OMER, Israel, Aug. 13, 2025 (GLOBE NEWSWIRE) — Odysight.ai Inc. (NASDAQ: ODYS), a leading provider of visual based predictive maintenance (PdM) and condition-based monitoring (CBM) solutions, announces its financial results for the first half of 2025 and provides a business update.

Key highlights for the six months ended June 30,2025

- Revenue of $2.4 million.

- Net cash position1 of approximately $33.2 million as of June 30, 2025.

- Uplisted to the Nasdaq Capital Markets; added to the Russell Microcap® Index.

- Strengthened global presence with commercial achievements:

| – | Delivered system for the Heron TP UAV platform with Israeli ministry of defense (MOD) and Israeli Air Force (IAF). | |

| – | Signed a strategic partnership with a multinational technology group to integrate Odysights’s predictive health monitoring (PHM) system on several platforms. | |

| – | Received a PO from a European partner for an industrial solution to be deployed in various industrial sectors such as cranes, elevators and transportation systems. | |

| – | Partnered with Israel Railways to deploy Odysight’s PHM system to prevent derailments and enhance railway safety. | |

Einav Brenner, Chief Financial Officer of Odysight.ai: “During the second quarter, we deepened our partnerships with tier-one customers and advanced the development and integration of our predictive maintenance system, which monitors critical conditions across key industrial sectors. This supports our ongoing transition toward the aerospace and defense sectors, a shift initiated last year that may lead to short-term fluctuations in our quarterly revenues. We are proud our system was selected for deployment on the Heron TP – a Medium Altitude Long Endurance (MALE) unmanned aerial vehicle (UAV) and a strategic asset to the Israeli Ministry of Defense and Air Force. We also signed an agreement with a multinational technology group operating in defense, mining, agriculture and autonomous vehicles. This collaboration strengthens our partner’s global position as a leader in critical systems and marks a key milestone in expanding our predictive maintenance technology beyond aviation. As we scale initial orders and lay the groundwork for broader global collaborations, we are encouraged by the strong technological performance of our solutions and optimistic that early traction will translate into financial results.”

Financial highlights for the six months ended June 30, 2025

Revenues were approximately $2.4 million, compared to $1.4 million from the six months ended June 30, 2024. The increase was primarily attributed to the full recognition of approximately $1.7 million in revenues from the fulfillment of a contract with a Fortune 500 medical company and to an increase in revenues from our vision-based platform solutions for PdM and CBM.

Backlog2 was approximately $14.4 million as of June 30, 2025.

Cost of Revenues was $1.8 million, compared to $1.1 million for the six months ended June 30, 2024. The increase was primarily attributed to approximately $1.0 million in cost of revenues related to the fulfillment of a contract with a Fortune 500 medical company, to the recognition of an inventory impairment of $0.2 million, and to an increase in revenues from our vision-based platform solutions for PdM and CBM.

Gross Profit was $0.7 million, reflecting a gross margin of approximately 28%, compared to gross profit of $0.3 million and gross margin of approximately 21%, for the six months ended June 30, 2024.

1 Including cash, cash equivalents and restricted cash.

2 Backlog is measured and defined differently by companies within our industry. We refer to “backlog” as our booked orders based on purchase orders or hard commitments but not yet recognized as revenue. Backlog is not a comprehensive indicator of future revenue and is not a measure of profitability. Orders included in backlog may be cancelled or rescheduled by customers. A variety of conditions, both specific to the individual customer and generally affecting the customer’s industry, may cause customers to cancel, reduce or delay orders that were previously made or anticipated. Projects may remain in backlog for extended periods of time.

Operating expenses were $9.7 million, compared to $6.0 million for the six months ended June 30, 2024. The increase was primarily driven by the expansion of the Company’s operations, including the development of new Industry 4.0 products, efforts to penetrate new markets and enhance product visibility, as well as one-time expenses related to the Company’s uplisting to Nasdaq.

Net loss was $8.3 million, compared to $5.3 million for the six months ended June 30, 2024.

Cash Balance1 as of June 30, 2025 was $33.2 million, compared to approximately $13.6 million as of June 30, 2024. In February 2025, the Company uplisted to the Nasdaq Capital Market and completed a U.S. underwritten public offering with gross proceeds of approximately $23.7 million.

Financial highlights for three months ended June 30, 2025

Revenues were approximately $0.4 million, compared to $1.2 million from the three months ended June 30, 2024. The decrease in revenues was primarily attributable to the decrease in revenues from the Fortune 500 medical company customer.

