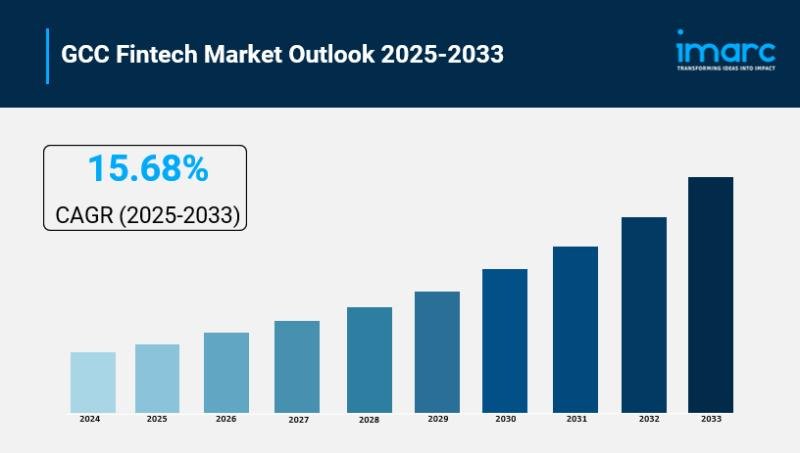

GCC Fintech Market Overview

Market Growth Rate 2025-2033: 15.68%

According to IMARC Group’s latest research publication, “GCC Fintech Market Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033”, the GCC fintech market size is projected to exhibit a growth rate (CAGR) of 15.68% during 2025-2033.

How AI is Reshaping the Future of GCC Fintech Market

● AI is transforming the GCC fintech market by boosting efficiency in banking operations, automating customer service, and enabling data-driven decision-making, reducing costs significantly.

● Governments in the UAE, Saudi Arabia, and Bahrain are supporting AI-driven fintech innovation through regulatory sandboxes and fintech hubs, fostering startups and streamlining product launches.

● AI-powered tools improve fraud detection and personalized financial services in the GCC, helping banks and fintechs better understand customer needs while securing transactions.

● The rise of AI-native fintech startups in the GCC, supported by investments and innovation hubs like Dubai’s DIFC, challenges traditional banks and accelerates digital financial transformation.

● AI integration with open banking APIs enables highly personalized financial products and seamless customer experiences, driving both financial inclusion and market competitiveness across the region.

Grab a sample PDF of this report: https://www.imarcgroup.com/gcc-fintech-market/requestsample

GCC Fintech Market Trends & Drivers:

The GCC fintech market is thriving thanks to increasing digital adoption and smartphone penetration across the region. Consumers are embracing mobile wallets, digital payments, and online banking solutions for their convenience and speed. This surge in digital financial activities is supported by governments launching initiatives like Saudi Arabia’s Fintech Saudi and the UAE’s regulatory sandboxes, which encourage innovation and the smooth rollout of fintech services. Banks and startups alike are tapping into AI and big data to create seamless customer experiences, making financial services more accessible, especially for the younger, tech-savvy population driving demand.

Regulatory support and government backing play a pivotal role in accelerating fintech growth in the GCC. Governments in the UAE, Bahrain, and Saudi Arabia are actively creating fintech-friendly ecosystems, offering incentives, updated regulations, and innovation hubs to attract fintech firms. These efforts improve compliance processes, promote financial inclusion, and provide secure frameworks for emerging digital solutions like blockchain, AI-powered payments, and open banking APIs. This encouragement not only strengthens local fintech capabilities but also turns the GCC into a competitive fintech hub on the global stage.

Another significant trend is the rise of embedded finance and AI-driven personalization within the GCC fintech space. Financial services are increasingly integrated into non-financial platforms, offering users instant credit, insurance, or payment options right where they interact daily, like e-commerce or ride-hailing apps. AI algorithms analyze user behavior to tailor services in real-time, enhancing convenience and satisfaction. Companies like Emirates NBD and Network International are leading this innovation wave, leveraging strategic partnerships and AI to reshape how financial services are delivered, making them more intuitive and responsive to individual customer needs.

GCC Fintech Industry Segmentation:

The report has segmented the market into the following categories:

Deployment Mode Insights:

● On-premises

● Cloud-based

Technology Insights:

● Application Programming Interface

● Artificial Intelligence

● Blockchain

● Robotic Process Automation

● Data Analytics

● Others

Application Insights:

● Payment and Fund Transfer

● Loans

● Insurance and Personal Finance

● Wealth Management

● Others

End User Insights:

● Banking

● Insurance

● Securities

● Others

Country Insights:

● Saudi Arabia

● UAE

● Qatar

● Bahrain

● Kuwait

● Oman

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=10530&flag=E

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in GCC Fintech Market

● August 2025: GCC fintech investments are smashing records, with more than $6.1 billion raised in just the first half of this year-a 37% jump compared to last year. Driving this is not only a sharp rise in funding for digital payments and open banking, but also the strong push by governments and new regulatory sandboxes that welcome startups in sectors like digital assets and AI-driven finance. As a result, about 65% of regional consumers now say they prefer digital-first financial services, marking a major cultural shift towards a cashless, tech-enabled society.

● July 2025: The UAE continues to lead the GCC’s startup and fintech boom, registering over 5,600 startups in a single recent quarter-more than any other country in the region. Fintechs in the UAE benefit from investor-friendly free zones and initiatives like Hub71, which attracted $224 million in early-stage investments this year and helped create more than 400 jobs. Meanwhile, Oman rolled out its regulated fintech sandbox, focusing on digital payments, blockchain, and open banking to accelerate responsible innovation in the broader Gulf region.

● July 2025: Fintech platforms specializing in SME support are gaining real traction across the GCC. Omnispay, a UAE-based digital payments platform for small businesses, secured $1.5 million in seed funding to expand its offering for SMEs. Other notable moves include the partnership between Paymob and Tamara to revolutionize SME payment solutions and the rapid funding success of companies like FlapKap ($34 million) and Pemo ($7 million), which are streamlining spend management and digital lending for businesses in the region.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.