Mordor Intelligence has published a new report on the Optical Transceiver Market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Optical Transceiver Market Overview

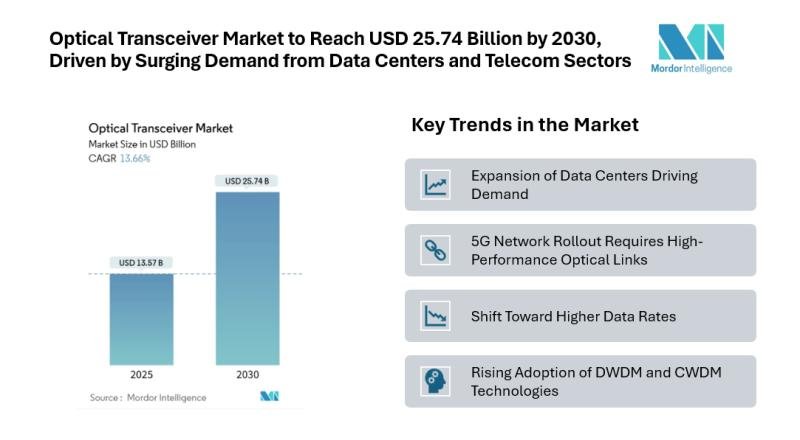

The global optical transceiver market is projected to grow from USD 13.57 billion in 2025 to USD 25.74 billion by 2030, registering a CAGR of 13.66% during the forecast period (2025-2030). The rise of cloud services, high-bandwidth applications, and expansion of 5G networks are expected to significantly influence market demand.

The growing reliance on high-speed internet and increasing global data traffic are placing new demands on network infrastructure. Optical transceivers, as key enablers of fiber optic communication, are now essential components for telecom operators, hyperscale data centers, and enterprise networks alike.

As businesses continue to adopt cloud computing, artificial intelligence workloads, and Internet of Things (IoT) applications, the need for fast, scalable, and reliable network connections has never been greater. Optical transceivers, which convert electrical signals into optical ones and vice versa, support these functions by allowing efficient data transmission over long distances with minimal latency and signal loss.

Report Overview: https://www.mordorintelligence.com/industry-reports/optical-transceiver-market?utm_source=openpr

Optical Transceiver Market Key Trends

Expansion of Data Centers Driving Demand

The growth of hyperscale and edge data centers is one of the primary factors boosting the demand for optical transceivers. Organizations across the globe are increasing their investments in data infrastructure to support cloud computing, AI workloads, and streaming services. These facilities require high-speed interconnects and low-latency networks, which optical transceivers help enable through efficient and long-distance data transmission.

5G Network Rollout Requires High-Performance Optical Links

As telecom operators continue to roll out 5G infrastructure, the need for optical transceivers in front-haul, mid-haul, and back-haul network segments is growing. Optical modules are vital in ensuring low latency, high bandwidth, and reliable connections between 5G base stations and the core network. This trend is particularly strong in regions like Asia-Pacific and North America, where 5G deployments are rapidly scaling.

Shift Toward Higher Data Rates

There is a growing move from 10 Gbps and 25 Gbps modules toward higher-speed optical transceivers, especially those supporting 100 Gbps, 200 Gbps, and 400 Gbps speeds. This shift is being driven by applications that require greater bandwidth, such as real-time video streaming, AI processing, and cloud-based services. High-speed transceivers are becoming standard in large-scale networks due to their ability to handle larger volumes of data more efficiently.

Rising Adoption of DWDM and CWDM Technologies

To maximize the capacity of existing fiber networks, many network operators are turning to Dense Wavelength Division Multiplexing (DWDM) and Coarse Wavelength Division Multiplexing (CWDM) technologies. These methods allow multiple data streams to be sent over a single optical fiber, significantly increasing bandwidth without the need for new infrastructure. Optical transceivers compatible with DWDM and CWDM are seeing increased adoption across telecom and enterprise networks.

Miniaturization and Form Factor Optimization

There is increasing demand for compact and energy-efficient transceivers that can be densely packed into switches and routers. Form factors like QSFP28, QSFP-DD, and OSFP are gaining popularity as they support high data rates while maintaining a small footprint. This trend supports the growing need for space-saving designs in high-performance computing and cloud environments.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/optical-transceiver-market?utm_source=openpr

Optical Transceiver Market Segmentation:

The optical transceiver market is diverse, spanning multiple segments based on protocol, data rate, form factor, fiber type, distance, application, and geography.

