The bill splitting apps market has gained significant traction in recent years, driven by evolving consumer behavior and the growing demand for convenience in financial transactions. These applications are designed to simplify the process of sharing expenses among individuals, eliminating the complexities of manual calculations and reducing the chances of errors. The increasing use of smartphones, coupled with rising digital literacy and the expanding adoption of cashless payments, has further propelled the growth of bill splitting apps across both developed and developing markets. As urban lifestyles become more social and collaborative, especially among millennials and Gen Z, the need for seamless, accurate, and instant financial reconciliation tools has become increasingly essential. The integration of artificial intelligence, real-time tracking, and user-friendly interfaces has made these applications more intuitive and reliable, further contributing to their popularity.

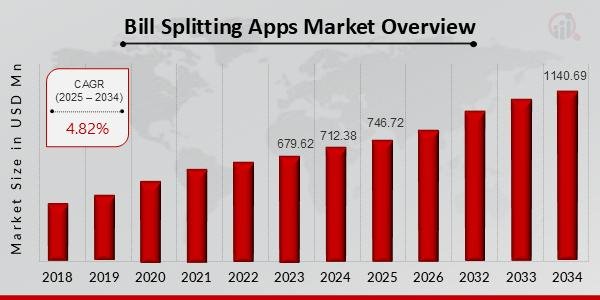

Bill Splitting Apps Market is projected to grow from USD 746.72 billion in 2025 to USD 1140.69 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 4.82% during the forecast period (2025 – 2034).

➤ Get An Exclusive Sample of the Research Report at – https://www.marketresearchfuture.com/sample_request/22401

The market for bill splitting apps can be segmented based on application type, platform, and end-user demographics. From an application standpoint, these solutions are used in a variety of settings including dining out, traveling, household expenses, subscription management, and group event planning. Each of these segments represents a unique set of user requirements and transactional behaviors, driving developers to create specialized features tailored to specific use cases. Platform segmentation highlights the availability of bill splitting apps across iOS, Android, and web-based platforms, ensuring accessibility across a wide range of devices. Additionally, segmentation by user demographics reveals a strong adoption among younger age groups, particularly students, working professionals, and digitally native users who frequently engage in social activities and group-based spending. This segmentation helps developers and marketers tailor app functionalities and outreach strategies to better serve their target audiences and meet evolving consumer expectations.

The dynamics of the bill splitting apps market are influenced by several driving forces and challenges. One of the primary drivers is the growing trend of digital transformation in personal finance management, as consumers seek easier and faster ways to manage shared expenses. The shift towards cashless economies and the widespread adoption of digital payment methods have created a conducive environment for the growth of bill splitting apps. Moreover, the rise of the gig economy and freelance work culture has increased the demand for flexible financial tools that support collaboration and remote interactions. However, the market also faces challenges such as data security concerns, varying regulatory frameworks across regions, and the need for continuous technological updates to keep pace with user expectations. Market players must navigate these complexities while delivering high-performing, scalable, and compliant solutions that cater to a global audience. User education and onboarding remain critical, as some users may still be hesitant to adopt digital financial tools due to privacy concerns or lack of familiarity.

➤ Buy this Premium Research Report at – https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=22401

Key Companies in the Bill Splitting Apps Market Include

o Snapcash

o Splitwise

o Beem It

o Tab

o PayPal

o Divv

o Tricount

o Alipay

o Line Pay

o Kakao Pay

o Toss

o Venmo

o Google Pay

o WeChat Pay

o Settle Up

Recent developments in the bill splitting apps market point towards a wave of innovation and strategic growth. Many companies have introduced new features such as automated recurring bill tracking, group wallets, debt reminders, and integration with social media platforms to enhance user engagement. Some apps now offer rewards, cashback, or loyalty programs to encourage regular use and increase customer retention. Partnerships with banks, restaurants, and financial platforms have expanded the ecosystem and created new revenue streams for app developers. Additionally, the use of blockchain technology in some bill splitting solutions has opened new possibilities for transparency, security, and decentralization. The rise of open banking frameworks and API integrations has allowed for seamless synchronization with bank accounts, ensuring that users have up-to-date information on transactions and balances. Companies are also focusing on localizing their offerings to cater to regional preferences, languages, and compliance requirements, which is especially important for expanding into emerging markets.

➤ Browse In-depth Market Research Report – https://www.marketresearchfuture.com/reports/bill-splitting-apps-market-22401

From a regional perspective, the adoption and growth of bill splitting apps vary based on technological infrastructure, financial literacy, and cultural preferences. In North America and Europe, high smartphone penetration, widespread use of digital payments, and a strong emphasis on financial independence have led to robust market growth. These regions are characterized by a tech-savvy population and a strong appetite for innovative fintech solutions, making them ideal markets for early adoption and advanced features. In Asia-Pacific, rapid urbanization, the growing middle class, and the increasing popularity of mobile wallets are driving the demand for bill splitting apps. Countries with large young populations and dynamic digital ecosystems are particularly fertile ground for these applications. Latin America and the Middle East are also witnessing increased interest in financial apps, supported by improvements in mobile connectivity and digital banking infrastructure. However, varying levels of financial inclusion and internet accessibility continue to pose challenges in some areas, requiring tailored strategies to ensure successful market penetration and user adoption.

In conclusion, the bill splitting apps market represents a vibrant and rapidly evolving segment of the fintech industry, shaped by technological advancements, changing social norms, and growing demand for convenient financial management tools. As users become more accustomed to digital solutions and expect greater control over their financial interactions, bill splitting apps will play a critical role in simplifying shared expenses and fostering financial collaboration. The future of this market lies in continued innovation, enhanced user experience, strategic partnerships, and strong regulatory compliance, all aimed at delivering seamless and secure solutions that cater to the diverse needs of modern consumers around the world.

➤ Top Trending Reports:

o Animation Software Market – https://www.marketresearchfuture.com/reports/animation-software-market-23584

o Artificial Intelligence in Automotive Market – https://www.marketresearchfuture.com/reports/artificial-intelligence-in-automotive-market-23588

o 5G Femtocell Market – https://www.marketresearchfuture.com/reports/5g-femtocell-market-23549

o Online K 12 Education Market – https://www.marketresearchfuture.com/reports/online-k-12-education-market-23535

o Nfc Chips Market – https://www.marketresearchfuture.com/reports/nfc-chips-market-23505

o Managed It Infrastructure Service Market – https://www.marketresearchfuture.com/reports/managed-it-infrastructure-service-market-23501

o Managed Sd Wan Services Market- https://www.marketresearchfuture.com/reports/managed-sd-wan-services-market-23553

o Multichannel Campaign Management Market – https://www.marketresearchfuture.com/reports/multichannel-campaign-management-market-23642

o Network Traffic Analytics Market – https://www.marketresearchfuture.com/reports/network-traffic-analytics-market-23652

o Admission Management Software Market – https://www.marketresearchfuture.com/reports/admission-management-software-market-23651

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Also, we are launching “Wantstats” the premier statistics portal for market data in comprehensive charts and stats format, providing forecasts, regional and segment analysis. Stay informed and make data-driven decisions with Wantstats.

Contact Us:

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com

This release was published on openPR.