Overview of the Fintech as a Service Market

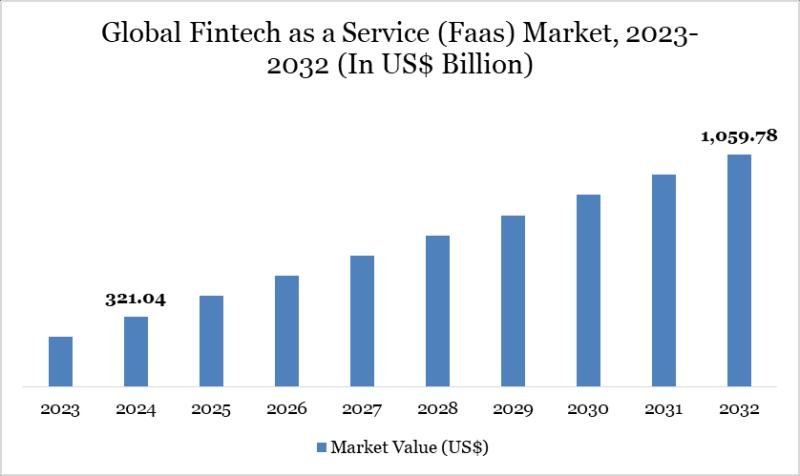

Global Fintech as a Service (Faas) Market reached US$ 321.04 billion in 2024 and is expected to reach US$ 1,059.78 billion by 2032, growing with a CAGR of 16.10% during the forecast period 2025-2032.

The global Fintech as a Service market has witnessed significant growth over the past few years, driven by increasing demand across multiple industries and advancements in technology. The market is characterized by rising adoption of innovative solutions, growing consumer awareness, and supportive government regulations in major economies. As industries continue to prioritize efficiency, sustainability, and cost optimization, Fintech as a Service is becoming a critical enabler of business transformation.

Download exclusive insights with our detailed sample report (Corporate Email ID gets priority access): https://www.datamintelligence.com/download-sample/fintech-as-a-service-market?ophp

Fintech as a Service Market Report by DataM Intelligence offers a detailed assessment of the global fintech and digital financial infrastructure landscape, highlighting market size, key players, and critical growth drivers. With the rise of embedded finance, open APIs, and AI-powered platforms, the report delivers strategic insights from 2025 to 2033. In 2025, fintech adoption surged alongside generative AI integration, enhancing customer experience and operational efficiency. Major U.S. financial institutions invested heavily in digital infrastructure and began implementing new data-access models that may reshape partnerships with fintech providers.

Key Highlights from the Report

➤ The Fintech as a Service market is projected to grow at a CAGR of 16.10% between 2025-2032.

➤ Payments segment accounted for the largest market share in 2024.

➤ North America emerged as the dominant regional market.

➤ Strategic collaborations and M&A activities are shaping the competitive landscape.

➤ Sustainability and digital transformation are creating new opportunities in the market.

Market Segmentation

By Type (Payments as a Service, Banking as a Service (BaaS), Lending as a Service, Insurance as a Service (InsurTech), Others), By Deployment (Cloud-Based, On-Premises, Hybrid), By Technology (API-based Services, Blockchain, AI & Machine Learning, Robotic Process Automation (RPA), Others), By Application (Banks & Financial Institutions, Insurance Companies, Fintech Startups, eCommerce & Retail Businesses, Telecom Companies, Government Agencies, Others)

Looking for in-depth insights? Grab the full report: https://www.datamintelligence.com/buy-now-page?report=fintech-as-a-service-market

Regional Insights

The global Fintech as a Service market demonstrates strong performance across multiple regions:

• North America leads the market due to high adoption rates, strong R&D activities, and the presence of key market players.

• Europe benefits from stringent regulations, increasing focus on sustainability, and government-backed innovation programs.

• Asia-Pacific is expected to witness the fastest growth during the forecast period, fueled by rapid industrialization, growing consumer base, and rising investment in infrastructure.

• Latin America and Middle East & Africa are also showing promising growth, supported by economic reforms and foreign direct investments.

Market Drivers

The fintech as a service market is expanding rapidly due to the rising demand for digital banking, mobile payments, and embedded finance solutions across industries. Drivers include increasing adoption of APIs and cloud-based services, the need for faster financial transactions, and regulatory support for open banking. Small and medium-sized enterprises (SMEs) are increasingly leveraging FaaS platforms to reduce costs and improve customer experience, further accelerating market growth.

Reasons to Buy the Report

✔ Comprehensive market insights with accurate growth projections through 2032.

✔ In-depth segmentation analysis to identify high-growth areas.

✔ Regional breakdown highlighting key opportunities across global markets.

✔ Competitive landscape profiling leading players and recent strategic moves.

✔ Actionable insights for investors, policymakers, and industry stakeholders.

Frequently Asked Questions (FAQs)

◆ How Big is the Global Fintech as a Service Market?

◆ Who are the Key Players in the Fintech as a Service Industry?

◆ What is the Projected Growth Rate (CAGR) of the Market from 2025 to 2032?

◆ What is the Forecast Value of the Market by 2032?

◆ Which Region is Expected to Dominate the Market During the Forecast Period?

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/fintech-as-a-service-market?ophp

Company Insights

Key players operating in the Fintech as a Service market include:

Finastra, Stripe, Inc, Rapyd Financial Network Ltd, foo.mobi, Solid Financial Technologies, Inc, Synctera Inc, SAP Fioneer, TCS BaNCS, PayMate, Backbase and among others.

Recent Developments

➠ In 2024, Global financial technology leader FIS had launch of its 2024 FIS Fintech Hangout Series, an initiative that fosters and connects fintech startups, investors, financial institutions, FIS experts, and participants from the FIS Fintech Accelerator Program.

➠ Stripe, a leading FaaS provider, powers embedded payment infrastructure for platforms like Shopify and Amazon, enabling seamless transactions across geographies. The market is expanding across regions, with fintech-friendly regulations in the EU, India, and the US fostering innovation. As both startups and large enterprises increasingly look for cost-effective, scalable, and secure fintech solutions, the FaaS model is becoming a foundational pillar in the evolving digital finance ecosystem.

Conclusion

The global Fintech as a Service market is positioned for significant growth, driven by strong demand across industries, technological innovation, and supportive regulatory environments. While challenges such as high costs and regulatory hurdles exist, emerging opportunities in digital transformation, sustainability, and new applications are expected to create profitable pathways for market players. Companies that invest in innovation and strategic collaborations will remain at the forefront of this evolving landscape.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription?harssh

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights-all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Consumer Behavior & Demand Analysis

Contact Us –

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us –

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.