Cost of Revenues was $0.2 million, compared to $0.7 million for the three months ended June 30, 2024. The decrease was primarily attributed to the decrease in delivery to the Fortune 500 medical company customer.

Gross Profit was $0.1 million, reflecting a gross margin of 37%, compared to gross profit of $0.5 million and gross margin of approximately 44%, for the three months ended June 30, 2024.

Operating expenses were $4.6 million, compared to $2.9 million for the three months ended June 30, 2024. The increase was primarily driven by the expansion of the Company’s operations, including the development of new Industry 4.0 products, efforts to penetrate new markets and enhance product visibility

Net loss was $4.1 million, compared to $2.2 million for the three months ended June 30, 2024.

About Odysight.ai

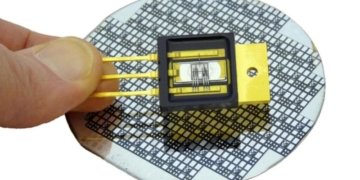

Odysight.ai is pioneering the Predictive Maintenance (PdM) and Condition Based Monitoring (CBM) markets with its visualization and AI platform. Providing video sensor-based solutions for critical systems in the aviation, transportation, and energy industries, Odysight.ai leverages proven visual technologies and products from the medical industry. Odysight.ai’s unique video-based sensors, embedded software, and AI algorithms are being deployed in hard-to-reach locations and harsh environments across a variety of PdM and CBM use cases. Odysight.ai’s platform allows maintenance and operations teams visibility into areas which are inaccessible under normal operation, or where the operating ambience is not suitable for continuous real-time monitoring.

We routinely post information that may be important to investors in the Investors section of our website. For more information, please visit: https://www.odysight.ai or follow us on Twitter, LinkedIn and YouTube.

Backlog

We present our results of operations in a way that we believe will be the most meaningful and useful to investors, analysts, rating agencies and others who use our financial information to evaluate our performance. Backlog is presented for supplemental informational purposes only, and is not intended to be a substitute for any GAAP financial measures, including revenue or net income (loss), and, as calculated, may not be comparable to companies in other industries or within the same industry with similarly titled measures of performance. In addition, backlog should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. Therefore, backlog should be considered in addition to, not as a substitute for, or in isolation from, measures prepared in accordance with GAAP.

1 Including cash, cash equivalents and restricted cash.

Forward-Looking Statements

Information set forth in this news release contains forward-looking statements within the meaning of safe harbor provisions of the Private Securities Litigation Reform Act of 1995 relating to future events or our future performance. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including, but not limited to, statements regarding long-term growth prospects. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology. Those statements are based on information we have when those statements are made or our management’s current expectation and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward- looking statements. Factors that may affect our results, performance, circumstances or achievements include, but are not limited to the following: (i) market acceptance of our existing and new products, including those that utilize our micro Odysight.ai technology or offer Predictive Maintenance and Condition Based Monitoring applications, (ii) lengthy product delays in key markets, (iii) an inability to secure regulatory approvals for the sale of our products, (iv) intense competition in the medical device and related industries from much larger, multinational companies, (v) product liability claims, product malfunctions and the functionality of Odysight.ai’s solutions under all environmental conditions, (vi) our limited manufacturing capabilities and reliance on third-parties for assistance, (vii) an inability to establish sales, marketing and distribution capabilities to commercialize our products, (viii) an inability to attract and retain qualified personnel, (ix) our efforts obtain and maintain intellectual property protection covering our products, which may not be successful, (x) our reliance on a single customer that accounts for a substantial portion of our revenues, (xi) our reliance on single suppliers for certain product components, including for miniature video sensors which are suitable for our Complementary Metal Oxide Semiconductor technology products, (xii) the fact that we will need to raise additional capital to meet our business requirements in the future and that such capital raising may be costly, dilutive or difficult to obtain, (xiii) the impact of computer system failures, cyberattacks or deficiencies in our cybersecurity, (xiv) the fact that we conduct business in multiple foreign jurisdictions, exposing us to foreign currency exchange rate fluctuations, logistical, global supply chain and communications challenges, burdens and costs of compliance with foreign laws and political and economic instability in each jurisdiction, including the adoption or expansion of economic sanctions, tariffs or trade restrictions and (xv) political, economic and military instability in Israel, including the impact of Israel’s war against Hamas, Hezbollah and Iran. These and other important factors discussed in Odysight.ai’s Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on March 26, 2025, and our other reports filed with the SEC, could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release. Except as required under applicable securities legislation, Odysight.ai undertakes no obligation to publicly update or revise forward-looking information.