By Protocol:

Ethernet

InfiniBand

Fiber Channel

CWDM/DWDM

FTTx/PON

Other Protocols

By Data Rate:

Less than 10 Gbps

10 to 40 Gbps

40 to 100 Gbps

100 to 400 Gbps

Greater than 400 Gbps

By Form Factor:

SFP/SFP+

QSFP/QSFP+

QSFP28/QSFP-DD

CFP/CFP2/CFP4

OSFP

Others

By Fiber Type:

Single-Mode

Multi-Mode

By Reach Distance:

Short-Reach (Less than 10 km)

Medium-Reach (10 – 40 km)

Long-Reach (Greater than 40 km)

By Application:

Data Centers

Telecommunications

Enterprise/Campus

Industrial and Others

By Geography:

North America: United States, Canada, Mexico

South America: Brazil, Argentina, Rest of South America

Europe: United Kingdom, Germany, France, Spain, Italy, Russia, Rest of Europe

Asia-Pacific: China, India, Japan, South Korea, Australia, Rest of Asia-Pacific

Middle East: GCC, Rest of Middle East

Africa: South Africa, Nigeria, Egypt, Rest of Africa

Asia-Pacific, particularly countries like China, Japan, and India, is expected to see fast growth, driven by aggressive 5G rollout and investments in large-scale data centers. North America remains a major market with heavy demand from cloud providers and enterprises.

Explore Our Full Library of Technology, Media and Telecom Research Industry Reports – https://www.mordorintelligence.com/market-analysis/technology-media-and-telecom?utm_source=openpr

Key Players

The market includes several well-established companies that are known for delivering reliable, high-performance optical transceivers tailored for various use cases:

Coherent Corp. – A leading supplier of optical components, Coherent offers a wide range of transceivers for high-speed data and telecom networks.

Accelink Technologies – This China-based company provides optical modules and subsystems for telecom and data center customers globally.

Sumitomo Electric Industries – Known for its innovation in fiber optics, Sumitomo manufactures a broad range of optical devices and modules.

Fujitsu Optical Components – Fujitsu specializes in high-speed transceivers that support next-generation communication networks.

Lumentum Holdings – A major name in optical networking, Lumentum provides optical transceivers used in both datacom and telecom applications.

These companies continue to enhance their product portfolios to meet growing demand for higher bandwidth, longer reach, and compact form factors, ensuring compatibility with new network architectures and standards.

Conclusion

The optical transceiver market is poised for steady growth, supported by expanding data infrastructure, rising adoption of high-speed internet, and the global shift toward 5G. With applications spanning telecom, data centers, and enterprise networking, the demand for reliable and scalable optical components is expected to continue rising over the next several years.

Industry Related Reports

Fiber Optic Cable Market

The Fiber Optic Cable Market Report is Segmented by Cable Type (Armored Cable, Non-Armored Cable, Ribbon Cable, and Other), Fiber Mode (Single-Mode Fiber, Multi-Mode Fiber, and Plastic Optical Fiber), Installation Type (Aerial/Overhead, Underground/Buried, and More), End-User Industry (Telecommunication, Power Utilities and Smart Grid, Defense and Aerospace, Industrial Automation and Control, and More), and Geography.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/fiber-optic-cable-market?utm_source=openpr

Submarine Optical Fiber Cable Market

The Submarine Optical Fiber Cable Market Report is Segmented by Geography (Trans-Pacific, Trans-Atlantic, United States-Latin America, Intra Asia, Europe-Asia, and Europe-Sub-Saharan Africa). The Market Sizes and Forecasts are Provided in Terms of Value (USD) for all the Above Segments.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/submarine-optical-fiber-cable-market?utm_source=openpr

Brazil Optical Transceiver Market

Brazil Optical Transceiver Market Report is Segmented by Protocol (Ethernet, Fiber Channels (including FTTx), CWDM/DWDM, and Other Protocols), Data Rate (less Than 10 Gbps, 10 Gbps To 40 Gbps, 41 Gbps To 100 Gbps, Greater Than 100 Gbps (including 400 Gbps)), Application (Data Center, Telecommunication, and Other Applications). The Report Offers Market Sizes and Forecasts in Value (USD) for all the Above Segments.

To know more visit this link: https://www.mordorintelligence.com/industry-reports/brazil-optical-transceiver-market?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana – 500032, India

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.