InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the “Global Digital Payment Market- (By Offering (Solutions (Payment Gateway, Payment Processors, Payment Wallet, Point of Sale, and Other Solutions), Services (professional services (Consulting, Implementation, Support & Maintenance), Managed Services), By Transaction Type (Domestic and Cross Border), Payment Mode (Cards, Digital Wallet, ACH Transfer), By Vertical (BFSI, Retail & E-commerce, Healthcare, Travel & Hospitality, IT & ITeS, Telecom, Transportation & Logistics, Media & Entertainment, Other Verticals)), Trends, Industry Competition Analysis, Revenue and Forecast To 2034.”

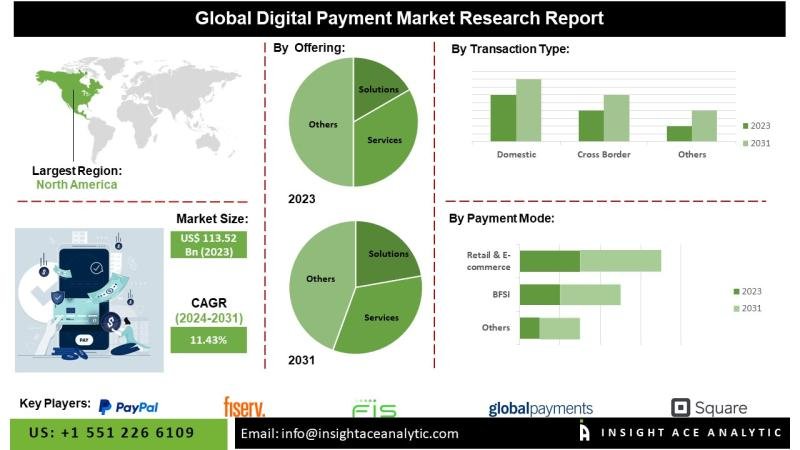

According to the latest research by InsightAce Analytic, the Global Digital Payment Market is valued at US$ USD 124.8 Billion in 2024, and it is expected to reach USD 357.7 Billion by the year 2034, with a CAGR of 11.2% during a forecast period of 2025-2034.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/2168

Digital payments encompass the electronic transfer of monetary value conducted by individuals, businesses, or organizations through various digital platforms. These transactions include online payments, mobile-based payments, contactless solutions, and digital wallet usage. Facilitated by advancements in internet connectivity, mobile technology, and secure payment infrastructure, digital payments provide a seamless and secure alternative to conventional financial transactions. In recent years, the digital payment landscape has undergone significant growth and innovation, fundamentally transforming the way financial transactions are carried out by both consumers and enterprises.

The digital payments market is characterized by intense competition, with participants ranging from traditional financial institutions and major technology firms to agile fintech startups. The sector’s growth is largely driven by the rise of e-commerce and the increasing adoption of technology-enabled financial services. Prominent players such as @Google Pay, @Apple Pay, @Samsung Pay, and @Alipay have captured considerable market share by investing in cutting-edge technologies and enhancing their platforms. For instance, @Alibaba Group developed @Alipay to streamline transactions between consumers and merchants, thereby optimizing efficiency and improving user experience.

List of Prominent Players in the Digital Payment Market:

• PayPal (US)

• Fiserv (US)

• FIS (US)

• Global Payments (US)

• Square (US)

• Stripe (US)

• VISA (US)

• Mastercard (US)

• Worldline (France)

• Adyen (Netherlands)

• ACI Worldwide (US)

• Temenos (Switzerland)

• PayU (Netherlands)

• Apple (US)

• JPMorgan Chase (US)

• WEX (US)

• FLEETCOR (US)

• Aurus (US)

• PayTrace (US)

• Stax by FattMerchant (US)

• Verifone(US)

• Spreedly (US)

• Dwolla (US)

• BharatPe (India)

• Payset (UK)

• PaySend (UK)

• MatchMove (Singapore)

• Ripple (US)

• EBANX (Brazil)

• Others

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-02

Market Dynamics

Drivers:

The growing consumer inclination toward non-cash payment methods is a primary factor driving the expansion of the digital payments market. These methods offer enhanced speed and convenience for transferring funds between accounts. The adoption of cost-effective payment technologies, including QR code-based systems and compact terminal solutions, is further supporting this transition.

Millennials are at the forefront of this digital shift, embracing mobile and online payment platforms at a rapid pace. Additionally, increasing demand for seamless and user-friendly experiences is a key catalyst for market growth. As competition intensifies, the ability of service providers to deliver exceptional customer experiences has become a vital differentiator, fostering greater user engagement and long-term loyalty.

Challenges:

Despite its robust growth trajectory, the digital payments sector faces several critical challenges. A major obstacle is the lack of standardized frameworks for facilitating cross-border transactions. This is compounded by regulatory discrepancies between jurisdictions and a shortage of technical expertise in emerging markets, which collectively hinder the efficiency of global digital payment systems. As international trade continues to grow, inconsistencies in government regulations, data governance policies, and incompatible national payment infrastructures create significant operational complexities. The limited capacity of many domestic systems to support cross-border integration further restricts the scalability and performance of international digital payment solutions.

Regional Trends:

The Asia-Pacific (APAC) region is anticipated to lead the global digital payments market in terms of revenue, supported by a strong projected compound annual growth rate (CAGR). The widespread adoption of digital wallets and mobile payment platforms in high-population countries such as China and India, along with elevated smartphone penetration, is propelling regional growth. At the same time, North America remains a significant contributor to the global market. The region benefits from advanced digital infrastructure, high internet accessibility, and a technologically adept consumer base, all of which create a conducive environment for the continued adoption of digital payment solutions across both consumer and business segments.

Recent Developments:

• In Sept 2023, Temenos contributed cutting-edge payment functionalities to IBM Cloud, thereby facilitating the transformation of financial institutions with an emphasis on security and adherence to regulations. Availability was extended to the Temenos Payments Hub on IBM Cloud for Financial Services throughout IBM’s hybrid cloud infrastructure, powered by LinuxONE and Red Hat OpenShift with IBM Power.

• In Aug 2023, PayPal Holdings Inc introduced stablecoin, making it the first major financial company. This action has the potential to greatly enhance the sluggish acceptance of digital tokens for transactions.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/2168

Segmentation of Digital Payment Market-

By Offering-

• Solutions

o Payment Gateway Solutions

o Payment Processor Solutions

o Payment Wallet Solutions

o Point of Sale (POS) Solutions

o Others

• Services

o Professional Services

Consulting

Implementation

Support & Maintenance

o Managed Services

By Transaction Type-

• Domestic

• Cross Border

By Payment Mode-

• Cards

• ACH Transfer

• Digital Wallet

• Others

By Vertical-

• BFSI

• Retail & E-Commerce

• IT & ITeS

• Telecom

• Healthcare

• Travel & Hospitality

• Transportation & Logistics

• Media & Entertainment

• Others

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• Southeast Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

Read Overview Report- https://www.insightaceanalytic.com/report/digital-payment-market/2168

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: http://www.insightaceanalytic.com

Tel : +1 607 400-7072

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.