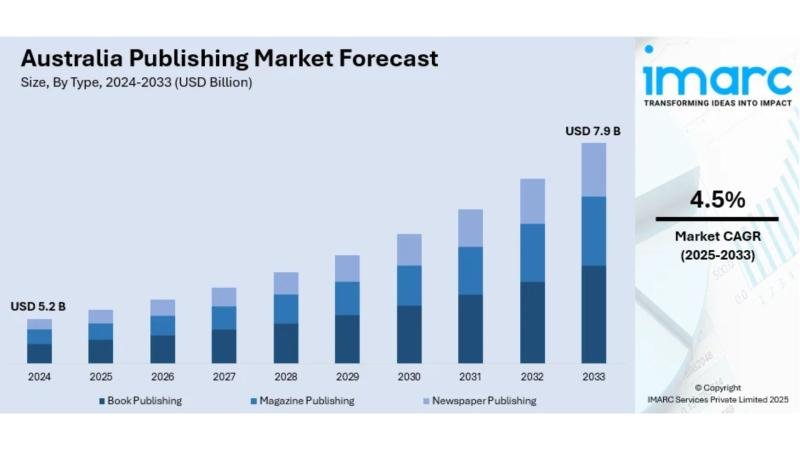

The latest report by IMARC Group, titled “Australia Publishing Market Report by Type (Book Publishing, Magazine Publishing, Newspaper Publishing), Platform (Traditional, Digital), and Region 2025-2033,” offers a comprehensive analysis of the Australia publishing market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia publishing market size reached USD 5.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.9 Billion by 2033, exhibiting a growth rate (CAGR) of 4.5% during 2025-2033.

Report Attributes:

• Base Year: 2024

• Forecast Years: 2025-2033

• Historical Years: 2019-2024

• Market Size in 2024: USD 5.2 Billion

• Market Forecast in 2033: USD 7.9 Billion

• Market Growth Rate 2025-2033: 4.5%

For an in-depth analysis, you can refer to a sample copy of the report: https://www.imarcgroup.com/australia-publishing-market/requestsample

How Is AI Transforming the Publishing in Australia?

• Natural Language Processing technologies are revolutionizing content creation and editorial processes, with AI-powered tools enabling publishers to produce content faster and analyze vast amounts of data for insights.

• Predictive analytics systems are optimizing publishing decisions through data-driven insights, helping publishers identify trending topics and reader preferences to maximize market success rates.

• Automated editorial workflows are streamlining manuscript processing and quality control, with AI tools reducing editing time by up to 40% while maintaining high content standards.

• Personalized content recommendation engines are enhancing reader engagement and book discovery, with algorithms analyzing reading patterns to suggest relevant titles and increase sales conversion.

• AI-driven market analysis platforms are transforming publishing strategies, enabling publishers to forecast demand patterns and optimize print runs with greater accuracy.

Australia Publishing Market Overview

• Digital transformation initiatives are accelerating across the industry, with e-books and audiobooks gaining significant market share while subscription-based models reshape revenue structures.

• Self-publishing platforms are democratizing the industry landscape, allowing independent authors to bypass traditional gatekeepers and reach global audiences directly through digital channels.

• Diverse content demand is expanding market opportunities, with readers increasingly seeking local voices and multicultural narratives that reflect Australia’s inclusive society.

• Educational publishing segments are growing due to expanding educational programs and digital learning platforms that require specialized content delivery systems.

• Social media influence is driving book discovery and reading trends, with platforms like TikTok and Instagram creating viral marketing opportunities for publishers and authors.

Key Features and Trends of Australia Publishing

• Subscription-based reading services are gaining momentum through platforms like Kindle Unlimited and Audible, creating recurring revenue streams while making digital content more accessible to consumers.

• Independent publishing success stories are inspiring more authors to explore self-publishing routes, with platforms generating billions in annual sales and offering higher royalty percentages.

• Cross-platform content strategies are emerging as publishers develop integrated approaches spanning print, digital, audio, and multimedia formats to maximize reach and engagement.

• Collaborative publishing models are evolving through partnerships between traditional publishers and digital platforms, combining editorial expertise with technological distribution capabilities.

• Niche market targeting is becoming profitable as digital platforms enable publishers to serve specialized audiences previously overlooked by mainstream publishing houses.

Growth Drivers of Australia Publishing Market

Market Growth Drivers:

1. Digital Transformation and E-Books – The rapid adoption of e-readers, tablets, and mobile devices is driving demand for digital content, with publishers expanding digital offerings to reach wider audiences and eliminate printing constraints.

2. Rise of Independent and Self-Publishing – Platforms like Amazon KDP and Smashwords are empowering authors to publish independently, with self-published books generating over $1.25 billion in annual sales globally.

3. Increased Demand for Local and Diverse Voices – Growing appetite for authentic Australian stories and multicultural narratives is creating lucrative opportunities for publishers investing in diverse author portfolios.

4. Educational Program Expansion – Increasing investment in education and digital learning platforms is driving demand for specialized educational content and innovative learning materials.

5. Social Media Influence on Reading Trends – Platforms like BookTok and Instagram are creating viral marketing opportunities that significantly impact book sales and discovery patterns.

Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/australia-publishing-market

Innovation & Market Demand of Australia Publishing

• AI-powered content generation tools are enhancing productivity for publishers and authors, with generative AI models helping create initial drafts and supporting creative processes.

• Blockchain technology integration is improving royalty tracking and copyright protection, providing transparent payment systems and reducing disputes between authors and publishers.

• Virtual and augmented reality applications are creating immersive reading experiences, particularly for educational content and interactive storytelling formats.