Company Contact:

Einav Brenner, CFO

info@odysight.ai

Investor Relations Contact:

Miri Segal

MS-IR LLC

msegal@ms-ir.com

Tel: +1-917-607-8654

ODYSIGHT.AI INC.

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

| Six months ended June 30, | Three months ended June 30, | |||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Unaudited | ||||||||||||||||

| USD in thousands | ||||||||||||||||

| REVENUES | 2,427 | 1,368 | 362 | 1,181 | ||||||||||||

| COST OF REVENUES | 1,756 | 1,077 | 229 | 667 | ||||||||||||

| GROSS PROFIT | 671 | 291 | 133 | 514 | ||||||||||||

| RESEARCH AND DEVELOPMENT EXPENSES | 4,843 | 2,975 | 2,356 | 1,408 | ||||||||||||

| SALES AND MARKETING EXPENSES | 1,024 | 459 | 628 | 225 | ||||||||||||

| GENERAL AND ADMINISTRATIVE EXPENSES | 3,802 | 2,585 | 1,587 | 1,245 | ||||||||||||

| OPERATING LOSS | (8,998 | ) | (5,728 | ) | (4,438 | ) | (2,364 | ) | ||||||||

| FINANCING INCOME, NET | 658 | 384 | 363 | 182 | ||||||||||||

| NET LOSS | (8,340 | ) | (5,344 | ) | (4,075 | ) | (2,182 | ) | ||||||||

ODYSIGHT.AI INC.

INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS

| June 30, 2025 | December 31, 2024 | |||||||

| Unaudited | Audited | |||||||

| USD in thousands | ||||||||

| Assets | ||||||||

| CURRENT ASSETS: | ||||||||

| Cash and cash equivalents | 32,910 | 18,164 | ||||||

| Restricted cash | 328 | – | ||||||

| Restricted deposit | – | 322 | ||||||

| Accounts receivable | 509 | 1,510 | ||||||

| Inventory | – | 203 | ||||||

| Other current assets | 1,138 | 588 | ||||||

| Total current assets | 34,885 | 20,787 | ||||||

| NON-CURRENT ASSETS: | ||||||||

| Contract fulfillment assets | – | 1,017 | ||||||

| Property and equipment, net | 379 | 407 | ||||||

| Operating lease right-of-use assets | 919 | 1,113 | ||||||

| Severance pay asset | 280 | 259 | ||||||

| Other non-current assets | 96 | 96 | ||||||

| Total non-current assets | 1,674 | 2,892 | ||||||

| TOTAL ASSETS | 36,559 | 23,679 | ||||||

| Liabilities and shareholders’ equity | ||||||||

| CURRENT LIABILITIES: | ||||||||

| Accounts payable | 554 | 442 | ||||||

| Contract liabilities – short term | 279 | 702 | ||||||

| Operating lease liabilities – short term | 538 | 539 | ||||||

| Accrued compensation expenses | 1,329 | 1,124 | ||||||

| Related parties | 155 | 120 | ||||||

| Other current liabilities | 439 | 368 | ||||||

| Total current liabilities | 3,294 | 3,295 | ||||||

| NON-CURRENT LIABILITIES: | ||||||||

| Contract liabilities – long term | – | 1,373 | ||||||

| Operating lease liabilities – long term | 381 | 508 | ||||||

| Liability for severance pay | 280 | 259 | ||||||

| Total non-current liabilities | 661 | 2,140 | ||||||

| TOTAL LIABILITIES | 3,955 | 5,435 | ||||||

| SHAREHOLDERS’ EQUITY: | ||||||||

| Common stock, $0.001 par value; 300,000,000 shares authorized as of June 30, 2025 and December 31, 2024, 16,326,656 and 12,612,517 shares issued and outstanding as of June 30, 2025 and December 31, 2024, respectively | 17 | 13 | ||||||

| Additional paid-in capital | 86,901 | 64,205 | ||||||

| Accumulated deficit | (54,314 | ) | (45,974 | |||||

| TOTAL SHAREHOLDERS’ EQUITY | 32,604 | 18,244 | ||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | 36,559 | 23,679 | ||||||