency Segments: Up to 6 GHz and Beyond

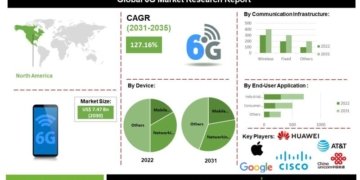

The up to 6 GHz frequency segment leads the market with 54.2% of revenue in 2025, reflecting widespread adoption in cellular communication, Wi-Fi, and defense applications. Its compatibility with existing infrastructure and cost-effectiveness have accelerated deployment, particularly in 5G networks.

Meanwhile, the up to 50 GHz frequency segment, often referred to as super high frequency (SHF), is rapidly expanding with a 41.9% market share, driven by applications in satellite communication, radar systems, and point-to-point microwave links. As more industries adopt high-frequency solutions for data-intensive and precision tasks, demand for both UHF and SHF RF interconnects is expected to continue growing robustly.

Aerospace and Defense Lead End-User Adoption

Aerospace and defense applications are projected to account for 46.5% of total RF interconnect market revenue in 2025, highlighting their critical role. RF interconnect solutions are essential for radar systems, electronic warfare, avionics, and satellite communication, where reliability and high-frequency performance are non-negotiable.

Government investments in defense modernization, satellite programs, and secure communication networks are supporting ongoing demand. RF cables and connectors are vital in mission-critical military electronic systems, ensuring rapid transmission with minimal signal loss under extreme environmental conditions.

Driving Forces Behind Market Expansion

Several factors contribute to the sustained growth of the RF interconnect market:

– 5G and high-speed networks: Expanding communication infrastructure drives demand for advanced cables and connectors.

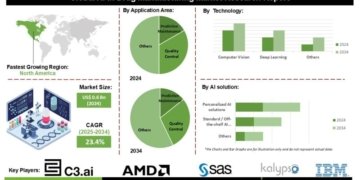

– IoT and smart technology adoption: Smart cities, connected devices, and real-time data transmission require reliable RF interconnect solutions.

– Aerospace and defense modernization: Increasing reliance on radar, avionics, and secure military communication systems fuels growth.

– Material and engineering innovations: New insulation, shielding, and connector designs improve performance and reliability.

Additionally, rising demand for compact, high-frequency connectors is reshaping product development strategies, enabling next-generation IoT applications, autonomous systems, and advanced data centers.

Industrial and Consumer Applications on the Rise

The industrial and ‘others’ segments, which include manufacturing, consumer electronics, telecommunication, and construction, are expected to account for over 61% of market revenue through 2035. Industrial applications are growing at a CAGR of 8.7%, driven by automation, digitization, and high-tech manufacturing needs.

Smart cities, powered by IoT sensors and connected infrastructure, rely on RF interconnects for real-time data collection and transmission, enhancing efficiency and public services. Consumer electronics also drive market expansion as devices demand reliable high-frequency connections for seamless communication and performance.

Request Market Research Draft Report: https://www.futuremarketinsights.com/reports/rf-interconnect-market

Regional Insights: Asia-Pacific and North America Lead

The Asia-Pacific region is projected to dominate the global RF interconnect market with 44% revenue share, fueled by manufacturing expansion, government initiatives, and infrastructure investments. Projects like India’s submarine optical fiber cable to link the Andaman and Nicobar Islands demonstrate regional commitment to high-speed connectivity.

North America is expected to experience strong growth with a CAGR of 8.3%, supported by government regulations, high-speed internet initiatives, and advanced defense infrastructure. In Europe, steady investments in telecommunications and aerospace applications maintain consistent demand, while Latin America and the Middle East show emerging opportunities for growth.

Competitive Landscape and Strategic Initiatives

The RF interconnect market is highly fragmented, with competition based on precision, efficiency, and reliability. Key market players include:

– Penn Engineering Components – Known for precision RF connectors and assembly solutions.

– Jupiter Microwave Components Inc. – Offers high-performance microwave components for commercial and defense sectors.

– Quantic Electronics – Strengthened portfolio through the acquisition of Microwave Dynamics in 2025, enhancing capabilities in amplifiers, oscillators, and frequency converters.

– Amphenol RF – Introduced SMA bulkhead jacks with IP67 rating for extreme environments, expanding its rugged RF connector offerings.

– Delta Electronics, Inc. – Partnered with Microsoft and COBO to develop an open networking switch supporting 800G transmission speeds for data centers.

– Samtec, Cobham Advanced Electronic Solutions, Ducommun, ETL Systems, Smiths Interconnect, DigiLens, Corning Incorporated – Focused on specialty solutions for high-frequency, low-loss transmission across industries.

These established companies, alongside emerging innovators, are leveraging R&D, strategic acquisitions, and partnerships to expand global market share, enhance product capabilities, and meet the evolving demands of high-speed communication networks.

Related Reports:

Digital Forensics Market: https://www.futuremarketinsights.com/reports/digital-forensics-market

ePayment System Market: https://www.futuremarketinsights.com/reports/epayment-system-market

Penetration Testing Market: https://www.futuremarketinsights.com/reports/penetration-testing-market

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware – 19713, USA

T: +1-347-918-3531

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

This release was published on openPR.