• Data analytics platforms are optimizing marketing strategies and reader engagement, with publishers using consumer behavior insights to improve targeted advertising and content development.

• Cloud-based publishing workflows are streamlining collaboration between authors, editors, and publishers, reducing production timelines and improving version control across teams.

Australia Publishing Market Opportunities

• Indigenous storytelling expansion is creating significant opportunities for publishers to amplify Aboriginal and Torres Strait Islander voices, supported by government cultural initiatives and growing market interest.

• Educational technology integration offers revenue growth through digital textbooks, interactive learning materials, and adaptive learning platforms that personalize educational experiences.

• International market penetration provides expansion opportunities through digital platforms that enable Australian publishers to reach global audiences without traditional distribution barriers.

• Podcast and audio content development represents emerging revenue streams as audio consumption grows, with publishers converting written content into multimedia formats.

• Corporate publishing services are expanding as businesses require content marketing, thought leadership materials, and internal training resources from professional publishing partners.

Australia Publishing Market Challenges

• Print media declining demand is pressuring traditional revenue models, forcing publishers to adapt business strategies while managing legacy printing infrastructure and distribution networks.

• Digital piracy concerns are impacting revenue streams, with unauthorized content sharing affecting sales particularly for popular titles and educational materials.

• Rising production costs are squeezing profit margins across print and digital formats, including paper costs, printing expenses, and technology infrastructure investments.

• Market saturation from self-publishing platforms is creating intense competition, making it difficult for individual titles to gain visibility in crowded digital marketplaces.

• Changing consumer reading habits are disrupting traditional publishing cycles, with shorter attention spans and preference for bite-sized content challenging conventional book formats.

Australia Publishing Market Analysis

• Market consolidation trends are emerging as larger publishers acquire smaller competitors to achieve economies of scale and expand their digital capabilities and market reach.

• Technology investment requirements are intensifying competitive pressures, with publishers needing to invest in AI tools, data analytics, and digital infrastructure to remain competitive.

• Reader demographics are shifting toward younger, digitally native consumers who prefer multimedia content and expect interactive features in their reading experiences.

• Revenue model diversification is accelerating through subscription services, licensing deals, merchandise sales, and multimedia adaptations of successful literary properties.

• Supply chain optimization initiatives are improving efficiency and reducing costs through print-on-demand services, digital distribution networks, and automated inventory management systems.

Australia Publishing Market Segmentation:

1. By Type:

• Book Publishing

• Magazine Publishing

• Newspaper Publishing

2. By Platform:

• Traditional

• Digital

3. By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Australia Publishing Market News & Recent Developments:

May 2025: Creative Australia hosted the Visiting International Publishers Forum, bringing together industry leaders to discuss global market trends, backlist success strategies, and AI integration opportunities for Australian publishers.

2024: Self-publishing platforms continued their growth trajectory, with independent authors generating over $1.25 billion in annual sales globally, demonstrating the viability of alternative publishing models for Australian content creators.

Australia Publishing Market Key Players:

• HarperCollins Publishers Australia

• Penguin Random House Australia

• Allen & Unwin

• Pan Macmillan Australia

• Hachette Australia

• NewSouth Publishing

• Text Publishing

• Black Inc.

• Scribe Publications

• UQP (University of Queensland Press)

• Murdoch Books

• Thames & Hudson Australia

Key Highlights of the Report:

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=24789&flag=E

FAQs: Australia Publishing Market

Q1: What factors are driving growth in Australia’s publishing market?

A: Key growth drivers include the digital transformation with increasing adoption of e-books and audiobooks, the rise of self-publishing platforms empowering independent authors, growing demand for diverse local voices, expansion of educational programs, and social media influence on reading trends and book discovery.

Q2: How is artificial intelligence impacting the Australian publishing industry?

A: AI is transforming publishing through automated content generation tools, predictive analytics for market insights, streamlined editorial workflows that reduce editing time by 40%, personalized recommendation engines, and data-driven publishing strategies that optimize print runs and marketing efforts.

Q3: What challenges does Australia’s publishing industry face?

A: Major challenges include declining demand for print media, digital piracy concerns affecting revenue, rising production costs across formats, market saturation from self-publishing platforms creating intense competition, and changing consumer reading habits toward shorter, multimedia content.

Q4: Which publishing segments show the strongest growth potential?

A: Digital platforms show the strongest growth, particularly e-books and audiobooks, while educational publishing benefits from expanding programs and digital learning platforms. Self-publishing continues growing with over $1.25 billion in global annual sales.

Q5: What opportunities exist for new entrants in Australia’s publishing market?

A: Emerging opportunities include Indigenous storytelling expansion, educational technology integration, international market penetration through digital platforms, podcast and audio content development, and corporate publishing services for business content marketing needs.

Conclusion of Report:

Australia’s publishing market stands at a transformative crossroads, where traditional publishing models are evolving to embrace digital innovation and diverse content demands. With the market projected to grow from USD 5.2 billion to USD 7.9 billion over the next decade, publishers who successfully navigate the digital transformation while championing local voices and leveraging AI technologies will capture the greatest opportunities. The rise of self-publishing platforms has democratized content creation, generating over $1.25 billion globally and empowering Australian authors to reach international audiences. While challenges such as market saturation and changing consumer habits persist, the fundamental shift toward digital-first strategies, combined with Australia’s rich storytelling tradition and multicultural perspective, positions the industry for sustained growth and global relevance in an increasingly connected world.

Contact Us:

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

About Us:

IMARC Group is a leading market research company that provides management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our solutions include comprehensive market intelligence, custom consulting, and actionable insights to help organizations make informed decisions and achieve sustainable growth.

This release was published on openPR.